Red-Flag insider sales by executives nearly double the likelihood of a securities class action lawsuit.

Most publicly traded companies assign executives some stock in the company as a part of their compensation. This theoretically keeps their interests aligned with the interests of the company, since a well-run company’s stock should rise, and a mismanaged company’s stock should fall. Of course, it is not that simple since a company’s stock prices are only correlated with the actual health of a company.

It is common for executives to regularly sell some amount of stock to support their lifestyle. But it raises a big red flag when an executive sells off a large percentage of their holdings. This could indicate that the executive has some information, yet unknown to the public, that something bad is going to happen that will harm the stock price.

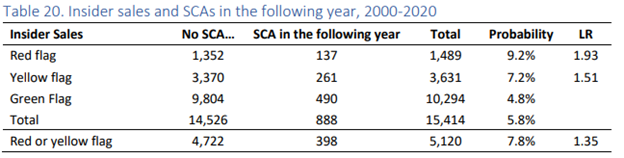

Our research indicates that large insider sales are associated with an increased incidence of securities class actions in the following year.

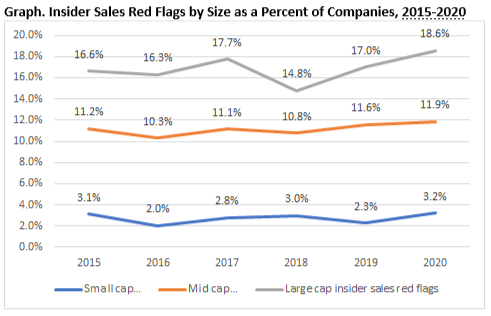

We assigned a red flag anytime an executive sold over 50% of their holdings, or the CEO or CFO sold over $500,000 in shares. There have not been any significant changes in how often we issued red flags over the last five years, but there is a significant difference between small, mid, and large cap companies.

In our analysis we found that red-flag insider sales nearly doubled the probability that a company would be subject to a securities class action lawsuit in the following year.

Interestingly, this correlation between insider sales and securities class actions is significantly weaker if you look at events in the same calendar year. A red-flag insider sale only increases the probability of having a Securities Class Action during the same calendar year by a factor of 1.35.

This disparity in risk between the year the trade is made, and the year following the trade means that the correlation is not simply due to the fact that both red flag insider sales and securities litigation disproportionately affects large companies.

The fact that the association between insider sales and securities litigation grows stronger over time has troubling implications. It indicates that executives may be trading on material information concerning potential adverse events as much as a year before that information reaches the public.

If you want to learn more about our research, start a conversation by emailing jcheffers@watchdogresearch.com.