Every investor makes mistakes when it comes to valuing an acquisition. However, the dramatic decline in market value of Kraft Heinz Co. (“KHC”) is not simply about failing to properly value KHC, or failing to manage the Company to meet growth expectations, it is about a collapse of confidence in the reliability of financial disclosures. Warren Buffet’s well-earned reputation as a great fundamental analyst cannot be questioned, but he rarely gets caught up with investments that present evidence of ethical and transparency challenges. And if he does, he is known to fix them quickly. KHC is the exception to this rule and it is a failure of such magnitude that it could over-shadow Buffet’s long-term reputation as a champion of good governance.

A Giant of Industry in Crisis

On August 26, David Knopf, who at 29 had ascended to the lofty heights of CFO at KHC in 2017, departed after a brief two year tenure. KHC’s CEO, Bernardo Hees, resigned in April. The company’s two most significant executives have left the company at a time of great turmoil; a $15 billion impairment in February, more impairments, restatements, internal control failures, late filings, class action litigation, SEC investigations and more have sent share prices tumbling.

Ever Since Warren Buffet resigned from the Board of Directors on February 22, 2018, the share values have fallen from over $90 to a little over $25 in September, 2019. Yet KHC has not made any substantial changes. We must wonder whether the only way out for the majority owners Berkshire Hathaway (26.7%) and 3G Capital (22%) to win investor confidence back will be to take the company private and completely change its management philosophy and competency. But at what cost and risk?

