In March HFFG was accused of siphoning off investors money to buy a stable of super-cars, but their problems started well before those allegations.

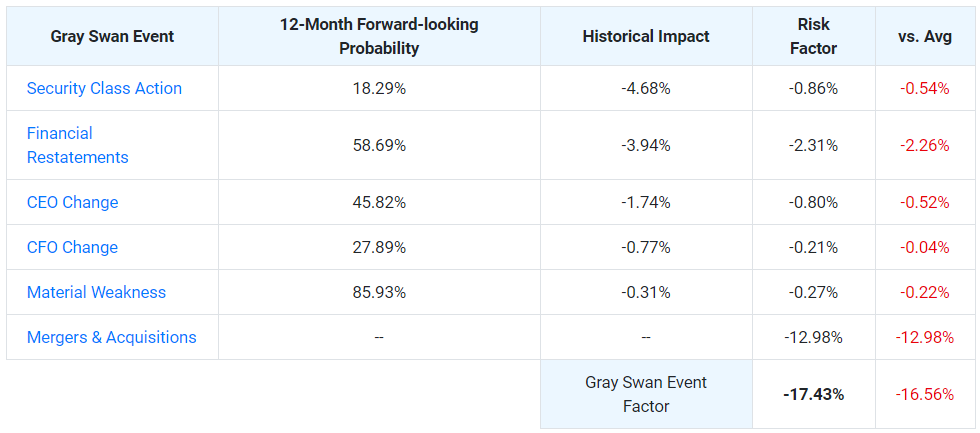

HFFG is a food distributor that primarily serves Asian restaurants in the Southeast, Pacific, and Mountain West regions of the U.S. HFFG currently has the dubious distinction of having our highest Gray Swan Event Factor (GSEF) score by far at 17.43%.

For those unfamiliar with our GSEF score, we calculate it by estimating the likelihood of certain “gray swan” events, and then estimate the potential impact of those events. Our research has demonstrated that this risk has not been properly priced into the marketplace, mostly because no one is doing the due diligence necessary to account for it. In fact, most firms rely on the analysts selling the stock to conduct this research.

Cascading Bad News for HFFG

HFFG seems to be suffering from a series of escalating problems. They reported serious material weaknesses in their financial reporting for FY 2018, just a few months before announcing a merger with B&R Global (B&R), another larger Chinese restaurant food distributor for an ostensible value of $400 million. B&R’s shareholders were awarded approximately 60% of the ownership of the surviving company.

In March, the company had to contend with the coronavirus and a scathing short-seller report by Hindenburg Research, as well as a securities lawsuit based on that report. HFFG was late in releasing its first quarter results, and when those results came out, they included a whopping $338 million impairment to goodwill. Before the impairment, the company had a goodwill balance of $406 million, which represented almost the entire value of the consideration provided by HFFG in the merger. This impairment wiped out approximately 83% of that value.

Restatement Incoming?

According to our statistical analysis, HFFG has a nearly 60% chance of a filing a restatement in the next 12 months. One of the biggest factors in that calculation is recurring material weaknesses in HFFG’s financial reporting. HFFG reported serious material weaknesses in both their annual reports for 2018 and 2019. In 2018, they disclosed:

“The material weakness related to the deficiency in the ability of our in-house accounting professionals to generate financial statements in the form required by applicable SEC requirements. Control deficiencies are related to the lack of proper documentation to evidence the review of customer orders and purchase orders, and lack of proper documentation to evidence customers’ acknowledgement of transaction amounts and account balances.”

In the annual report for 2019, the HFFG admitted that little progress had been made, “the Company does not have in-house accounting personnel with sufficient knowledge of US GAAP and SEC reporting experiences.”

We find this strange. Why haven’t they hired someone over the past year with the ability to follow GAAP? Is it so difficult to find an experienced and qualified person to lead the in-house accounting staff?

