Long ago FINRA warned that SPAC managers were incentivized to overpay for companies. This year a study of SPACs showed that their average return was -9.6%. Of all the SPACs studied, only 31.1% had positive returns.

“Show me the incentive and I’ll show you the outcome.” -Charlie Munger

2020 has held a lot of surprises, mostly bad. But one interesting surprise is that our records indicate that 480 companies went public this year, far more than any other year in the past decade (the next highest was 369 in 2014). This could benefit investors since they should have more options and more competition for their investing dollars.

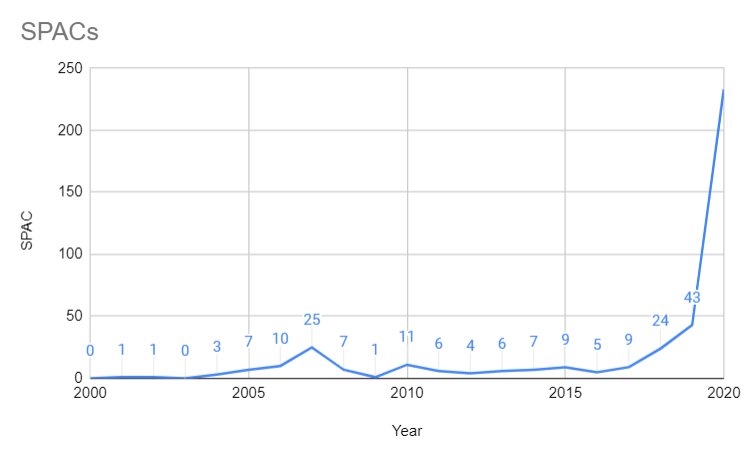

A significant reason for the overall increase in public companies is a dramatic increase in the number of companies that are going public through special purpose acquisition companies (SPACs). Look for yourself:

SPACs have become enormously popular. And they do offer some interesting advantages over traditional IPOs. A SPAC is formed as a blank check shell company and does not have any operations. This lack of prior operations makes performing due diligence less expensive and time consuming. This allows companies to go public much faster.

The money invested in a SPAC sits in an escrow fund while the manager of the SPAC looks for a suitable private company to invest in. Typically, the SPAC must find a target within 2 years, or the SPAC will be dissolved (and the money refunded).

The manager of the SPAC will typically receive 20% of the SPAC at a discount for consummating a merger (although sometimes they get less). This discount allows a manager to make money on an investment in a SPAC, even if the other investors lose money on the deal.

FINRA provided some guidance on SPACs back on October 13th 2008, and at the end of the notice they warn about a potential incentive problem for SPAC managers.

“SPAC managers have a strong incentive to buy a company, even at inflated values, since they will get 20 percent of the company at a nominal price.”

SPAC Returns Indicate Prices Are Inflated

On October 1st, Renaissance Capital released the results of its own study of SPACs since 2015 and found that the average return was -9.6%. And the median return was even worse at -29.1%. Of all the SPACs that they studied, only 31.1% had positive returns.

This is a dismal track record considering that traditional IPOs had returns of 47% over the same period. It is likely that the SPAC mangers’ incentive to pay inflated prices for mergers has contributed to the wide disparity in returns for SPACs versus IPOs.

Conclusion

This is really a corporate governance issue. Good corporate governance requires that the managers be properly incentivized to act in the best interests of the investors, since the money belongs to the investors and not to them.

Here SPAC managers get nothing if they cannot find a target but can still win big even if they overpay for an underperforming company. Although not every SPAC is structured this way, looking carefully at the incentives in a SPAC is something that every investor should do before following the crowd.

Contact Us

D&O insurers spend a lot of time on new bid requests. Our clients use our Watchdog Reports to quickly discover which bids they should pursue. Click here to request a free demo. Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.