In our first piece on Under Armour (UA) we looked at how a dramatic increase in non-audit fees by PriceWaterhouseCoopers (PWC) was a sign of financial problems and a leading indicator of litigation. We also briefly examined UA’s SEC investigation, which was first reported on by the Wall Street Journal. This investigation has remained somewhat mysterious and UA has denied any wrongdoing. Thanks to the newly required disclosures of Critical Audit Matters (CAMs), we are getting some clarity.

According to news reports, the SEC began its investigation into UA in July of 2017. The report indicated that there was shuffling sales from quarter to quarter to make the company look healthier. An extensive report by Francine Mckenna at “The Dig” raised the possibility that UA may have been “channel stuffing” by sending retailers more product than they can sell (a practice more likely when a transaction is not truly at arms-length). The speculation is that UA would push its inventory on retailers during a traditionally slower time of year, thereby boosting sales, and then record the loss of the returned merchandise in a more profitable time of year.

It is not clear from the investigation whether or not there has been any “channel stuffing,” but there are a few pieces of evidence that suggest UA has not been completely transparent in their accounting and may have to pay a price at the end of this investigation.

Lawrence Molloy Left in January 2017

Molloy, an outsider, was appointed the CFO in January 2016. In January 2017, he announced his resignation for “personal reasons.” The short tenure, the non-explanation, and the fact that the outsider Molloy was replaced with a long-time loyalist in David E. Bergman (joined in 2004) suggests that Molloy had a serious disagreement in how the company’s finances should be managed.

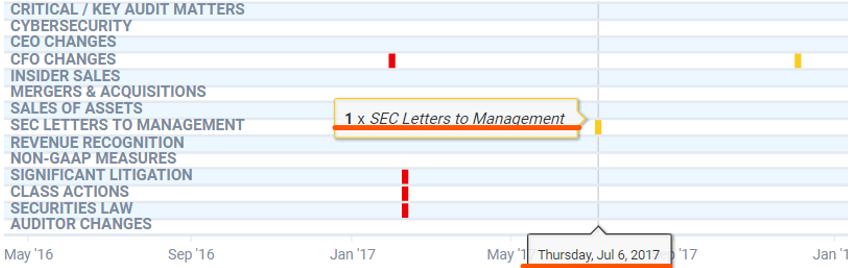

Correspondence with the SEC in May 2017

One interesting detail from the Wall Street Journal story is that this investigation by the SEC has been ongoing since July of 2017. Right around that time, our report flagged the release of an SEC comment letter correspondence.

When we looked at the letter itself, we found that the SEC first contacted UA on May 1st, 2017 with questions about the factors that had led to material increases in revenue:

we note you do not quantify the impacts of these factors or fully describe the specific new products lines or offerings that have caused the increase. Please expand your discussion to fully describe the specific reasons and factors contributing to the material changes in revenue…

The SEC wanted to know how much revenue growth was due to new product lines. UA’s response on May 30th, amongst other things was that “… the Company is not readily able to quantify the impact of unit sales growth of existing versus new product offerings.”

It strikes us as odd that UA would not know how much revenue they were receiving from new product offerings. The SEC might have found it strange as well. This exchange shows that the SEC was taking a critical view of UA’s revenue recognition methods, and the SEC may not have been satisfied with UA’s explanations.

Plank, Founder and CEO, Stepped Aside in October 2019.

It is not unusual for a founder of a company to step aside from the day-to-day operations of a company, but the timing here is suspicious. Plank’s departure came a few weeks before the Wall Street Journal broke its story about the SEC investigation.

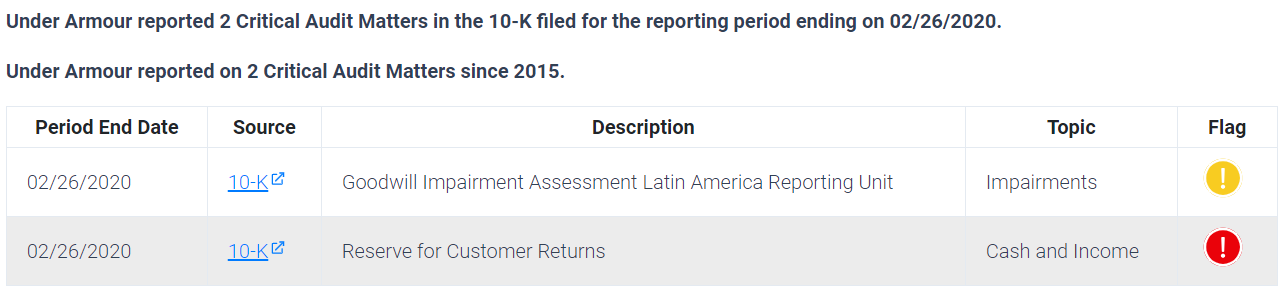

PWC’s Critical Audit Matter Disclosure Highlights Issues with Sales Returns and Allowances

Accounting firms are now required to disclose CAMs as a part of their report on a company. These disclosures require the firm to highlight areas in the accounting that required particularly challenging, complex, or subjective judgements by the auditor. Our report indicates that UA already has a red flag CAM concerning its Reserve for Customer Returns

When we looked at the filing, PWC explained that the company had recorded $219 million in this reserve for returns and markdowns. And they offered this by way of explanation:

The principal considerations for our determination that performing procedures relating to the reserve for customer returns is a critical audit matter are there was significant judgment by management in estimating the customer returns reserve, which in turn led to a high degree of auditor judgment, effort, and subjectivity in performing procedures and evaluating the significant assumptions used in developing the estimate, including the amount of outstanding returns that have not yet been received by the Company.

