SPACs have been utilizing amended annual reports, 10-K/As, to break bad news in 2021.

If you have ever had to tell someone bad news, you know that you can lessen the impact by picking your moment carefully. It is a way of abdicating responsibility, and it is extremely common in corporate America. For example, negative corporate disclosures tend to be released on a Friday evening, preferably before a long weekend.

For public companies, it is not just about when the disclosure is made, but how it is made. We are seeing a concerning trend in 2021 where companies are waiting to make their initial disclosures of bad news such as going concern opinions, ineffective internal control disclosures, and financial restatements in an amended annual 10-K filings (10-K/As), instead of 8-Ks and other traditional methods and long after the original “clean” 10-K was filed with the SEC.

Lordstown Motors is an electric car company that went public via SPAC. On June 8th, Lordstown Motors filed a 10-K/A, more than two months after it released its annual report on March 25th. As reported by Francine McKenna in The Dig, Lordstown disclosed a going concern opinion, an ineffective internal control assessment by management, and two subpoenas from the SEC (indicating that the SEC was conducting a formal investigation, not an informal inquiry). Lordstown also disclosed that their restatement announced in May would include an additional charge of $23.5 million, perhaps what tipped it into the “going concern” warning range.

10 Years of Data on 10-K/As

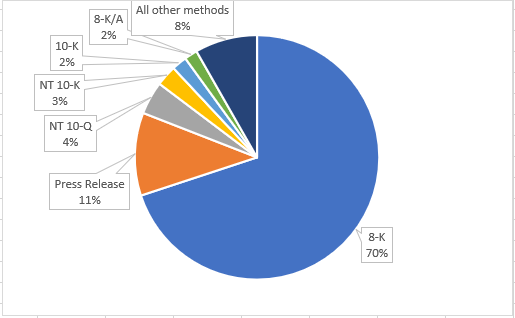

Until 2021, it was very unusual to see these sorts of disclosures originate in the 10-K/A. Generally, this sort of negative information that could move the stock price would be released in an 8-K, or in a press release. This graph represents initial disclosures by filing over the last ten years: (All our analysis is for publicly traded companies on the NYSE and Nasdaq.)

As you can see, 10-K/As are not even represented on this graph. That’s because they account for less than 1% of initial disclosures and are lumped in with some other filings in the “all other methods” category.

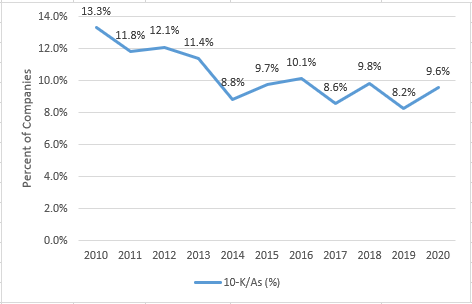

Another point that adds context is that 10-K/As themselves are not rare. They are filed by about 10% of companies a year.

Even though they are used to amend 10-Ks, 10-K/As are not typically used to communicate serious issues at a company for the first time, like an internal control issue, going concern issue, or a restatement. Over the last ten years only 3.6% of 10-K/As were used to reveal ineffective internal controls. Going concern opinions were even more uncommon, with only .06% of 10-K/As being used to reveal a going concern opinion. Finally, there were nearly 6,000 10-K/As filed from 2011-2020, but only 3 of them were used to initially disclose a non-reliance restatement.

2021 Brings a Big Change

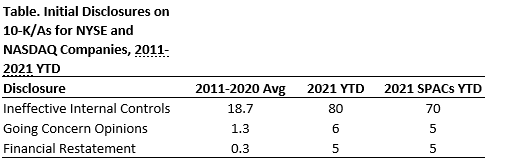

Lordstown’s use of a 10-K/A to disclose its going concern and internal control issues was, therefore, highly unusual. But Lordstown was just the biggest, most closely-watched company of many in 2021 that used this stealth maneuver. In 2021, companies have used 10-K/As to first disclose internal control issues, going concern warnings, and restatements at levels far in excess of the normal incidence.

According to our analysis, this change is due almost entirely to companies that went public via a SPAC.

Conclusion

SPACs and companies went public via SPACs have started using the 10-K/A to disclose bad news in a way that is novel and a bit sneaky. This may be due to incompetence, or it may be part of an effort to soften the impact on share price. What the market doesn’t read, the market doesn’t see and react to. (Fortunately, our Watchdog Reports capture all this information regardless of where it is filed!)

This is just another example of how SPACs, and the companies that go public via SPACs, differ from companies that go public via a traditional IPO. This may raise questions about the competence of the accounting, finance and legal advisors to these companies and their auditors, who are also supposed to be act as a control on bad financial information.

We’ve written previously about how SPACs are in a hurry to make deals and are incentivized to overpay for acquisitions. That’s bad for investors. The penchant for hiding bad news in a 10-K/A is a sign that many SPACs are not prepared to become a successful public company, and that their sponsors may have pushed them through a SPAC merger because the payout was too good to turn down.

If you are interested in more learning more about our research, contact jcheffers@watchdogresearch.com.

This article was amended on 8/9/2021 to correct the final table. We made an error that inflated the number of going concern opinions and have revised the numbers accordingly.