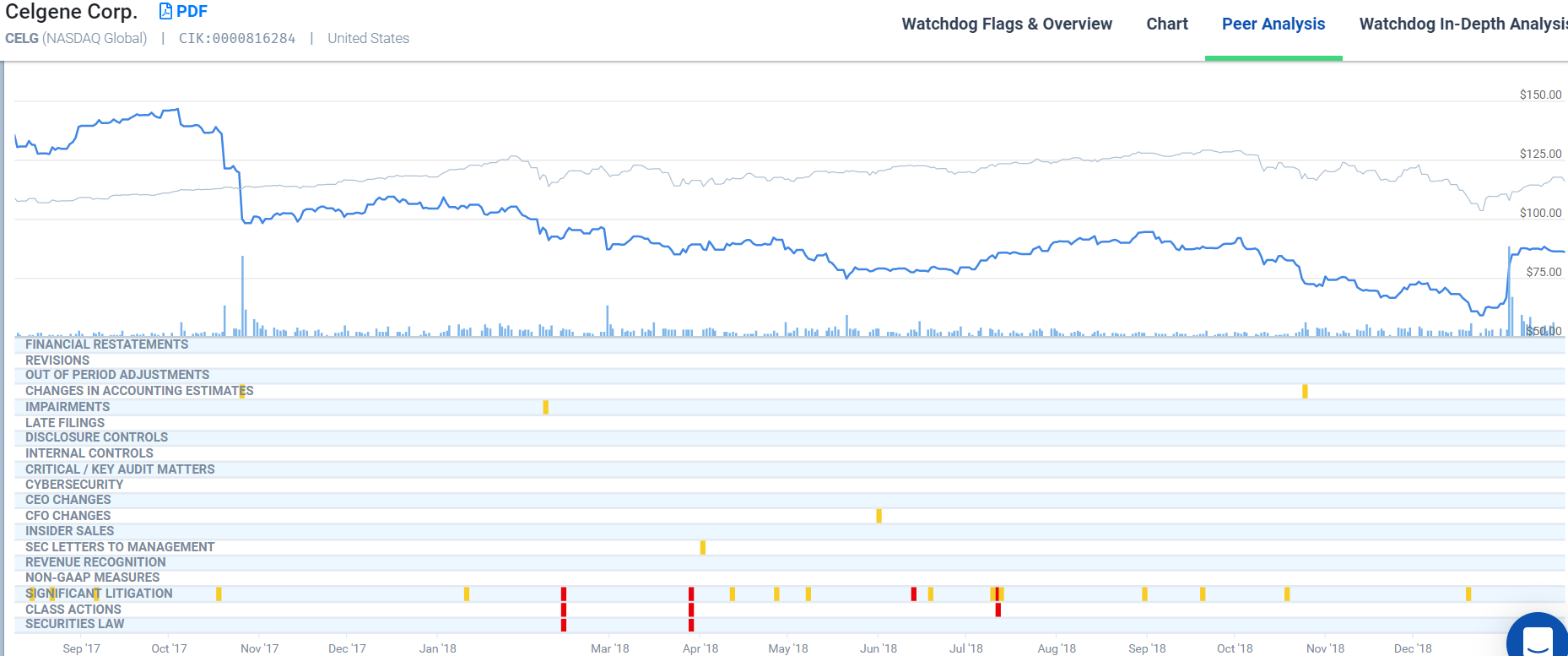

Bristol Myers Squibb (“BMS”) and Celgene announced in January of 2019 that they had entered into a merger agreement. Celgene’s share value had been on a downward trend for over a year, where its share value had dropped from over $146 in October 2017, down to less than $60 by Christmas in 2018.

BMS brought some holiday cheer to Celgene’s shareholders with the announcement of a deal, in which Celgene’s shareholders would receive $50 and one share of BMS stock in consideration for each share of Celgene’s stock – making for a purchase price of $102.43 per share at announcement date. The BMS shareholders have not shared in the enthusiasm, as evidenced by a fall in the share value after the January 3, 2019 announcement. Even now, the share price has not fully recovered; perhaps the market believes BMS is overpaying for Celgene. Perhaps, as some analysts believe, Celgene is the one taking a bath. It looked as if the merger might collapse when the Federal Trade Commission’s (“FTC”) raised anti-trust concerns about the effect the merger might have on competition for drugs that treat psoriasis. In response, Celgene announced it would sell Otezla, one of its most profitable products, to Amgen for $13.4 Billion to revive the deal. Now it seems the merger is a forgone conclusion with BMS inviting two members of Celgene’s Board of Directors onto its own Board. Additionally, BMS has asked its CFO to step aside to make way for Celgene’s new CFO David Elkins.

