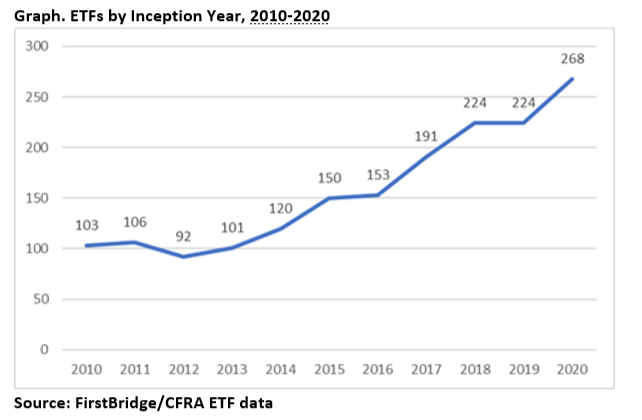

The sheer number of new ETFs created annually indicates that many of them many represent highly risky investment strategies.

ETFs are a relatively new investment vehicle that has become extremely popular over the past decade. An ETF is an investment vehicle that is traded on the exchange like a stock, but it represents a basket of stocks, commonly referred to as an index.

In 2020 the amount of money invested in ETFs eclipsed $5 trillion. ETFs have become popular in part because it their low fees, diversification, and tax efficiency. The key to their success is that they use an index, like the S&P 500, to create the underlying basket of stocks, so they do not use analysts to select stocks. Cutting out analysts lowers operating costs for the fund and lowers fees for investors.

ETFs don’t use analysts to select stocks and they seldom do any due diligence on the companies in the underlying basket. Instead, ETFs file a prospectus explaining a set of criteria for its index populates the fund with companies that fit that criteria.

An ETF is only as safe as its index. The safest indexes are ones that track the whole market, or a more established list like the S&P 500. When investors buy into these ETFs they are avoiding the risk of picking stocks for a portfolio, since oftentimes a monkey can do a better job than the experts at picking stocks.

Investing in a conservative index is a logical way to avoid risk because the index is well diversified. However, that logic breaks down when the criteria used to select the index becomes too narrow or colored by biases and misconceptions. Sometimes the criteria for the index will preclude the sort of diversification that makes investing in an ETF so appealing.

Instead, some funds use narrow criteria that make their portfolios far riskier, but most still don’t do any due diligence on the companies in the index. ECNS, for example, is an ETF that only includes small cap companies from China. We can’t think of a riskier investment. Investors in these kinds of ETFs take on enormous risk.

Are there a lot of highly risky ETFs? Look at the sheer number of ETFs created over the last ten years and come to your own conclusions.

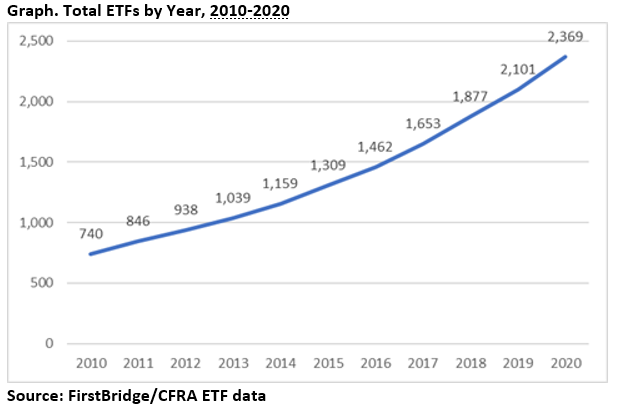

Since the number of new ETFs started every year has continued to grow, the total number of ETFs has increased as well.

Unlike other investment vehicles such as mutual funds, ETFs are not highly regulated. The lack of regulation is part of what makes investing in an ETF so appealing.

However, we are concerned that some ETFs sold to retail investors are sold without the proper fiduciary effort to warn the investors of the risks in the ETF. This exclusion of risk assessment would never be allowed if someone sold a mutual fund or other instrument to an investor. And no investor should buy any equity investment without fully knowing its risk.