October was a tough month for Honeywell investors. After starting out the month trading over $160, Honeywell’s share price closed at $140.83 on Oct. 24.

The recent drop in share price runs counter to the tone of the Honeywell’s most recent quarterly report. Headlines from the press release on Oct. 19 read as follows:

- Honeywell Delivers Third-Quarter Reported Sales Growth Of 6%, Operating Cash Flow Growth Of 33%

- Organic Sales up 7% Driven by Aerospace and Safety and Productivity Solutions

- Operating Income Margin up 40 Basis Points, Segment Margin up 70 Basis Points to 19.4%

- Reported Earnings per Share of $3.11; Adjusted EPS of $2.03, up 17%

- Adjusted Free Cash Flow up 51%, Conversion 119%

“Honeywell Rises on Earnings, Revenue Beat” ran one headline at TheStreet.

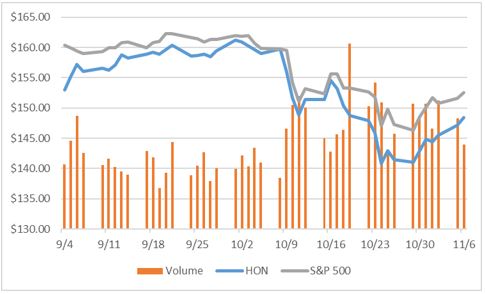

This graph shows Honeywell’s share price against the (scaled) S&P 500. Share prices had closed at $150.38 on Oct. 18, the day before the announcement. Despite the good news, shares fell to $148.71 on Oct 19 and then continued to steadily decline over the next week before bottoming out at $140.83, representing a cumulative loss of over $7 billion.

What happened?

The real news, of course, was that Honeywell had to restate its asbestos liabilities by more than $1.1 billion. In its 10-Q filed on 10/19/18, Honeywell made the following disclosure:

The Company’s revised estimated asbestos-related liabilities are now $2,610 million as of December 31, 2017, which is $1,087 million higher than the Company’s prior estimate. The Company’s Insurance recoveries for asbestos-related liabilities are estimated to be $503 million as of December 31, 2017, which is $68 million higher than the Company’s prior estimate. As of December 31, 2017, the net deferred income taxes impact was $245 million, with a decrease to liabilities and increase to assets, and the cumulative impact on Retained earnings was a decrease of $774 million.

A steady stream of law firms have since announced class-action lawsuits on behalf of shareholders, and the SEC has announced an investigation into Honeywell’s asbestos accounting.

So how much did the restatement cost investors?

Clearly, not all of the decline in Honeywell’s share price can be attributed to the disclosure of the asbestos liabilities and accompanying restatement. As the graph above shows, the share price of Honeywell declined in a large part because of a decline in the market, represented here by the S&P 500. The two lines track closely up until the date of the announcement on Oct. 19, at which point they diverge.

From Oct. 18 to Oct. 24, the S&P 500 dropped by 2.23%. Given Honeywell’s beta of 1.19, Honeywell would have been expected to decrease by 2.66%. If that had that been the case, Honeywell’s price would have been $146.38 on Oct. 24. Instead, Honeywell shares closed at $140.83. This suggests that the restatement may have cost Honeywell investors as much as $5.56 per share, or $4.11 billion in market value.

Interestingly, Honeywell’s restatement had been telegraphed in a comment letter from Honeywell to the SEC. That letter stated the following:

Honeywell determined that we had not appropriately applied the provisions of ASC 450 when measuring asbestos liabilities related to unasserted Bendix claims. Specifically, we concluded that the appropriate application of ASC 450-20 with respect to unasserted Bendix-related asbestos claims is to reflect the full term of the epidemiological projections in the measurement of such liability. The Company intends to revise its historical consolidated financial statements in future filings to reflect the inclusion of the full term of the epidemiological projections (through 2059) in its measurement of liability for unasserted Bendix-related asbestos claims.

This letter was dated Aug. 20 and disseminated on Oct. 10, 2018, a full nine days before the announcement on Oct. 19.

The fact that Honeywell’s stock tracked the market so closely even after the comment letter was disseminated on Oct. 10 suggests that most institutional investors were either unaware of the comment letter or unaware of its implications. Had they known, the larger investors would be expected to reduce their stake in Honeywell prior to the announcement, and the graph would show a greater divergence between the two lines in the period from Oct. 10 to Oct. 19. Instead, the evidence suggests that even the most sophisticated investors still may not do their homework, and that they most likely found out about Honeywell’s asbestos liabilities at the same time everyone else did.

Joseph Burke, Ph.D. is the Senior Economist and Data Scientist at Corporate Watchdog Reports.

Don’t miss another footnote! Let Corporate Watchdog Reports help you spot warning signs and red flags in SEC filings.