57% of Chinese delistings are associated with fraud, illegal activity, or highly suspicious circumstances, according to our research.

In our previous post, we looked at how Chinese companies are delisted at a higher rate than companies from any other country. In this post, we will look at why Chinese companies are delisted at such high rates.

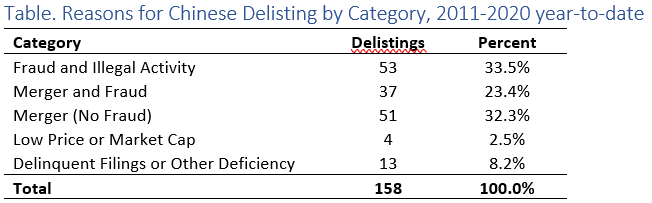

We collected data on 158 Chinese companies delisted from the NYSE and NASDAQ between 2010 and 2020. We gathered this data by searching through articles and public statements concerning each company, specifically examining the facts and circumstances around the time of delisting. We then categorized our results by keywords.

This blog is derived from “Chinese Deslistings: Frequency and Causes” a research report produced by Joseph Burke, PhD, and John Cheffers, for Watchdog Research. If you are interested in accessing the entire report, email jcheffers@watchdogresearch.com.

We were surprised to find that a majority of the delistings were associated with the keyword fraud, or that the facts and circumstances surrounding the delisting provided the indicia of fraud.

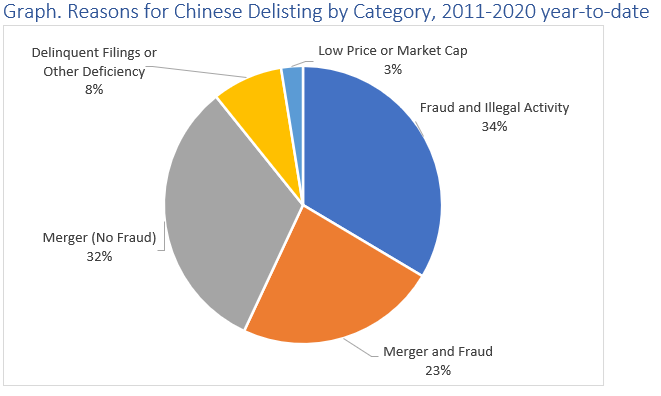

Here is the same information in an eye-catching Pie Chart:

Limitations on our Research

Companies rarely admit to committing fraud, so we cannot definitively determine whether fraud occurred in many of these cases. A delisting associated with the keyword “fraud,” means only that we found credible articles connecting the company to fraud in the press, or that circumstances surrounding the delisting were sufficiently suspicious to infer fraud.

The mere fact that press articles accused a company of fraud does not mean that a fraud caused the delisting, or even occurred at the same time as the delisting, so we may have put some companies in the fraud category where there was no fraud. By the same token, we may have missed fraud in some cases where the fraud was missed by the press.

Additionally, we know of at least one occasion where we initially missed a company entirely because the company changed its location out of China before getting officially delisted. We knew about this company from other research we were conducting, but we do not know if that sort of transfer is common or exceptionally rare.

Patterns

Not all fraud takes the same form, but we saw some common patterns:

A few companies were delisted on suspicion of fraud, but that was rare.

More often, companies had credible accusations of fraud directed at them by short sellers or in lawsuits before a delisting. Others were credibly accused of fraud after a merger that seemed to defraud shareholders and enrich insiders.

Finally, we inferred fraud in some circumstances where it multiple auditor changes and chronic late filings make it appear that independent auditors came across serious problems and would no longer sign off on the financial statements.

Conclusion

Our research strongly suggests that Chinese companies are delisted at higher rates than companies from other countries because they are far more likely to be unmasked as frauds. It will take some time to gather an equivalent dataset for U.S. and other foreign listings, but we suspect that a much smaller percentage of delistings in the U.S. will be associated with fraud.

Chinese companies are getting listed on U.S. exchanges in record numbers. Investors should exercise extreme caution if they are considering investing in a Chinese company.

Contact Us:

If you have questions about this article, please contact the author, jcheffers@watchdogresearch.com. If you have questions about the company generally, or for press inquires, please contact our president Brian Lawe, blawe@watchdogresearch.com.