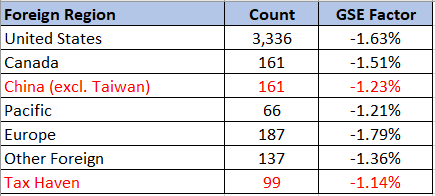

In our last post we compared the relative risks of investing in China and many other countries, including the U.S. We used our Gray Swan Event Factor, which weighs the impact of a host of different kinds of adverse events like restatements, disclosures of material weaknesses, turmoil at the C-suite level, mergers, etc.… We also track these events and flag them in our Watchdog Research reports (which are free to retail investors, reporters, and curious souls).

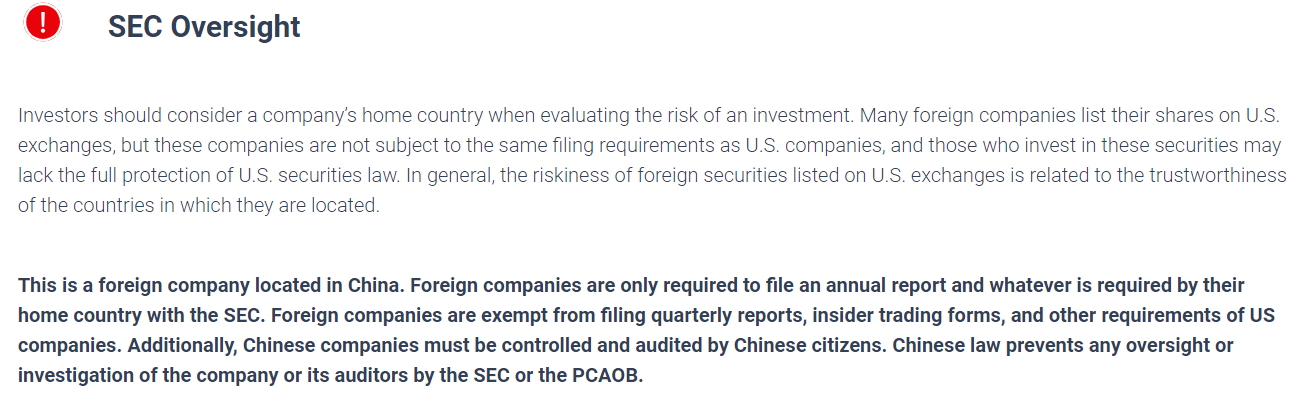

We discovered that China had a better score than the U.S., which was shocking, but we also found out that the SEC and PCAOB had issued an extensive warning to investors in Chinese firms. This warning told investors that financial reporting in China is not consistent, that there is no effective oversight of firms in China, and that there is no enforcement to catch rule-breakers.

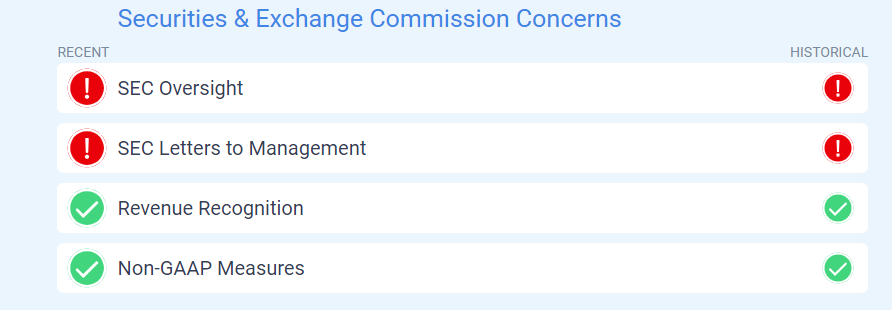

To ensure all the investors who rely on our reports receive this warning, we have added a new SEC Oversight flag to our report. Here is an example for Luckin Coffee:

If you click on the flag for Luckin, it will bring you to this warning:

We aren’t picking on Chinese companies; we also issue a similar warning for countries that are known tax-havens. If you looked closely at our summary table for country by county comparisons, you would have seen that countries classified as a tax-haven have an even lower Gray Swan Event Factor than China.

Our new flag highlights an uncomfortable fact. Our assumptions about the overall health of an investment depends on accurate and reliable information, which is not always available. Investors need to be cautious about having companies in their portfolios that hail from countries that do not have rigorous standards promoting corporate transparency.