Also note that because HFFG is classified as an Emerging Growth Company, its auditor does not offer an opinion as to the effectiveness of its internal controls. But considering that HFFG’s auditors do not understand how to apply Generally Accepted Accounting Principles, we can venture a guess as to what their auditor’s opinion would be if they gave one. HFFG’s problems are a great example of how the lack of the SOX 404(b) requirement lowers the quality of internal controls, which we have written about before.

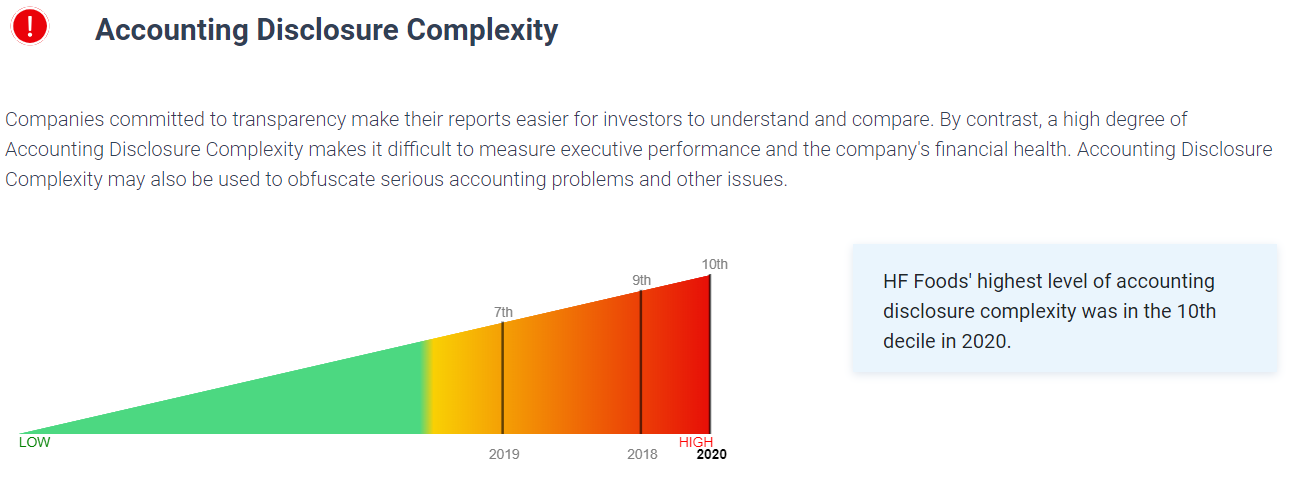

If HFFG can hire someone who understands GAAP, it is likely that they will need to revise the financial results from prior years. They will also need to simplify the financial reporting. This relatively small food distributor makes unusually complex accounting disclosures:

The SEC has made a serious effort to make all company disclosures accessible to the public by requiring the use of standardized formats and standardized language. As part of this effort, the SEC also requires companies to submit these filings in an XBRL format, so it is simpler for software to provide meaningful analysis without too much manual work.

As a practical matter, when a company makes a filing, they mark it with a set of standardized XBRL tags. However, sometimes a company needs to use “custom” XBRL tags because their data does not fit into the standard language or format. This graph represents how often a company introduces these “custom” tags in comparison with their industry peers. A relatively high number of custom tags indicate that a company’s disclosures are complex and opaque.

Extensive Related Party Transactions

HFFG’s material weaknesses also related to the review of their purchase orders. This potentially raises revenue recognition questions, raising a possibility that someone at the company could be engaging in accounting shenanigans. We have written about this issue before, when discussing Under Armour’s potential channel stuffing issues. Although not proof of manipulation, it is very concerning that HFFG has a “lack of proper documentation to evidence the review of customer orders and purchase orders.”

HFFG also has a high number of related party transactions. HFFG disclosed that it made sales of over $19 million and made purchases of over $40 million in related party transactions in 2019 alone. HFFG also recorded many other types of related party transactions, including advances both to related suppliers and from related customers, a $55 million term loan guarantee, and related lease transactions.

