Bigger companies may be more likely to be sued than smaller companies, but they are also more resilient.

Our firm, Watchdog Research, uses statistical analysis of past events to evaluate a company’s future. One of the most important events we track is the occurrence of Securities Class Action (SCA) lawsuits. All the data presented in this article is based on our statistical analysis of publicly available data concerning public companies on the NYSE and NASDAQ.

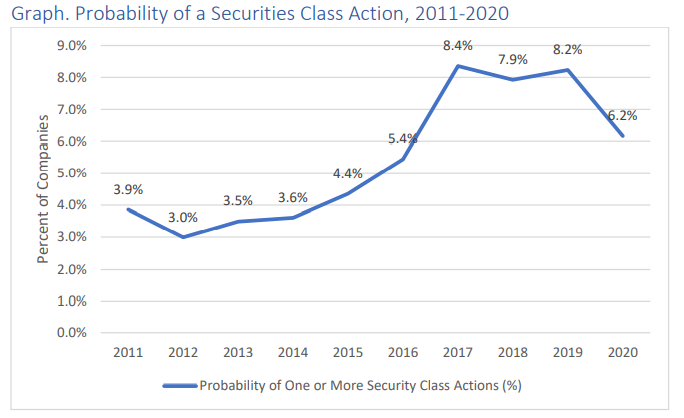

Our database allows us to track the probability that any given companies will be named in a SCA suit for a given year. Overall, the probability in the last ten years has increased, which has contributed to a hard market for D&O insurers.

Segmenting by Size

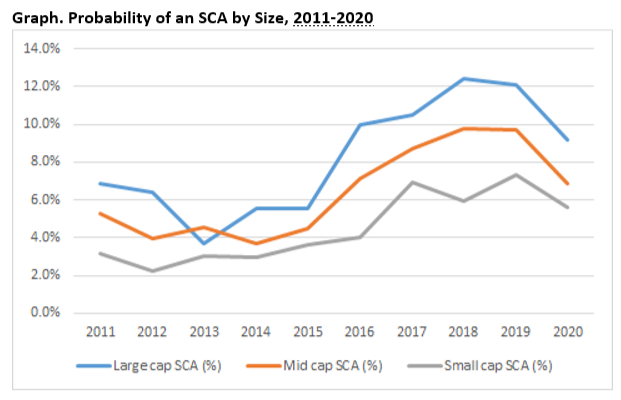

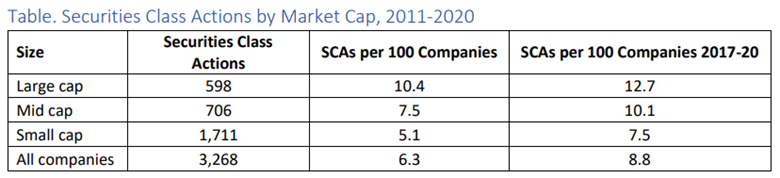

Our database shows us that this risk is not uniform for companies of all sizes. The larger a company is, the more likely it is to be named in a SCA suit.

In our research companies with over $10 billion in market capitalization are categorized as Large cap. Companies with less than $1 billion are categorized as Small cap. And all the companies that fall between them are considered Mid cap.

Cyan brought about a significant shift in the legal landscape for SCAs. So it is possible that higher SCA rates are part of a new paradigm and that there will be no return to mean. If that is the case, then the averages seen between 2017-2020 may become the norm.

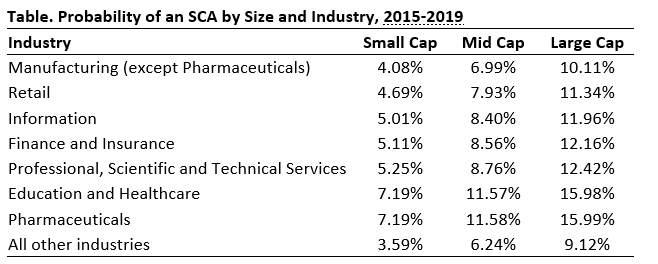

The size of a company may be one the most important factors to know concerning a company’s likelihood of being named in a SCA. It holds true in every industry, even in pharmaceuticals where small companies are particularly volatile.

Resilience

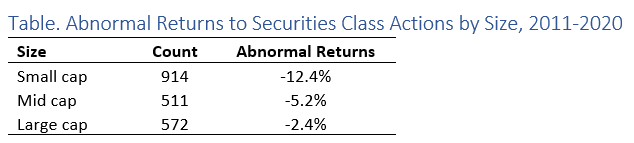

Large companies are far more likely to be named in a SCA than small companies, but larger companies often have the resources to handle these suits. We looked at the abnormal returns for all companies after they were named in a SCA suit and found that these events had a far greater negative impact on smaller companies than larger companies.

We calculated these abnormal returns by comparing the company’s stock price performance to the S&P 500 over the 30 days following the announcement of a SCA suit. It is clear that after the initial shock of the announcement wears off, large companies tend to recover quickly. Smaller companies tend not to fare as well.

Conclusion

Our data shows that no matter the industry, the larger a company is, the more likely it is to get sued in a SCA. However the risk calculation is not simple. Smaller firms are far less likely to get sued, but far more likely to suffer dramatic losses as a result of that suit.

These graphs and charts were made by our data scientist Joseph Burke, PhD. Much of this information is derived from “Frequency and Impact of Securities Class Actions: 2021” a Watchdog Report made by Joseph Burke, PhD, and Joseph Yarborough, PhD. If you are interested in purchasing this report, or a license to the dataset we used to create it, then contact jcheffers@watchdogresearch.com.