The number of SPACs exploded in 2020, exceeding the number of traditional IPOs for the first time ever. That growth looks like it will continue in 2021. SPACs have been around for a long time, however, they have only recently generated significant interest and capital.

Until recently, SPACs were a novelty and treated as such: FINRA warned investors about problematic incentives; D&O insurance coverage was expensive because it was so specialized; and only smaller more specialized accounting firms would provide independent auditing services.

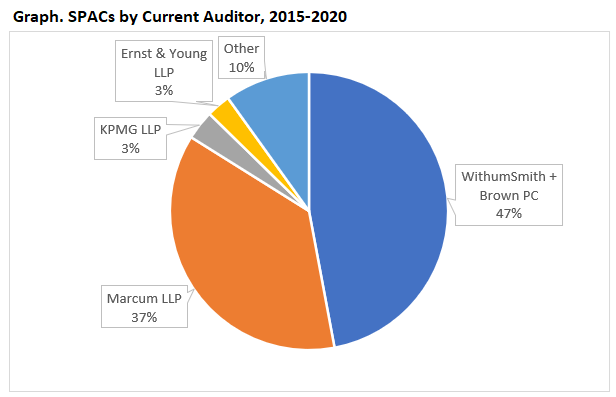

Over the last five years, two auditors have dominated the SPAC market, Marcum LLP and WithumSmith+Brown PC.

Up through the last five years, the Big 4, PwC, Delloite, Ernst & Young, and KPMG have largely steered clear of SPACs. From 2015-2020, PwC only took on one SPAC client. It will be interesting to see if the dramatic increase in the number of SPACs will result in greater interest from the Big 4.

What do we know about the two auditing firms that currently enjoy the lion’s share of the SPAC market? Marcum LLP did recently have some trouble with the PCAOB concerning their business in China; however, that does not tell us much about the SPAC side of their business.

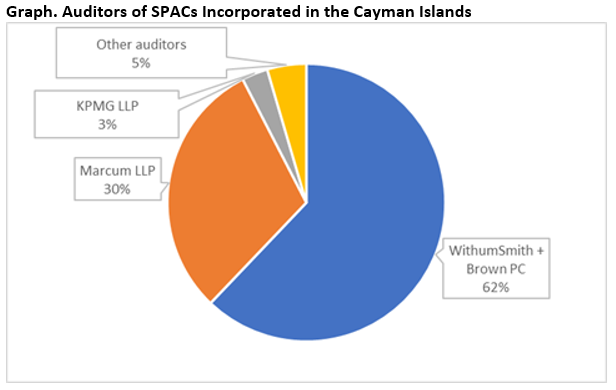

WithumSmith+Brown has not had any recent disciplinary issues with the PCAOB. According to their last inspection report (which was released in 2016) the firm has 11 offices, all within the U.S. Interestingly, they appear to specialize assisting SPACs which are looking to incorporate in “tax havens.” For the past five years, they have been the clear leader for SPACs looking to incorporate in the Cayman Islands, a tax haven.

Conclusion

For most of the last twenty years, SPACs occupied an insignificant portion of the market. Only two small auditing firms catered to this portion of the market. However, in the last three years, the number of SPACs has grown significantly, raising the profiles of Marcum LLP and WithumSmith+Brown. Now that SPACs are attracting billions in capital, it will be interesting to see if the Big 4 take any significant steps to encroach on the SPAC market.

Contact Us

D&O insurers spend a lot of time on new bid requests. Our clients use our Watchdog Reports to quickly discover which bids they should pursue. Click here to request a free demo. Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.