The SEC has reportedly been investigating since July of 2017 and yet the increased scrutiny has not spurred UA to solve the issue, as PWC issued this CAM for 2019.

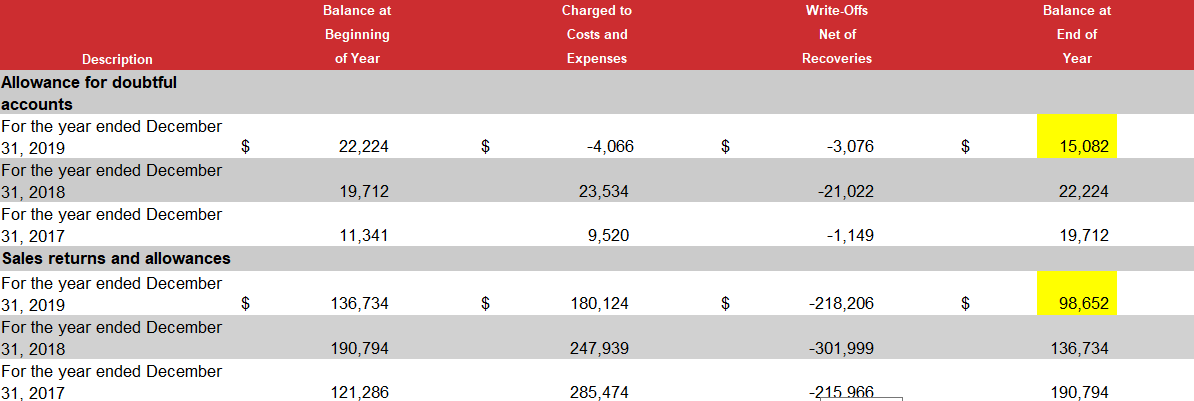

Remember that this “reserve” represents the value of merchandise that the company estimates will be returned to the company, effectively adjusting the final sales numbers. To understand the magnitude of the issue we took a closer look at some of these numbers (edited for formatting):

The sales returns and allowances and allowance for doubtful accounts amounts are significantly less this year than in years past. This could indicate that UA has been changing how it interacts with its retailers, pushing product less aggressively so that the retailers are less likely to overbuy and then return product. Additionally, the number has fluctuated greatly over the past three years, from which we can infer that PWC would probably have flagged the sales returns consistently if it had been required to relay CAMs in years past. Regardless, the fact that PWC highlighted these numbers as being particularly subjective is not comforting for investors.

How Typical was UA’s CAM?

A close examination of UA’s financial statements reveals how invaluable new CAMs disclosures are in understanding the story behind the numbers, but the CAMs have more to offer. They can also help us draw comparisons with other companies.

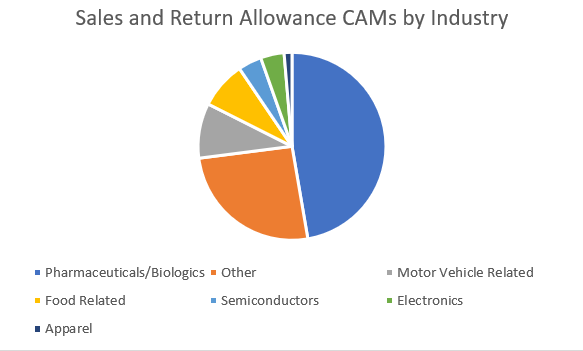

The latest research shows that CAMs relating to revenue (including sales returns and allowances) account for about 15% of all CAMS issued so far. Our analysts wanted to see how typical it is for a company to have a CAM that falls under the category of Sales Returns and Allowances. Currently, more than 1900 companies have filed CAMs. We narrowed by only looking at CAMs related to Sales Returns and Allowances. This narrowed our pool to only 74 companies. Here are the results broken down by industry:

No other apparel companies have had CAMs concerning the sales and returns allowances. However we discovered several limitations in this sort of analysis due to the CAMs disclosure requirement incremental roll-out. Currently, only large accelerated filers are required to file CAMs for 2019, and not every company has filed yet. There are 11 apparel manufacturers who will be required to file CAMs this year, but so far only 3 have done so. It is too early to draw any real conclusions, but we are excited about how this new disclosure will open the door to new and better insights.

One Last Word on “Channel Stuffing”

“Channel Stuffing” is considered a serious crime, and executives have received lengthy prison sentences for wire or mail fraud because of it. But to convict, the DOJ would need to prove the requisite intent (i.e. a purpose to defraud), and the fact that the investigation has been going on for almost three years indicates that the DOJ does not have a smoking gun. UA may be entirely innocent of “channel stuffing.” We won’t really know until the DOJ or UA brings all the details to light.