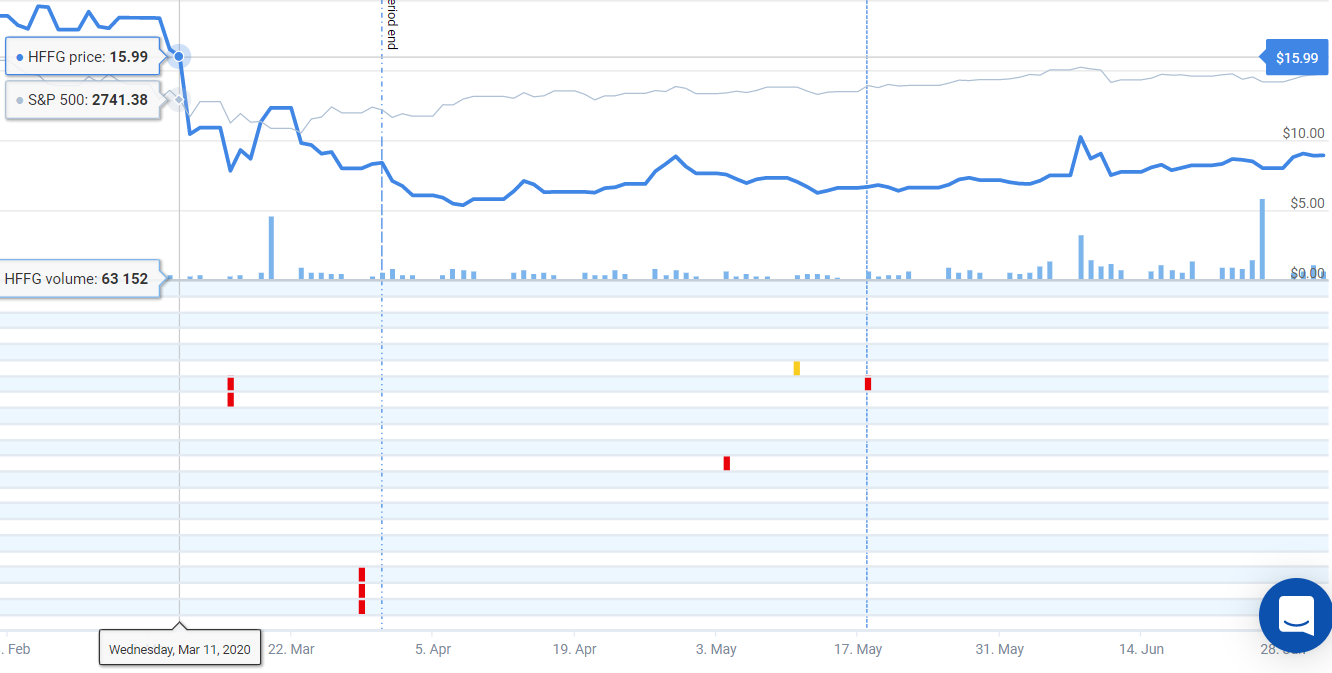

Additionally, the company loaned over $8 million to entities either owned by the Chairman- and co-CEO Zhou Min Ni or his son; Ni initially guaranteed the loans before he “purchased” them with over 632,746 shares. But Ni also had to put an additional 208,806 shares into escrow, and he will lose all or part of those shares if the average closing price of the stock is below $13.30 for the 250 days leading up to September 30th, 2020. Considering that the stock price dropped below $13.30 in March and has stayed consistently below $10.00 since, Ni has a very strong incentive to do something that will make the share price recover.

Accusations by Hindenburg Research

Hindenburg Research is an activist short-seller in the mode of Muddy Waters founded by Nate Andersen. In March, this short seller published a report on HFFG which included assertions based on public information as well as non-public information.

The core claim made by Hindenburg was that the merger between HFFG and B&R was not conducted at “arm’s length” as stated by the relevant disclosures, but that both of these companies were previously part of the same Chinese investment group. Unfortunately, many of underlying documents supporting Hindenburg’s contention are in Chinese and are not easily verified. One interesting fact that seems to support Hindenburg’s assertion is that the two companies were neatly divided into east and west divisions.

