The China based coffee company Luckin disclosed a massive fraud on April 2nd, and only five days later, another China based company TAL Education, announced that one its employees had been arrested for fabricating sales. A decade ago, a wave of Chinese companies were exposed as frauds, which damaged China’s reputation. The confluence of Luckin’s fraud with news that the Chinese lied about coronavirus has damaged China’s reputation once again as many people have come to believe that investing in Chinese companies is too risky.

We wanted to look at some data and see if there were any major variations between Chinese companies and Western companies. We specialize in tracking and predicting gray swan events. These are events related to the financial reporting of companies that can seriously injure the value and integrity of a company. Our Gray Swan Event Factor represents an aggregation of these events and their impact on the value of the stock. A higher Gray Swan Event Factor indicates more risk of an event that could damage a company’s integrity and stock price.

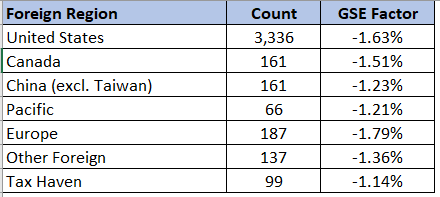

Since the Gray Swan Event Factor is an aggregation of many kinds of events, including mergers, restatements, securities litigation, C-suite turnover etc…, it correlates well with the overall health of a company. We wanted to know if China (or any other country for that matter) would score any differently than the U.S. or Europe. Our PHDs ran the numbers and here were our results:

Here we can see Chinese companies have a significantly lower Gray Swan Event Factor than the United States, Europe, or Canada. On its face, this result indicates that Chinese companies are healthier and less risky investments companies in Europe, Canada, or the U.S., which would be a stunning and counter-intuitive result. But after looking deeper into the matter, we believe that it may mean the precise opposite and that Chinese companies are an even riskier investment than most people believe.

The reason why Chinese companies have a lower GSEF is because they reported fewer gray swan events than western countries, but that is probably because Chinese companies are subject to less scrutiny than Western companies.

In fact, the SEC and the PCAOB (a quasi-private entity that provides oversight for auditors) issued a joint statement on April 21st that specifically warned investors about investing in Chinese companies. They warn that, (1) the quality of financial statements are not consistent, (2) the quality of independent audits is uncertain because the PCAOB is unable to conduct inspections, (3) U.S. authorities cannot really enforce the rules against foreign persons and companies, and (4) there is essentially no legal recourse if you fall prey to fraud.

Our comparison of GSEF by country proves that fewer gray swan events are reported in China than in the U.S., Canada, or the EU. This paradoxically is strong evidence that we should take the SEC’s warning about Chinese companies seriously because they are not subject to the same level of scrutiny as Western companies.

Contact us:

Our Watchdog Reports are Free for Retail Investors, if you are a professional investor you can sign up or call our subscription manager about a group rate, at 239-240-9284.

If you have questions about this blog, send our content manager John Cheffers an email at jcheffers@watchdogresearch.com.