CFOs play an outsized role in the financial health of a company. When a CFO leaves abruptly or under bad circumstances, that event can have far reaching implications. Lawrence “Chip” Molloy’s departure from Under Armour was as damaging as it was sudden and mysterious. Within a year after being brought in from as an outsider, he had resigned for “personal reasons.” In his wake there was litigation, an SEC investigation only recently brought to light, and—of course—more litigation.

We have already taken a closer look at some of the finer details on this story; we looked at how UA’s spike in non-audit fees was a leading indicator of financial distress and litigation, and we looked at how UA’s comment letters and recent CAM disclosure lend credence to a theory, supported by Francine Mckenna’s reporting, that UA may be under investigation for “channel stuffing.”

It appears in UA’s case that the rounds of litigation and the SEC investigation were a direct result of Molloy’s departure. Molloy’s departure in 2017, understood in its proper context, was a leading indicator of the financial troubles and litigation that UA would suffer in 2019—over two years later. Molloy’s story is interesting, but we wanted to look further into the numbers and see if this was a unique circumstance, or if it was emblematic.

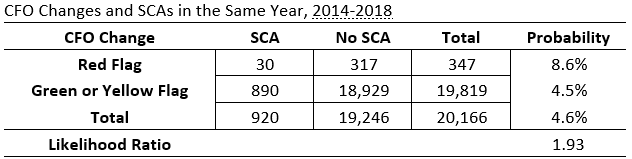

We started with at every CFO change that was marked as a red flag in our reports from 2014-2018. Then we looked at the likelihood that that CFO change would coincide with a Securities Class Action (SCA) lawsuit in the same year. Here were our results:

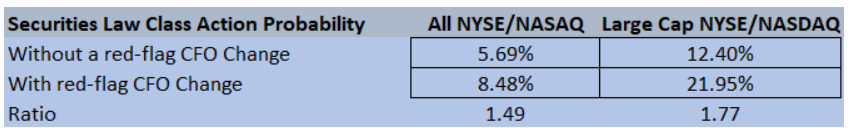

This result is not that surprising, since oftentimes the same issues that cause a CFO to resign abruptly are the same issues that provide fodder for a lawsuit. In a previous post we had analyzed ten years of data (which explains the small variation in the numbers) to determine the likelihood of a SCA lawsuit arising in the same year as a red-flag CFO change, and this is what we found:

This result is also interesting, although not surprising. The bigger companies have more public scrutiny, so if their CFO unexpectedly departs, a SCA is far more likely to occur; or if a SCA is filed upon learning of some problem, the CFO is more likely to be fired. In the case of UA, litigation followed closely behind both the resignation of Molloy in 2017 and the departure of the founder Kevin Plank as CEO in 2019.

CFO Change as a Leading Indicator

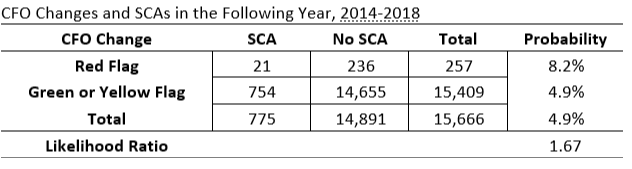

It is clear from the numbers that a red-flag CFO change in any given year corresponds with an increased risk of a SCA lawsuit during that year, especially for big companies. But that warning is often too late, since litigation can come hot on the heels of an early CFO resignation. We ran the same analysis to see if red-flag CFO changes have been a leading indicator of a more litigation in the following year:

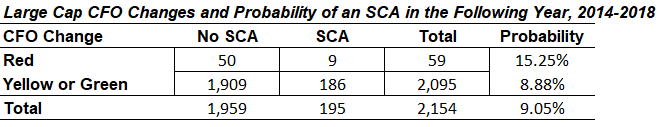

Here we have a statistically significant correlation, demonstrating that a red-flag CFO change is a leading indicator of SCA litigation in the following year. Moreover, the risk is greater for large cap companies:

One more interesting point is that the results of a similar study on red-flag CEOs did not yield the same results. CEO departures did correlate with an increased risk of SCA litigation for the same year, but not for the following year. This makes sense, since an abrupt CFO change probably relates to the financial health of a company, but a CEO can be removed abruptly for all sorts of other reasons.

UA’s Issues Emblematic of Other Red-Flag CFO Departures

The numbers we have presented indicate that UA’s problems with SCA litigation following the resignation of Molloy is emblematic, and not a fluke or exception. The UA example is helpful because it gives a window as to what is going on behind these numbers. When something dramatic like a unexpected CFO departure occurs and the company offers little or no explanation as to what is going on, it is more likely that there is a major problem going on that will trap the company in expensive litigation. The best course of action for these companies is to be fully transparent and address their issues head-on so that their problems do not linger for years.