With the merger looming, now is a good time for investors to evaluate their position in the company. In their annual statements, both Celgene and BMS openly discussed a number of potential risk factors. Here at Watchdog, our analysts wanted to see if there were any risks that are not openly discussed that are worth considering. Mergers of this size can present all sorts of accounting and legal issues, and our team wanted to see if they could foresee any issues that exist now but will not show up until after the consummation of the marriage. After looking at the Watchdog Reports and digging into the background, our analysts foresee potential issues that could arise due to unconventional accounting methods of Celgene and the ongoing opioid crisis affecting BMS. Sceptics among us wonder whether a big bath is coming.

Celgene’s Unusual Segment Accounting Methodology May Be Hiding Large Writedowns of Goodwill

One feature of every Watchdog Report is a flag for any conversations with the SEC. We went back and looked at question 4 from a letter sent in 2016 which asked, “ Please provide us your analysis under ASC 280-10 for concluding that you apparently have only one reportable segment.” The SEC was confused because most public companies are usually broken up into more than one reporting segment, often based on geography or service. Here Celgene seemed to have four “franchises” that all had their own presidents, which would be typical of a company with multiple reporting segments. Celgene gave a lengthy response, but here is the relevant part:

We believe that none of our functional areas, including what we refer to as our global franchises and regional commercial organizations, possess all of the attributes of the three characteristics of operating segments described in ASC 280-10-50-1, and therefore we conclude that our business is a single operating segment.

Why is this important? Because it affects the way that Celgene accounts for intangible assets and goodwill. Pharmaceutical companies like BMS and Celgene rely heavily on bringing new drugs to market and capitalizing on them before generic versions of the product come to market. After these drugs are conceived, but before they are brought to market, these embryonic products can be considered intangible assets. These intangible assets have a long gestation period and require a lot of cash to clear regulatory hurdles and pass trials. And developing them is risky, only one out of 5,000 drugs that enter preclinical testing make it to market. So big pharmaceutical companies like Celgene and BMS often acquire smaller companies that have a drug in the later stages of development to refresh their pipeline.

When Celgene acquire companies, it does so to get a product in that companies’ pipeline, which shows up as an intangible asset on the balance sheet, and any premium that Celgene pays is reflected on the balance sheet as goodwill. If the product dies in utero, then the intangible assets gained in the acquisition must be written off as an impairment, but the goodwill does not. Companies are only required to write down goodwill when the fair value of the reporting segment falls below the carrying value (or book value) of the assets. At Celgene, there is only one reporting segment, so it can shelter the goodwill from failed acquisitions and artificially soften the impact of those impairments on the balance sheet.

In October 2017, Celgene announced that it would discontinue the trials for one of its products, and ended up reporting an impairment of $1.6 billion. This impairment was not accompanied by any reduction in goodwill. Celgene has made several acquisitions over the years so that it currently has five products in the late stages of it pipeline, recorded as $16 billion in intangible assets, along with $8 billion in goodwill. Investors know that it is possible that some of those intangible assets will be written down as some products in the pipeline may be aborted, but they may not know that some of the $8 billion in goodwill represents assets which derived from already dead products. It would seem counter to accounting ethics for a company to purchase a company for its products but then after writing off those products keep the associated goodwill on their balance sheet. It is hard to conceive that this is what FASB had in mind when it simplified the goodwill reporting rules by removing the requirement to test goodwill with a hypothetical purchase price allocation. Rules always must be in service of principles, so what principle would this fall under; conservatism, transparency, truthfulness, fairness?

Will the Opioid Crisis be the Straw that Breaks BMS’s Back?

