A dramatic increase in non-audit fees means something is happening, and you should know what it is.

Every publicly traded company must disclose how much money they pay their independent auditor, and thanks to Sarbanes Oxley, they must disclose how much money was for audit services (audit fees) and how much was for services unrelated to the audit (non-audit fees).

Independent audit firms have expertise in a wide range of services, so it is not unusual for a company to hire their auditor for services unrelated to their audit. In fact, despite the independence concern it can create, our research shows that companies with higher non-audit fees are less likely to be subject to securities class action litigation.

However, a spike in non-audit fees can be a cause for concern. A dramatic increase in non-audit fees does not necessarily indicate a negative event, but it does indicate that something new is occurring and that it requires the expertise of an accounting firm.

Spikes in Non-Audit Fees Can Foreshadow Negative Events

In 2019 Under Armour reported a dramatic spike in non-audit fees. In November 2019, the Wall Street Journal broke a story that Under Armour was subject to an SEC investigation concerning their accounting practices.

It is likely that Under Armour’s increase in non-audit fees were related to navigating the investigation and remediating the problems that led to the SEC investigation. The SEC settled the case for $9 million less than two weeks ago.

Spikes in Non-Audit Fees Can Merely Accompany Complicated Financial Transactions

A spike in non-audit fees signals a new event, but not necessarily one that is negative. For example, in 2016 Hilton Hotels paid non-audit fees of over $13 million, a 181% increase over the prior year. This increase was primarily due the complicated tax implications for Hilton’s spinoff into three distinct entities.

The Example of Motorola

Motorola is a casualty of the iPhone. From dominance to relative obscurity, the company has all but faded from memory (although it remains a relatively large company with $33 billion in market capitalization).

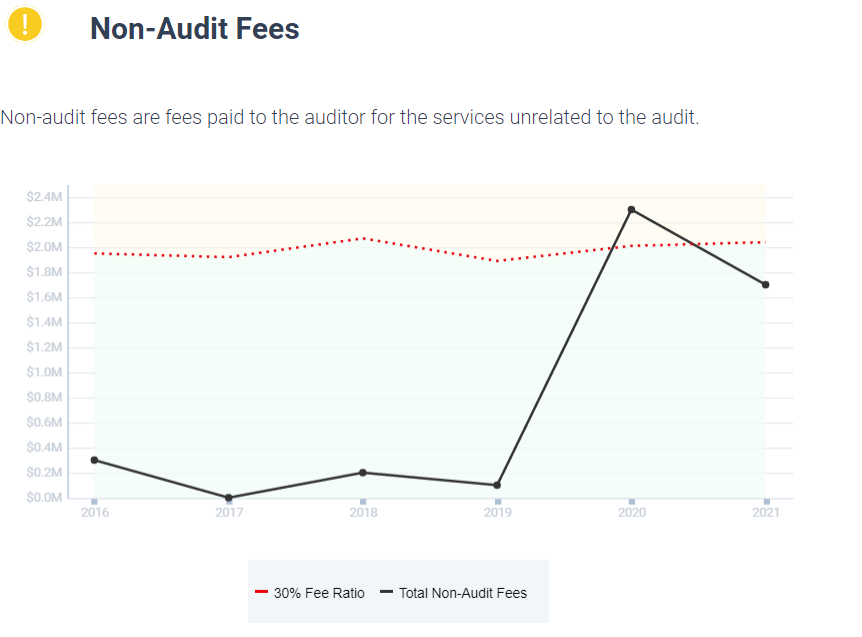

In 2020 Motorola had the largest percentage increase in non-audit fees of any company over the last five years, rising 2,200% from $100,000 to $2.3 million.

This increase was probably due in part to Motorola’s auditor change, from KPMG (which had served as their auditor for over 50 years) to PricewaterhouseCoopers. It is also interesting that Motorola’s CFO departed in June, 2020, for personal reasons.

We are not claiming that Motorola has done something wrong. But unexplained change carries risk, and our job at Watchdog is to help investment and insurance professionals spot risks.

We contacted Motorola for comment and they simply replied that non-audit fees for 2021 were disclosed on page 76 of their annual report.

Conclusion

The disclosure of audit and non-audit fees gives some limited insight into a company. If the fees are changing, it must be because something at the company is changing. Although oftentimes the explanation is readily available to investors, sometimes it isn’t.

Here it is important to know what you do not know. For D&O insurance professionals, it is important to spot these potential risks and get explanations from the company when underwriting a policy or renewing a contract.

Our Watchdog Reports help insurance and investment professionals spot risk, and they are available for over 4,500 public companies. Email jcheffers@watchdogresearch.com to find out if our reports can help you.