In 2020 CFO turnover fell from historic levels, yet CFO turnover maintains its long-term upward trend.

The CFO position may be one of the most important positions at any public company. Financial problems at a public company tend to fall in the lap of the CFO first. If the CFO departs under troubling circumstances, that can be a signal of trouble down the road.

When Lawrence Molloy left Under Armour in 2017 for “personal reasons” it was a serious red-flag. Under Armour soon disclosed significant accounting-related problems, problems that have resulted in an SEC investigation and a Wells Notice.

It is not surprising that our research consistently identifies red-flag CFO changes as leading indicators for securities class action litigation.

This post is derived from our 2021: Frequency and Impact of CFO Changes report authored by Joseph Burke and Joseph Yarborough. If you would like to read the report, please email jcheffers@watchdogresearch.com.

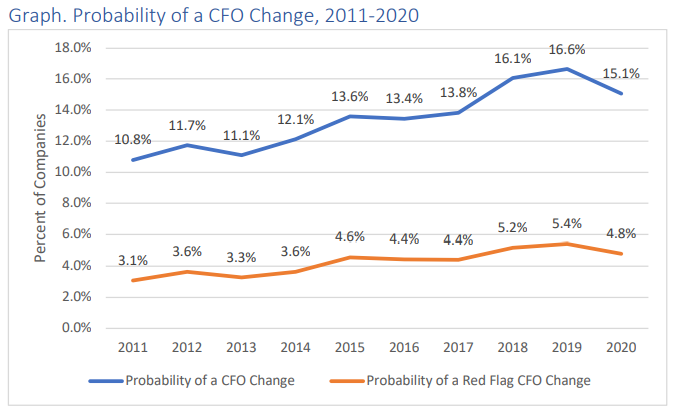

CFO changes have been rising steadily over the last ten years. In 2011, only 10.8% of companies reported a CFO change, whereas in 2020, 15.1% of companies reported a CFO change.

CFO changes reached historic highs in 2018 and 2019. The turnover in 2020 represents a slight decline from those historic highs, although it remains the third-highest year on record. The overall trend continues to bend upwards, signaling continued volatility in the market.

Red-flag CFO changes tend to follow the overall CFO turnover trends. Red-flag changes have also increased over the last 10 years, rising from 3.1% in 2011 to 4.8% of companies in 2020.

Our Watchdog Reports can help you keep an eye on over 30 crucial flags, like CFO turnover. Retail investors can see our reports for free. Investment and Insurance Professionals should contact jcheffers@watchdogresearch.com for special offers.