Another key assertion in Hindenburg’s report is that the chairman and co-CEO Zhou Min Ni has been using the related party transactions to inappropriately siphon money out of the company. Hindenburg asserts that background checks of these related parties reveal that no fewer than 17 super-cars with total value of over $3.5 million were registered to these entities. Hindenburg also provides photos, supposedly from the Instagram account of Ni’s son Raymond, of Raymond showing off this collection of super-cars.

After this report was published, the Rosen Law Firm filed a class action Complaint against HFFG in the Central California District Court. The complaint closely mirrors the report by Hindenburg research.

The C-Suite

Corporate governance problems are often at the root of accounting-related issues. Chaos in the C-suite translates into chaos throughout the organization. HFFG has had an unusual structure post-merger. Zhou Min Ni and Xiao Mou “Peter” Zhang, formerly the heads of HFFG and B&R respectively, are now co-CEOs. Adding to the confusion, three different people have held the office of CFO at HFFG since last March.

Mergers often hurt companies in the short run because the difficulty of combining systems and cultures cost more than the “synergies.” Even if both companies were previously affiliated, as Hindenberg Research asserts, the fact that Peter Zhang and Zhou Min Ni are sharing the position of CEO will raise a plethora of issues. Additionally, HFFG’s inability to develop effective internal controls for the past two years does not bode well for achieving “synergies”.

The Goodwill Impairment

We anticipated that the outbreak of the coronavirus would cause many companies to test their goodwill, and that this would lead to a rash of impairments. We also anticipated that some companies would disingenuously use the pandemic as cover to write off junk goodwill. So, did HFFG write off the goodwill because they needed to, or did they write it off because it was a convenient excuse?

HFFG’s $338 million impairment may not be earth shattering in an absolute sense, but relative to its size it is exceptionally large. When Kraft Heinz wrote off $15 billion in intangible assets and goodwill, that wiped out about 12% of the company’s assets and reduced equity by 23%. By comparison, HFFG’s impairment wiped out 35% of the total assets, and eliminated over half of the equity.

Keep in mind that this merger was consummated in December 2019. At that time HFFG paid a premium for B&R and recorded over $400 million in goodwill from the deal. However, the assumptions underpinning the purchase price have changed, as 83% of that value has now been erased. But was this justified?

That all depends on whether you trust management to perform accurate valuations. Valuations are more of an art than a science because they require a great deal of estimates and assumptions about the future. But how can you properly evaluate the future during a black swan event? When they were conducting their valuations in March and April, they did not know what the effects of the coronavirus would be, nor how long those effects would persist. The effects could end soon, or they may never end.

Here is the irony, the pandemic is so disruptive that it constitutes a triggering event, causing every company to test their goodwill for impairment, but it is also so disruptive that it makes the future predictions critical for a proper valuations highly subjective. If Hindenburg’s assertions about self-dealing turn out to be accurate, then it would be reasonable to believe that there was an ulterior motive for this impairment.

Did HFFG make reasonable assumptions in their valuation estimates? We cannot be sure, but since their financial reporting is unreliable, given their lack of expertise with GAAP and chronic internal control issues, we find it likely that these valuations are riddled with problematic assumptions.

Conclusion

HFFG has had a difficult year so far. The merger certainly has posed a difficult set of challenges, made worse by the management team’s material weaknesses in their financial reporting. They are already enduring one securities lawsuit and have made a massive impairment. But if our research is correct this is only the opening salvo and 2020 probably has a lot more in store for HFFG.

Contact us:

Retail Investors get free access to our Watchdog Reports. Institutional Investors and those interested in our Gray Swan Event Factor can subscribe, or call our subscription manager, at 239-240-9284.

If you have questions about this blog send John Cheffers, our Director of Research, an email at jcheffers@watchdogresearch.com. For press inquiries or general questions about Watchdog Research, Inc., please contact our President, Brian Lawe at blawe@watchdogresearch.com.