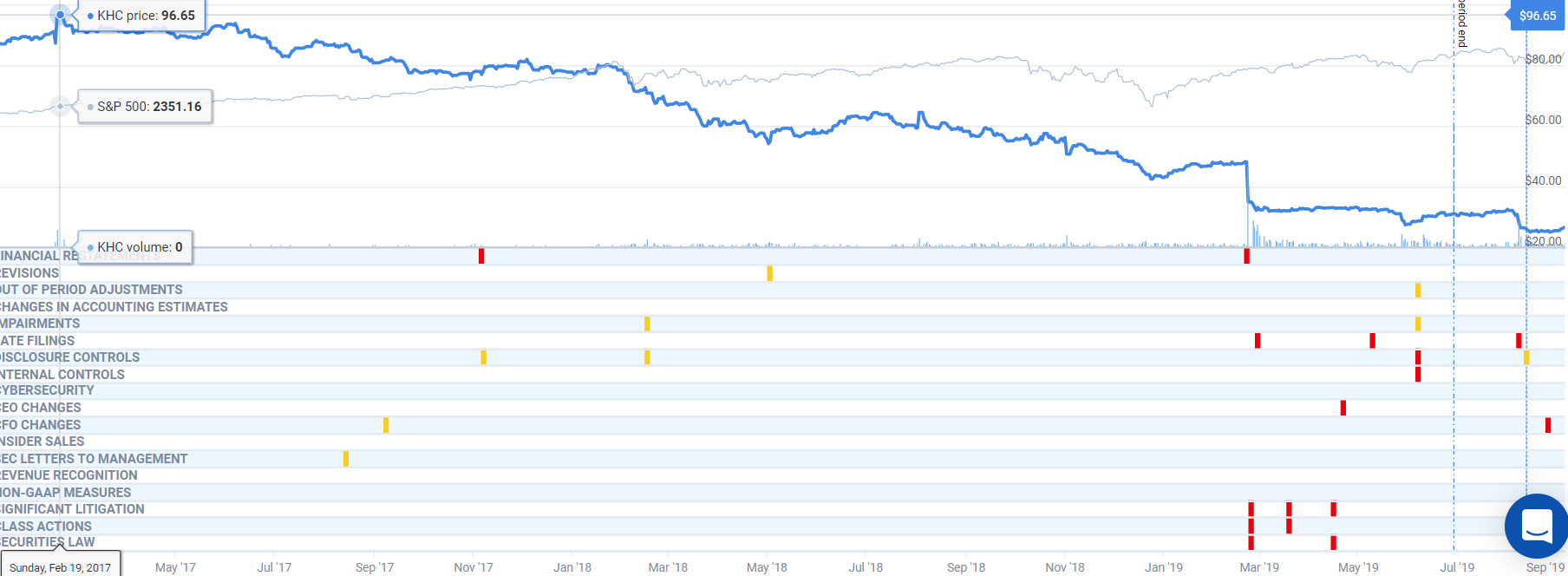

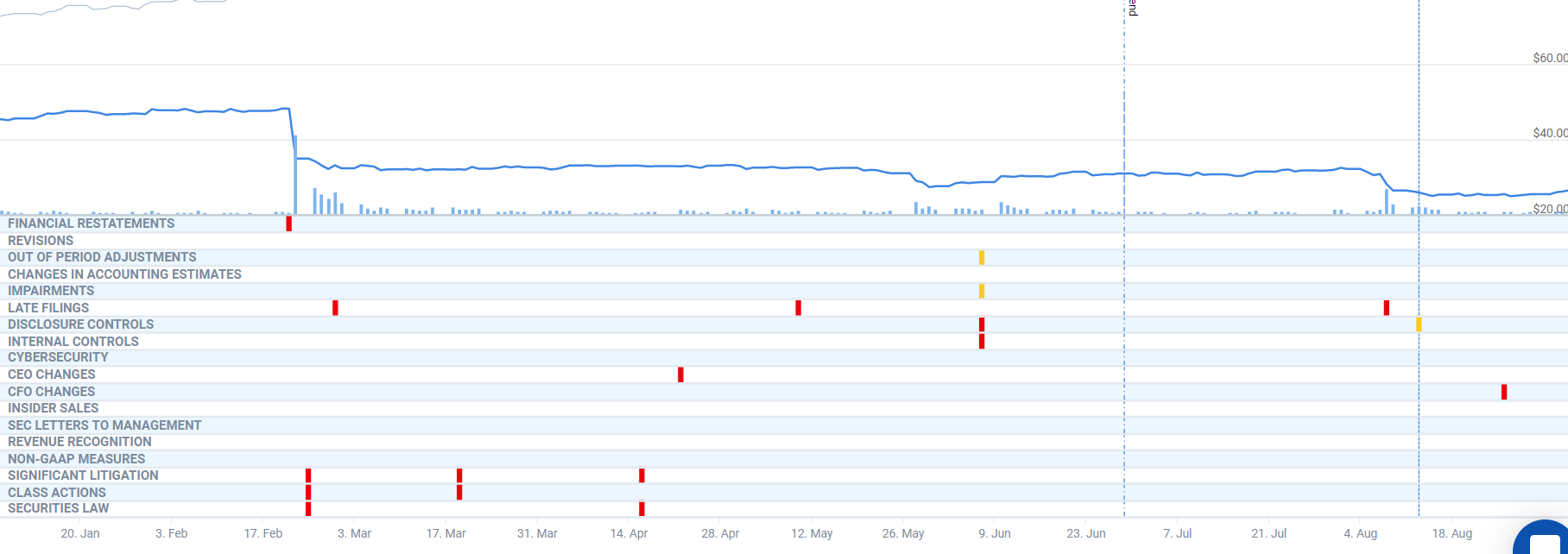

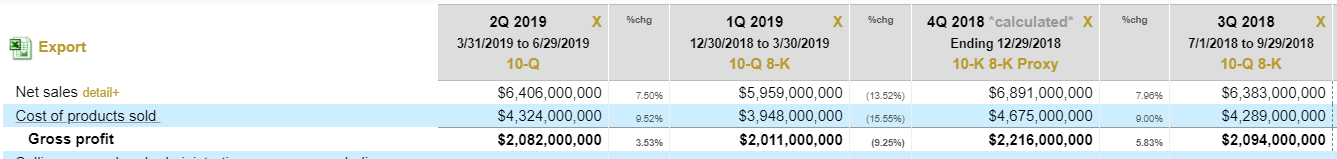

A brief look at the Watchdog Report shows just how precipitous KHC’s fall has been:

How Did Things Go So Wrong for Kraft Heinz – A Gray Swan event?

Kraft Heinz was formed in 2015 when the two of the largest private investment firms, Berkshire Hathaway and 3G Capital, arranged a merger between Kraft and Heinz. 3G Capital is a Brazilian firm known for revitalizing companies by cutting executives and using a zero-based budget approach to boost profitability; their approach helped successfully revitalize AB InBev, Burger King, and Tim Horton’s. With Berkshire Hathaway providing the capital and 3G Capital providing both capital and the management with a proven track record, how could things have gone so wrong at KHC?

In April of this year, we wrote a report concerning KHC after it issued its $15 billion impairment of intangible assets. What concerned us the most about the impairment was that it raised serious questions about the transparency and reliability of its accounting since the merger:

For the fourth quarter of 2018, in connection with the preparation of our year-end financial statements, we assessed the changes in circumstances that occurred during the quarter to determine if it was more likely than not that the fair values of any reporting units or indefinite-lived intangible assets were below their carrying amounts. While there was no single determinative event, the consideration in totality of several factors that developed during the fourth quarter of 2018 led us to conclude that it was more likely than not that the fair values of certain reporting units and indefinite-lived intangible assets were below their carrying amounts…

As a result of our interim impairment test, our unaudited results for the fourth quarter of 2018 included non-cash impairment losses of approximately $15.4 billion, including $7.1 billion related to goodwill and $8.3 billion related to indefinite-lived intangible assets.

