Watchdog Research provides an easy-to-use report for over 4,500 public companies based on 29 different categories of public disclosures. Our extensive database enables us to study larger trends affecting publicly traded companies.

The Supreme Court’s decision in Cyan in 2018 was a big victory to plaintiff’s law firms because it opened the doors of the state courts to federal claims under the Securities Act of 1933. These state law cases had already been permitted in some jurisdictions, but Cyan threw the doors open all over the country, with predictable results.

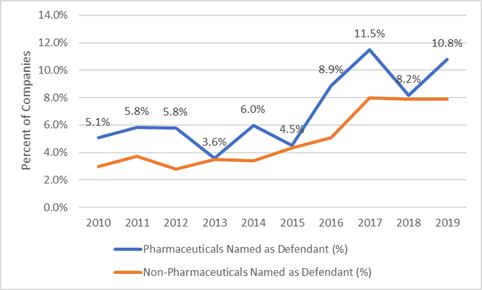

For the last three years, the percentage of companies named in a securities class action suit have been extremely high, hovering around 8%. This has been a great development for plaintiff’s attorneys, but a major problem for corporations and the insurers who provide D&O Insurance to cover the costs of these suits.

To get a sense of how disruptive this change has been, we compared the current level of litigation with the amount of litigation associated with what is considered the riskiest class of companies—pharmaceuticals. Our research indicates that over the last 10 years, that on average 7.45% of pharmaceutical companies have been named as defendants in securities class actions annually. If you were to compare the rates of security class action suits year over year between pharmaceuticals and everyone else, it would look like this:

This graph was created by Joseph Burke, PhD, using data from Audit Analytics. Audit Analytics uses NAICS codes to classify companies by industry.

Our research indicates that over the last ten years pharmaceuticals have been the second riskiest industry for securities class action litigation (Education and Healthcare has been the riskiest).

This graph demonstrates that the average company is now much more likely to be named as a defendant in a securities class action lawsuit than a company in a very risky class, such as pharmaceuticals, would have been a mere five years ago.

Will the Pendulum Swing Back?

In his blog the D&O Diary, Kevin LaCroix recently reviewed a few court decisions, both in Delaware and California, which indicate that companies may be able to blunt Cyan’s impact by adopting charter provisions that designate federal courts as the proper forums for their cases. These charter provisions could potentially protect companies from having to defend themselves in state courts where there are fewer procedural protections. It is too early to tell how of much of an impact these decisions will have on litigation trends.

Contact Us:

If you have questions about this article, please contact the author, jcheffers@watchdogresearch.com. If you have questions about the company generally, or for press inquires, please contact our president Brian Lawe, brianlawe@watchdogresearch.com.

Our company has access to a proprietary database that includes all material litigation, classified by issue, for public companies. If you are interested in some bespoke research on litigation trends, please contact jcheffers@watchdogresearch.com.