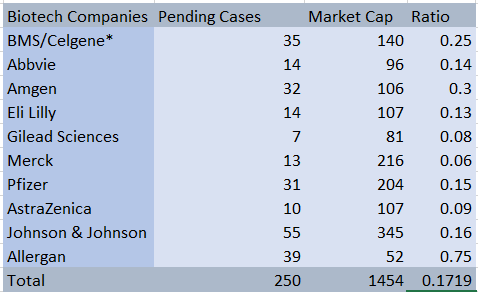

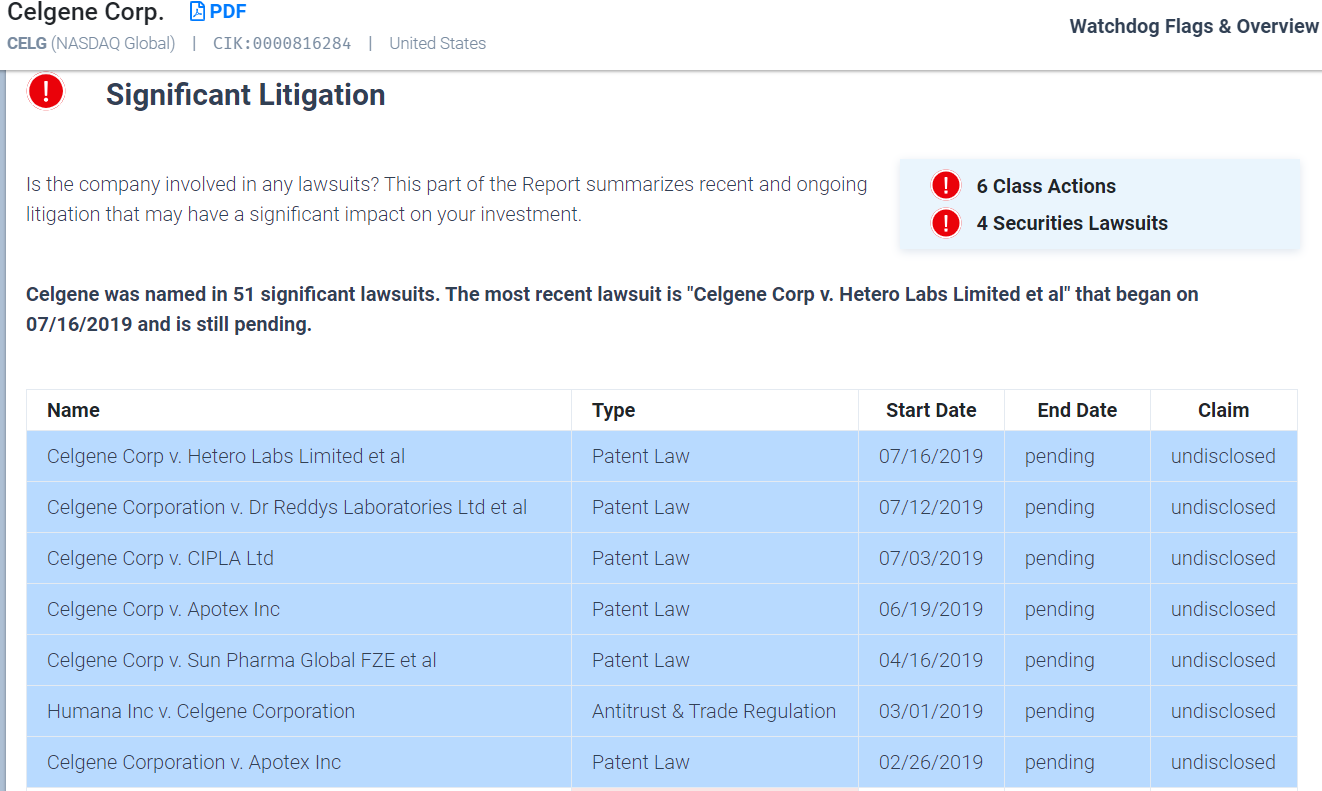

BMS and Celgene already have an aggregate of 35 open cases that the new entity will likely have to deal with after the dust from the merger has settled. Anyone who has had to deal with corporate litigation knows that it can be incredibly disruptive to management and operations alike.

Our analysts looked at the amount of litigation by market cap to provide a simplistic way comparing how much litigation risk these biotech companies typically absorb. Although hardly scientific, this comparison shows that the new company will be taking on more risk than most of its peers.

Litigation

Source: Audit Analytics

*Projected for new Company

**AbbVie announced an acquisition of Allergan PLC in July which would dramatically increase its litigation risk.

After adjusting for size, only Amgen and Allergan PLC face more pending litigation than the new BMS company will face. Most of this litigation comes from Celgene which currently has 25 pending cases. A brief look at the Watchdog Report shows that most of this pending litigation is in the area of patent law.

Extensive litigation can create all sorts of issues because it is inherently unpredictable. BMS and Celgene latest quarterly reports include a great deal of detail about these suits, but not much in the way of reserves to cover the costs and potential settlements or judgments. Now the accounting rules do not require the companies to reserve for costs because they do not know what the exposure will be, and that we can discuss another day. What concerns us more is that BMS does not include any warning concerning litigation stemming from the opioid crisis. This omission is important because BMS manufactured Percocet, an opioid drug that is highly addictive, and is facing serious litigation for their role in the opioid crisis.