While not a black swan event, this declaration had a strong tinge of gray. This statement makes it appear as if something catastrophic occurred in the fourth quarter of 2018, or that some latent problem only manifested itself in the fourth quarter of 2018. However, sales for 2017 and 2018 were virtually flat, raising serious questions about the price paid for Kraft. Even Warren Buffet publicly expressed his belief that they had overpaid.

In 2017, cash flows from operations had been an anemic $500 million, a mere 4.5% of operating income. This could easily have led to a major impairment except that as noted in footnote (e) to the 2017 year-end report, the Tax Cuts and Jobs Act provided a $7 billion benefit to KHC, which helped mask its poor performance.

On February 22, 2018, less than a week after the disappointing 2017 earnings were released, Warren Buffet resigned his position on the Board of Directors. And in August of 2018, 3G Capital trimmed its holdings in KHC from 29% to 22%.

Buffett’s resignation and 3G Capital’s reduction of its stake were indicators that the company was overvalued, but KHC created the opposite impression with their disclosures. A look at the Watchdog Report shows that KHC filed impairments to intangible assets and goodwill in 2016 and 2017 of $18 million and $49 million, respectively – something akin to accounting virtue signaling. In 2016, that impairment was 0.8% of their net income, and in 2017 it was .4% of their net income. These amounts were miniscule in relation to the reported size of intangible assets. In 2016 and 2017, $100 billion of KHC’s $120 billion in assets were in intangible assets and goodwill. These impairments were meant to reassure investors that KHC’s assets were well tested, conservative and accurate. So, when KHC issued its $15 billion impairment to goodwill and intangible assets, it blindsided the public and the market lost confidence in the integrity of the company’s financial reporting. That lack of confidence in the trustworthiness of the reporting, coupled with a steady stream of bad news, has sent the share value spiraling.

Watchdog’s Concerns About the Ongoing Lack of Transparency in Current Reporting

Was the $15 billion impairment too high, too low, or, just right? Should some of this impairment have been a restatement? KHC got into this problem by trying to make its financial statements look better than they were, and then blindsiding the public with a questionable impairment. So, did they come clean in 2018’s 10-k? Can investors rest assured that the worst is over? Our analysts looked at the latest 10-Q and what they found was not encouraging.

Post-impairment, intangible assets and goodwill form over $85 billion of the $103 billion remaining in company assets, as the company carries a long-term debt of over $30 billion. The company’s net assets ($103 billion in assets less $50 billion in liabilities) are at $53 billion. As of today, the market cap has fallen to approximately $32 billion, which reflects an overvaluation of approximately $20 billion. In the Risk Factors section of its latest 10-K annual report (which was released several months late), KHC disclosed:

Brands with a heightened risk of future impairments had an aggregate carrying amount of $29.3 billion … Of the $29.3 billion with a heightened risk of future impairments, $24.0 billion is attributable to brands with 0% excess fair value over carrying amount.

Kraft Heinz has 19 reporting units, and it classified any reporting unit where the fair value was less than 20% over the carrying amount as having a heightened risk for impairment. How confident can you be in KH’s own assessment of its risks? Well, as of the second quarter of 2019 (filed only two months later), Kraft Heinz has recorded an additional $1.218 billion in impairments to intangible assets and goodwill. And it made this additional disclosure:

Reporting units with 10% or less fair value over carrying amount had an aggregate goodwill carrying amount of $33.0 billion as of the 2019 annual impairment test date

Not only did KHC need to issue another impairment, but it also moved the goal posts on what assets are at a heightened risk for impairment in the future. Our analysts believe that more impairments, perhaps even large ones, are likely.

