Investors in Chinese companies are at a greater risk of a total loss from delisting than those investing in companies from any other country. This risk is especially high in the first few years after a Chinese company is listed on a U.S. Exchange.

This blog is derived from “Chinese Deslistings: Frequency and Causes” a research report produced by Joseph Burke, PhD, and John Cheffers, for Watchdog Research. If you are interested in accessing the entire report, email jcheffers@watchdogresearch.com.

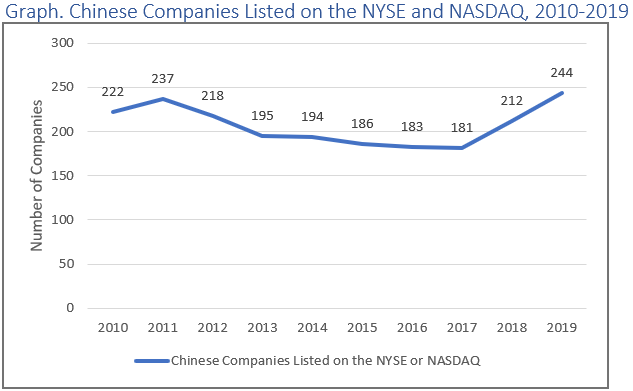

IPO activity has boomed in 2020, with October the busiest month in 20 years. For Chinese companies, this recent uptick continues a trend from 2018 and 2019.

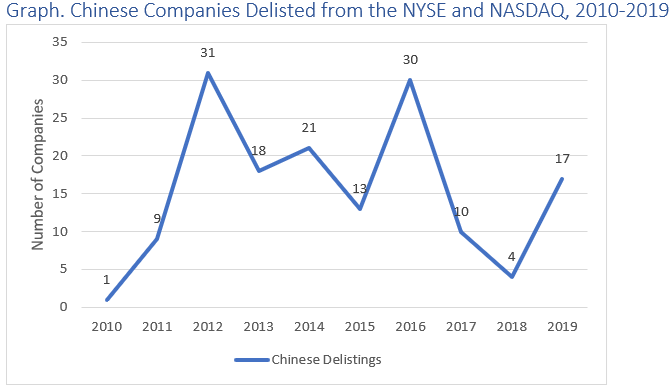

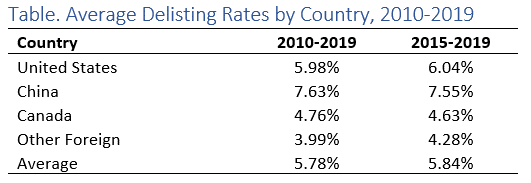

After the previous IPO wave that crested in 2011, Chinese companies experienced a subsequent wave of delistings. Over the past ten years an average of 7.63% of Chinese issuers have been delisted every year, although that number has experienced tremendous variation year-to-year.

Many of the Chinese companies that made up the first wave of Chinese listings were small China-based issuers that gained access to the market via reverse merger. Small Chinese companies merged with defunct publicly traded companies, thereby getting onto U.S. exchanges through a “backdoor listing.” Many of these companies were later exposed as frauds, and the SEC and the Nasdaq eventually tightened up standards to prevent widespread abuse of these “backdoor listings.”

The SEC and Nasdaq tightened their rules in 2011, which resulted in a number of delistings. But interestingly, Chinese delistings remained at elevated levels for several years, and rose again in 2019. For the first and later part of the past decade, Chinese companies have consistently delisted at a higher rate than any other country.

It is worth noting that a good portion of early Chinese delistings were associated with the reverse merger scandal and that the SEC and the exchanges tightened restrictions in the aftermath of the reverse merger wave. But this table demonstrates that delistings for Chinese companies have remained high since 2015, despite the reforms that were made by the SEC.

It is also worth noting that much of the recent IPO surge has been due to the proliferation of SPAC mergers, which are a hybrid of traditional reverse mergers and traditional IPOs. We don’t know how these SPAC companies will fare, but the early results have not been promising, with average returns of negative 9.6% according to a study by Renaissance Capital.

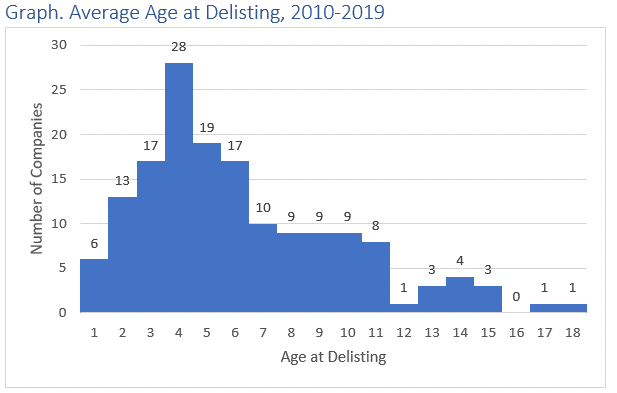

Age at Delisting

One key piece of our report looks at how long these companies stayed on the exchanges before they were delisted. Our research indicates that most Chinse companies were delisted within a few years of getting onto an exchange.

This graph shows that most Chinese delistings occur within a few years of an IPO. That should give investors pause when they consider pouring their money into one of the many Chinese companies have listed in the last few years.

Conclusion

No company is a sure bet, but some are riskier than others. Investors expect some up and downs in the market, but a delisting can represent a total loss of value in an investment, and the potential risk of a delisting should be a top concern when deciding where to invest. Investors should exercise great caution when investing in Chinese companies.

As a part of our analysis, we also looked at when the circumstances surrounding these delistings raised concerns of fraud. But to see those numbers, you will have to wait for Part II.

Contact Us:

If you have questions about this article, please contact the author, jcheffers@watchdogresearch.com. If you have questions about the company generally, or for press inquires, please contact our president Brian Lawe, blawe@watchdogresearch.com.