Fear over the opioid crisis has reached a fever pitch, and opioid manufacturers are the ones who are receiving most of the ire of the public. In August, Johnson & Johnson was ordered to pay $572 million, and that was considered a slap on the wrist. Perdu Pharma just recently declared bankruptcy in the face of overwhelming litigation, and the Sackler family behind the company announced that they would back an $11.5 billion settlement. That did not satisfy the District Attorney of Pennsylvania, who filed suit against the Sackler family personally for their role in the opioid crisis. Public sentiment is strong, and judges are lending a sympathetic ear to plaintiffs. Every company that is implicated will likely incur significant legal costs and need to pay large settlements and judgments.

Our analyst’s concerns over increased lawsuits is not mere speculation, BMS Canada has already been named in a $1.1 billion suit filed in Toronto because it manufactured Percocet. It is likely that for BMS, this Canadian lawsuit is only the beginning.

What Challenges Will the New Company Face?

With approximately 708 million shares outstanding, BMS will need at least $35 billion in cash to close the deal. The value that Celgene’s shareholders receive is partly contingent on the value of BMS’s stock when the deal closes. BMS’s stock initially declined after the announcement, but currently sits at around $50, which is where it was in January. If the value holds, then the total purchase price for Celgene will be around $70 billion.

BMS has taken on $24 billion in long-term debt obligations to bring its total cash position to about $28 billion, enough combined with Celgene’s cash of $7 billion to consummate the acquisition. After that cash is spent, the new company will have BMS’s long term debt of $24 billion along with Celgene’s long-term debt of $20 billion, for a combined total of $45 billion in long term debt alone. At least investors were warned of the risk in BMS’s 10-k:

As a result of the acquisition and increased indebtedness, we anticipate that our corporate credit ratings will be decreased by one or more ratings agencies. The increased indebtedness and any payments pursuant to the contingent value right will significantly reduce the amount of cash flow available …

Now that Celgene has agreed to sell Otezla to Amgen for $13 billion, that cash will reduce the company’s indebtedness, but it will also damage the growth of the new company by depriving it of an asset which had sales of $1.6 billion last year, and was on pace to grow another 10% this year.

BMS will be counting on the five products that Celgene has in the late stages of its pipeline to provide the growth the company will need to satisfy its long-term debt obligations. If some of these products have delays in their release, or have to be aborted, the substantial expected revenue from those products may not materialize in time to save BMS from its creditors. BMS may not have much margin for error when the merger is completed, and a substantial drop in market value due to an aborted or delayed product line, or the realization of material legal obligations could result in large write offs of goodwill, and further issues with creditors.

Nothing is certain in business. This deal has the potential to either bring in huge returns on investment or turn into a total fiasco. At Watchdog, our focus is on transparency, bringing hidden problems to light and providing context so that investors can make informed decisions. For this merger, we are prescribing both BMS and Celgene an extra treatment of transparency before their wedding, we can only wait and see if they will take their medicine.

BMS’s biggest institutional investor with 8% of ownership, Wellington Management Group PLC, attempted a coup earlier this year to scuttle the deal. It will be interesting to see what they do if the merger experiences more hiccups before and after consummation.

Read our Watchdog Reports for Yourself?

Watchdog Report for Bristol Myers Squibb Co.

Watchdog Report for Celgene Corp.

Get a free trial to our whole library of reports here.

What is Watchdog?

Watchdog Research, Inc. is an independent research provider that publishes Watchdog Reports. Our reports contain warning signs, red flags, material disclosures, and peer analysis for use in valuation, risk analysis, due diligence research, and idea generation. Watchdog Reports are designed to assist investment professionals fulfill their fiduciary obligations and to help investors, executives, board members, regulators and educators learn what they need to know about publicly traded companies. Watchdog Research, Inc. utilizes over 75 specialists and analysts to provide accurate and timely information to our readers.

The Watchdog Blog Team

Note: Our team is made up of current and former Big Four CPAs, Public Company CFOs, Litigation Specialists, Lawyers, Accounting Educators, Ethicists, Regulators, Entrepreneurs, and yes, even a few overly opinionated Harvard MBAs. Our mission is to write blogs that promote transparency in corporate disclosures.

Contact us:

If you want to subscribe to Watchdog Reports, call our subscription manager, at 813-670-2060.

If you have questions about this blog, call our content manager John Cheffers at 239-240-9284.