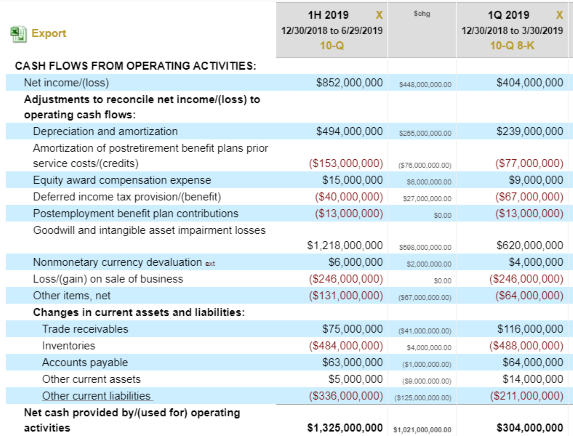

Furthermore, in assessing whether Kraft Heinz is being transparent about its current financial condition our analysts also looked at the 2019 quarterly statements of cash flows:

What our analysts see in this statement is a lack of income produced by core operating activities. The $246 million gain on the sale of a business was due to a pre-tax benefit on the sale of Heinz India Private Limited in January 2019. That sale is not a part of the core business, and the credits from the amortization of post-retirement benefit plans’ prior service costs ($153 million) is not either. And who knows what the Other Items are at $131 million. Yet these three items on the statement of cash flows account for approximately 60% of the total Net Income. These kinds of one-off net income additions do not inspire confidence in the transparency of KHC’s financials.

This statement of cash flows is troubling because it seems that KHC is not experiencing the kind of growth it needs but is trying to find ways to mask that deficiency. However, that is only the beginning of our concerns about the reliability and competency of the management team at KHC.

An SEC Investigation Reveals a History of Poor Management

On February 21, 2019, KHC disclosed that it had received a subpoena from the SEC concerning their procurement practices. It also stated that its own internal investigation had revealed a $25 million increase to the cost of goods for the fourth quarter of 2018, but that it expected no other significant effects from the investigation:

At this time, the Company does not expect the matters subject to the investigation to be material to its current period or any prior period financial statements.

However, on May 6, 2019 KHC disclosed that its internal investigation had revealed misconduct on the part of some of its employees, requiring an adjustment of approximately $208 million going back to the merger in 2015. And even though it did not believe the issue to be material, in the company’s 10-K, (not filed until June 7, 2019) Kraft Heinz issued a restatement because:

[D]ue to the qualitative nature of the matters identified in our internal investigation, including the number of years over which the misconduct occurred and the number of transactions, suppliers, and procurement employees involved, we determined that it would be appropriate to correct the misstatements in our previously issued consolidated financial statements by restating such financial statements. The restatement also included corrections for additional identified out-of-period and uncorrected misstatements in the impacted periods. Accordingly, we have restated our consolidated financial statements and the impacted amounts within the accompanying footnotes thereto.

So, what was this procurement issue the SEC was looking into? According to the company’s latest 10-Q, employees were withholding information about supplier rebates, incentives, and pricing arrangements to manipulate the accounting to meet unrealistic benchmarks set by management.

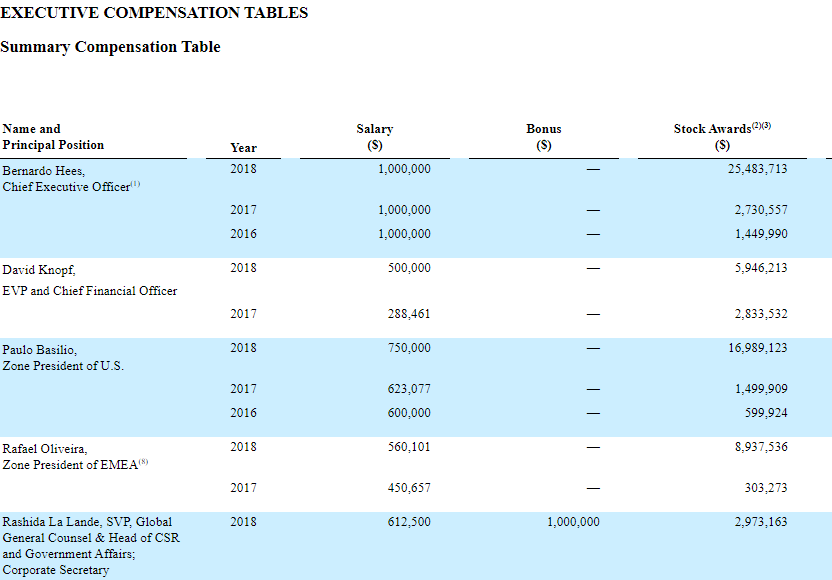

Even though no one in senior management was implicated in this fraud, the manipulation of these operational metrics can be laid squarely at their feet. When 3G Capital’s Bernardo Hees took the helm at KHC, he replaced 11 of the company’s 12 senior executives with younger employees who were heavily compensated with performance-based bonuses. With growth stagnant, one has to wonder whether some of these inexperienced young executives used fraud to meet their objectives, and until the SEC brought it to light, this fraud went (apparently) unnoticed or overlooked by senior management.

