Under Armour still has not recovered from a serious blow it suffered in early November 2019 when the Wall Street Journal reported that the company had been under investigation by the SEC for its accounting practices. One element of the story that rattled investors was that the investigation had been going on since July of 2017, yet it had not been addressed in a transparent way by management.

It was reported that Under Armour has allegedly been shifting its sales in between quarters to appear healthier. Companies with seasonal sales often try unconventional and even counter-productive methods to boost traditionally slow quarters and smooth out their numbers, but the ongoing SEC investigation indicates that something more sinister is at play here.

For it’s part, Under Armour has said it did nothing wrong. However, a court found these troubling allegations substantial enough to revive a securities lawsuit that it previously had dismissed with prejudice because of the new evidence presented. Now Under Armour is facing three suits over the matter, and the one certainty of this litigation is that it will be expensive for Under Armour (and their D+O underwriter).

Non-Audit Fees Increased Dramatically at Under Armour

Whenever a story like this gets broken, people always want to look back and see if there were any leading indicators or warning signs. In our opinion a lack of transparency is the most important sign that a company could be in trouble. When a company like Under Armour is going through a lot of turmoil and they attempt to paper over and obscure the problem instead of hitting it straight on, then we get concerned that there are deeper problems festering.

Investors did have some indications that something was wrong at Under Armour. The company went through a tremendous amount of turmoil in their management team in 2016-2017. Lawrence Molloy replaced a long-time CFO in January 2016, then announced his resignation for “personal reasons” about a year later. If Molloy was experiencing health issues, they didn’t stop him from finding work shortly thereafter, or from serving on the board of Sprouts during that time. When highly paid executives start leaving for “personal reasons,” that raises a red flag.

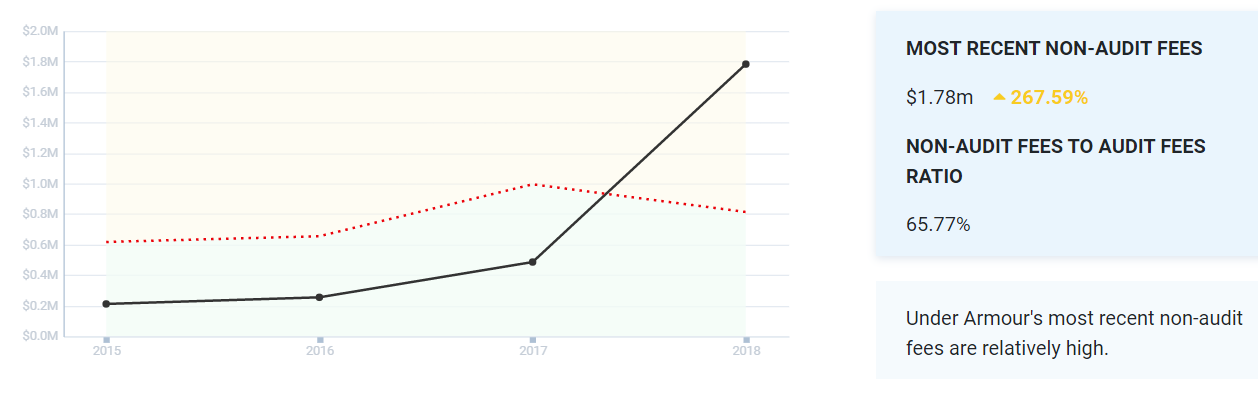

Volatility at the executive level does not necessarily indicate something is wrong; it can be a sign of health if a company has become moribund. However, those rapid changes at the executive level in 2017 were followed a dramatic 267% increase in Non-Audit fees paid to PWC for 2018.

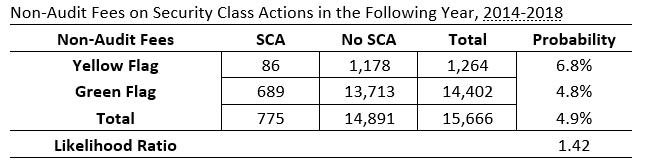

Considering that Under Armour’s accounting disclosures are not particularly complex, and that their traditional audit fees had been hovering around the 25th quartile for several years and had actually decreased significantly in 2018, this dramatic increase in non-audit fees signaled that Under Armour was wrestling with significant issues. Our Analysts looked back at the period from 2014-2018 and found that a high non-audit fee that raises a yellow flag in our reports corresponded with a statistically significant increase in the risk of securities litigation.

If high non-audit fees are generally a leading indicator of securities litigation, a dramatic one-year increase in non-audit fees would be an even more compelling sign of financial distress. Here Under Armour’s 268% increase in non-audit fees, paired with unexplained turmoil on the executive level, provided ample notice that trouble was on the horizon.