When CRON restated the third quarter results for 2019, it attributed the restatement to “accounting errors.” Accounting errors? No kidding! Over a quarter of the company’s supposed revenue went up in smoke.

Cronos Group, Inc “CRON” is headquartered in Canada and sells cannabis and its derivative products wholesale. They sell the “medicinal” kind of cannabis in Canada, Israel, and Colombia, where it is legal. And in the U.S., they sell CBD oil and other cannabis derivatives that contain negligible amounts of THC.

CRON was listed on the Nasdaq in May of 2018 and was initially listed as a foreign entity with Emerging Growth Company (EGC) status. Last March, the tobacco giant Altria invested $1.8 billion in CRON. Under the terms of the deal Altria received 45% of the stock with a warrant to purchase another 10%.

With Altria’s cash and valuable experience, CRON seemed poised to dominate the pot market, but there was a catch. Altria’s investment meant that starting in 2020, CRON’s accounting would be subject to more scrutiny. They would no longer qualify as an EGC, or as foreign filer, meaning their accounting would need to comply with GAAP and their auditor KPMG would be required to test their internal controls throughout the year.

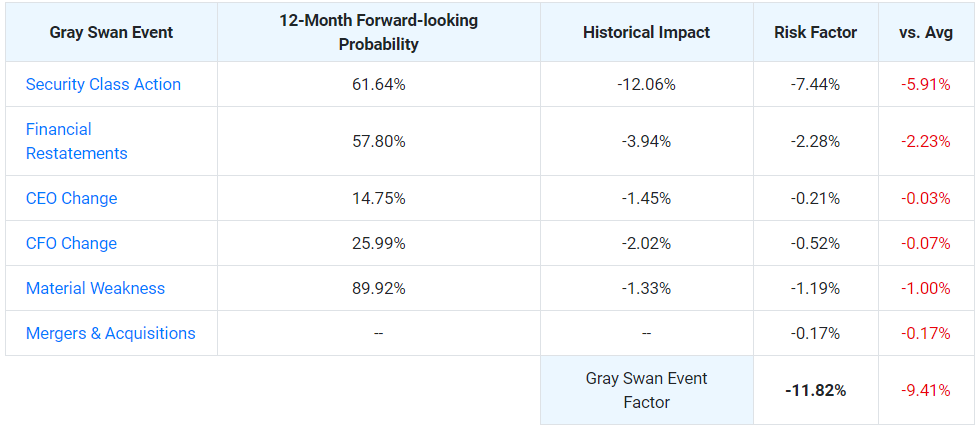

CRON’s accounting did not hold up well to the extra scrutiny. In March, CRON restated revenue for 2019 and revealed material weaknesses in their internal controls. As can be seen from our Gray Swan Event Factor table, these revelations indicate that CRON will face significant challenges going forward:

Restatement Cancels Revenue

On March 2nd, CRON filed an incomplete annual report, citing an internal effort to properly account for revenue from certain wholesale transactions. On March 17th, CRON announced that it would need to restate its previously issued financial information by canceling C$7.6 million (approximately $5.6 million U.S.) in recorded sales.

In their unaudited 2019 third quarter results, CRON had claimed to have brought in C$31,111 million in gross revenue (approximately $23 million in U.S. dollars). After revealing that over $5 million in sales never occurred, they reported that their annual gross revenues were only $25.6 million.

When CRON restated the third quarter results from 2019, it attributed the problem to “accounting errors… due to three wholesale transactions… that were inappropriately accounted for as revenue.” Accounting errors? No kidding! Over a quarter of the company’s supposed revenue a at that time simply did not exist.

It is difficult to believe management’s contention that this overstatement was due to an “accounting error” and not outright manipulation and fraud. After all, it beggars belief that the CFO and CEO would be unaware of the details of these three wholesale transactions that accounted for a quarter of the company’s revenues.

EGCs Internal Controls and Material Weaknesses

CRON brought on KPMG in May 2018 after it was listed on the Nasdaq. The management at CRON probably wanted to increase investor confidence by hiring a Big 4 firm with lots of experience. But as an EGC, CRON did not have to comply with SOX 404(b), so KPMG did not test the company’s internal controls throughout the year or offer an opinion of the effectiveness of those controls.

That all changed in 2020, when CRON lost its EGC status after Altria’s investment. The internal investigation that eventually revealed these “accounting errors” was conducted at the direction of the Audit Committee, indicating that KPMG may have discovered the suspicious transactions while testing the internal controls and alerted the Audit Committee.

KPMG also filed a Critical Audit Matter (CAM) for the revenue recognition related to the company’s wholesale purchases. Auditors are required to file CAMs in their annual report to disclose when a matter requires particularly challenging, complex, or subjective judgements. Investors should pay attention to CAMs because they indicate which numbers in the annual report may be “subjective,” and therefore easier to manipulate.

