Our company specializes in assessing the probability a company will suffer a Gray Swan Event, rare but predictable events that can negatively affect the value of company stock. Our products help capture and assess risk. The collapse of Luckin Coffee was a powerful reminder of how risky an investment in a Chinese company can be, however, at the time our analysis did not capture the risk posed by Luckin.

Our analysis was lacking because the data was lacking. Foreign companies don’t have to meet the same rigorous disclosure requirements as U.S. companies, and that problem is exasperated among Chinese companies, at least according to the SEC and PCAOB. Our reports now include a flag that warns investors when a company hails from a jurisdiction without much real regulatory oversight, but we are looking to take that analysis one step further.

We are attempting to quantify the risk associated with investing in Chinese companies by quantifying the risk represented by the absence of data. It’s tricky stuff, but our PhDs are working on it. This project has generated all sorts of interesting data, and we thought we would share a snippet of that research with you here.

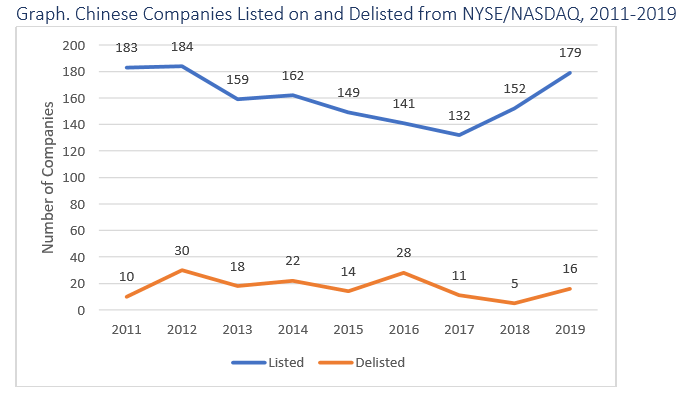

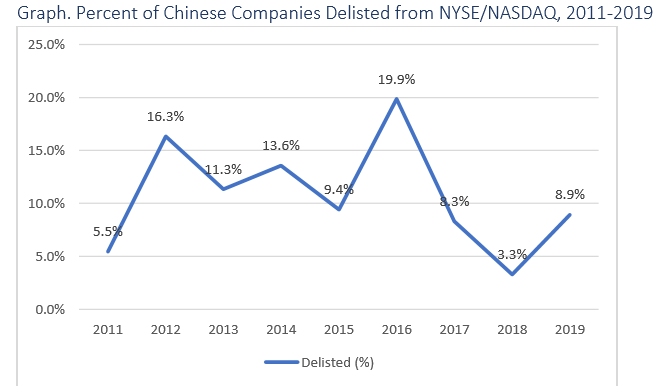

This graph shows the total number of Chinese companies listed on the Nasdaq and NYSE exchanges every year, along with the number of Chinese companies that were delisted. On average, over 10% of the exchange traded Chinese companies were delisted in the past decade.

This graph shows that delistings have not been steady or consistent. In 2012 the Chinese reverse merger scams were exposed, and Western investors soured on Chinese companies. The bad press corresponded with a temporary wave in delistings, and a concurrent fall in overall listings. That wave of delistings started to recede in 2017. It will be interesting to see if Luckin’s collapse generates a new wave of delistings, or if investments in China will go on undeterred.

Occasionally a delisting can benefit investors, if it occurs because a company is purchased or absorbed in a merger, but in most cases a delisting means a near total loss for shareholders. Low selling prices are a common reason for delisting, which signify an almost complete lack of investor demand or interest, even at bargain prices.

Conclusion

In the last few years, the hunger for investments in China has apparently become insatiable, at least amongst a certain class. This has fueled many hyped Chinese IPOs, including Luckin’s IPO. It will be interesting to see if the combined effect of Luckin’s fraud, and a political clash between the U.S. and the CCP over the CCP’s longstanding refusal to allow the PCAOB to conduct inspect Chinese auditors will dampen investor enthusiasm for Chinese companies.

Contact us:

Retail Investors get free access to our Watchdog Reports. Institutional Investors and those interested in our Gray Swan Event Factor can subscribe, or call our subscription manager, at 239-240-9284.

If you have questions about this blog send John Cheffers, our Director of Research, an email at jcheffers@watchdogresearch.com. For press inquiries or general questions about Watchdog Research, Inc., please contact our President, Brian Lawe at blawe@watchdogresearch.com.