Despite New Hires, Kraft Heinz Is Not Changing Its Management Culture

What Kraft Heinz needs is to regain the confidence of the market. To that end, the company has replaced both the CEO Bernardo Hees and CFO David Knopf. Yet it seems that they have not addressed their transparency issues. What accounts for this apparent recalcitrance despite the change in leadership?

Our analysts dug into the background of the management at KHC since the merger that created it in 2015. Berkshire Hathaway may have provided much of the funds for the merger, but the executives and the corporate philosophy were provided by the Brazilian firm 3G Capital.

Bernardo Hees, the former CEO, was brought on after running Burger King and Heinz, both acquisitions of 3G Capital. Hees has been replaced by Miguel Patricio, who has been working at AB InBev, which is another company helmed by 3G Capital.

David Knopf, the former CFO, was appointed at the age of 29 in 2017, and much of his prior experience had consisted of working for 3G Capital. His replacement is Paulo Basilio, a partner at 3G Capital who helped to organize the Kraft Heinz merger in 2015.

Another thing to note about this chart is the fact that all the top executives rely heavily on stock-based compensation for their earnings. (Note: Bernardo Hees forfeited his stock awards for 2018 when he resigned).

At Watchdog, we have serious doubts that the appointment of Patricio and Basilio will change the culture at KHC, especially since Basilio was not only the CFO when many of these problems were created but also was instrumental in proposing the acquisition in the first place. The company may have appointed two new bodies, but both of these men have held previous positions with KHC or related entities. Consequently, we do not expect to see any major changes in the culture of management at Kraft Heinz.

2020 May Bring More Trouble for Kraft Heinz

This year was one of the worst years in the history of Kraft Heinz. As a result, they have fired their CEO and CFO. Have they brought in anyone who is both independent and credible? No, they have brought in more of the same, two executives with direct connections to 3G Capital. Buffet seems to have stepped back and deferred to 3G Capital, just when KHC needs him to step in and take some control over the management of the company. His influence would provide the investors with some much-needed confidence and credibility in a company that has thrown away its good name. KHC is unlikely to grow their way out of their problems this year; the company is still highly leveraged and net sales and gross profits are down.

While projected operating results are not positive, it seems that the problems at KHC are primarily about management philosophy and reliability. That trustworthiness quotient is currently in a spiral that will not be corrected until management embraces transparency and provides much more information about the company’s goodwill and intangible asset value. From how they have been moving the goalposts with each quarterly report, it seems that management is in denial.

Auditor Involvement

PWC has been the auditor of KHC since at least 1979 and it will be fascinating to see their Critical Audit Matters for KHC this filing season. PWC gave KHC an adverse internal control opinion for the year ended 2018. But PWC did not give KHC an adverse opinion for 2017, and perhaps they should have. It is notable that audit fees from 2017 to 2018 grew from $9 to $19 million. It would not be a stretch to expect a further increase in audit fees for 2019. They clearly have been deeply involved in what has been happening and may have been pushing for more transparency. But it does beg the question, what has PWC been focusing on?

It is possible that PWC will resign the account, or that KHC will seek to bring on another auditor. At a minimum, a continuation of late filings by KHC can be expected and adverse internal control opinions will continue.

In short, KHC is in a reputational spiral. And Buffet risks seeing his sterling reputation for good governance tarnished in his twilight years. Displacing 3G Capital might be the right move. Will he save KHC in its eleventh hour? Will he get his soldiers off that fated beach?

Read the Watchdog Report Yourself

Get a free trial to our whole library of reports here.

What is Watchdog?

Watchdog Research, Inc. is an independent research provider that publishes Watchdog Reports. Our reports contain warning signs, red flags, material disclosures, and peer analysis for use in valuation, risk analysis, due diligence research, and idea generation. Watchdog Reports are designed to assist investment professionals fulfill their fiduciary obligations and to help investors, executives, board members, regulators and educators learn what they need to know about publicly traded companies. Watchdog Research, Inc. utilizes over 75 specialists and analysts to provide accurate and timely information to our readers.

The Watchdog Blog Team

Note: Our team is made up of current and former Big Four CPAs, Public Company CFOs, Litigation Specialists, Lawyers, Accounting Educators, Ethicists, Regulators, Entrepreneurs, and yes, even a few overly opinionated Harvard MBAs. Our mission is to write blogs that promote transparency in corporate disclosures.

Contact us:

If you want to subscribe to Watchdog Reports, call our subscription manager, at 813-670-2060.

If you have questions about this blog, call our content manager John Cheffers at 239-240-9284.