J. Alexander’s restaurants often ranks at the top of a Yelp or TripAdvisor review page. And for good reason. The steaks are excellent. The service is outstanding, and the atmosphere is relaxed.

J. Alexander’s is a publicly traded restaurant holding company (JAX) that operates 44 restaurants in 15 states under the brand names J. Alexander, Redlands Grill, Lyndhurst Grill, and Stoney River Steakhouse. A quick scan down the company’s Watchdog Report shows mostly green flags for the recent period, with the exception of a yellow flag indicating a letter sent to the company by the SEC, a red flag under shareholder activism and a yellow flag under Audit Fees. Let’s unpack those flags and see what might be amiss.

We’ll start with the red flag. The red flag indicates recent shareholder activism. Each company’s Watchdog Report shows shareholder activism because such activism helps uncover potential risks that are otherwise hard to find for the company. This is exactly the case with J. Alexander’s. The most recent red flag was a letter sent from a large shareholder, Marathon Partners Equity Management, LLC, to the board of JAX on October 20, 2017. The full Corporate Watchdog Report for JAX includes a link to the letter as filed with the SEC. Here’s that link: SC 13D/A

Marathon’s activist letter is scathing. It criticizes JAX’s board for their proposed acquisition of another restaurant chain called 99 Restaurants. The letter outlines several board member’s potential self-dealing and conflicts in the acquisition, as well as raising serious questions about the 99 Restaurants deal structure and pricing.

Read the letter. The letter is exactly what Shareholder Activism is all about and you’ll see why we include such information in every Watchdog Report.

About two weeks after the Marathon Partner’s letter was filed with the SEC, Justin Dobbie, the Legal Branch Chief from the SEC’s Office of Transportation and Leisure, sent JAX CEO Lonnie Stout a formal SEC letter requesting information raised in the Marathon letter filing. That formal SEC letter is linked in the full Corporate Watchdog Report for JAX, here. Watchdog Research will continue to update the exchange of letters between the SEC and JAX for our paid subscribers.

The information we uncover in our report and the links to the underlying information is well worth reading for any JAX shareholder, potential holder, equity analyst, board member, auditor, financial advisor or broker/dealer engaged in the sale of JAX stock. We would go so far as to say knowing this information is vital to the fiduciary or suitability obligation by many of those readers.

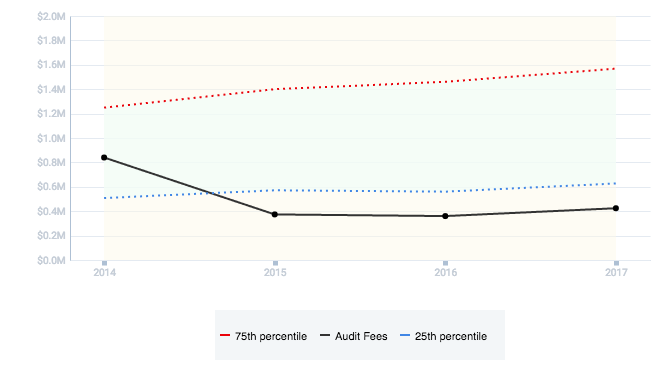

We wrap-up the discussion on JAX by highlighting the last yellow flag on JAX’s Watchdog Report. That yellow flag shows an unusually low payment by JAX to its accounting auditor KPMG. The full Watchdog Report for JAX shows the company’s audit fees fall below the 25th percentile for the industry:

This last yellow flag, combined with the other yellow and red flag, should give readers even more pause for concern. Outside Audit Firms have an obligation to represent shareholders. If the company’s board approves an auditor, but does not provide enough resources for the auditor to fully and completely execute an audit – especially for a company with such a conflicted board – our readers should seriously question whether the auditor has enough resources to uncover potential issues at the company.

In sum, while the steaks are great at J. Alexander’s something seems fishy. Buyer beware.