Additionally, KPMG identified three material weaknesses in the internal controls for the financial reporting of CRON. The weaknesses related to risk assessment, lack of segregation between purchase and sale responsibilities, and an inability to ensure that “non-routine transactions” that deviated from contract terms were properly authorized and recorded.

How Did CRON Add Over $5 Million with an “Accounting Error”?

In its CAM disclosure, KPMG specifically pointed to non-monetary transactions where CRON simultaneously purchased and sold inventory with a vendor. Cron would trade dried cannabis flowers for cannabis resin in a “non-monetary transaction.” The company states that no revenue should be recognized from these transactions.

If we read the tea leaves, it appears that someone at CRON engaged in three “non-routine transactions” with their vendor, deviating from the terms of the sales contract and recording large amounts of revenue from the transactions, when they actually were non-monetary “trades” that raised no revenue. Additionally, whomever was responsible for this apparently did not record the transaction properly or notify the CEO or CFO of what they were doing.

Bizarrely, the CFO and CEO didn’t notice or ask any questions, which is weird because these non-monetary transactions would not have brought in any new cash, even though they apparently accounted for $5 million in gross sales. The SEC seems interested in how this could have happened; they have reportedly asked CRON to preserve documents concerning the matter.

Corporate Governance Problems

After a merger, there can be all sorts of problems that arise when bringing together two different management teams. Altria’s investment created a similar problem at CRON. Altria added four new members to the board and brought in Jeffery Barbato as CFO in April 2019. The first “accounting error” occurred in the second quarter of 2019 so that it was Altria’s Barbato that certified both of the quarterly statements containing over $5 million in “accounting errors”.

It is also interesting that Bruce Gates, added to the board by Altria and Chairman of the Compensation Committee, resigned the same day that the restatement was announced. If that wasn’t fishy enough, the explanation for his departure was that he was “going to focus on other increased professional responsibilities.”

CRON may have been happy to take Altria’s money, but Altria is a big tobacco company, not a charity. The team members Altria brought in may have been putting a lot of pressure on CRON to accelerate growth. That pressure, coupled with inadequate internal controls, may have created the perfect environment for “accounting errors.”

The current situation for the top brass of CRON is untenable, expect major changes this year.

KPMG Cleaning up the Accounting…For a Price

CRON has given over $2 million to KPMG for its services in 2020. That’s 7% of revenue! In total, they have spent $4.4 million on the internal review costs related to the restatement. It is likely that they will spend much more as the remediation efforts continue and the litigation costs pile up.

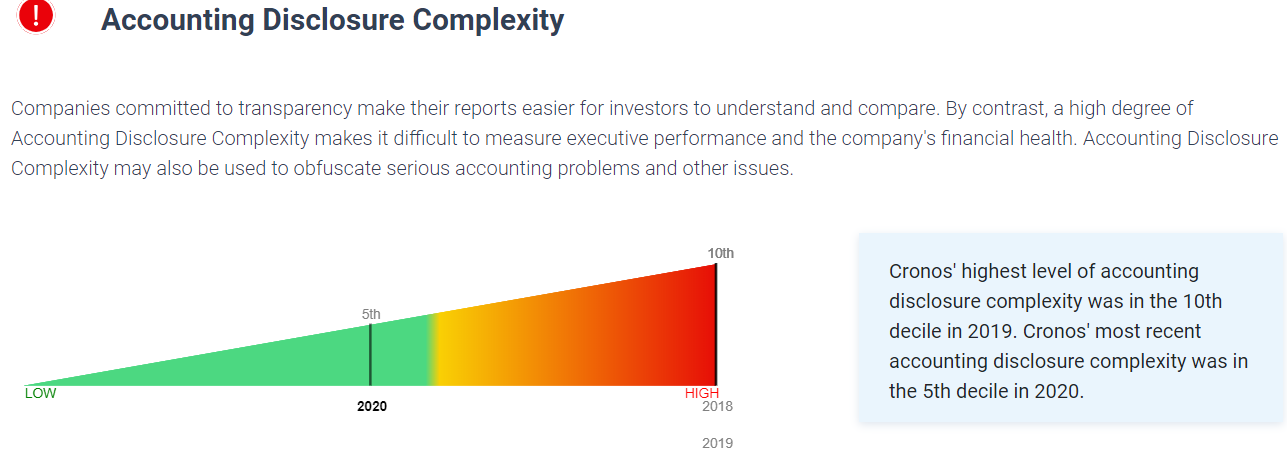

One bright spot for CRON is that KPMG appears to have helped reduce the complexity of CRON’s disclosures:

Financial disclosures decrease in complexity when companies use fewer custom XBRL tags. It appears that CRON has made an effort in 2020 to put their disclosures into more standard and accessible language. It is likely that KPMG has been assisting them in this task.

Conclusion

CRON is a posterchild for the why the U.S. should reconsider allowing Emerging Growth Companies to forego the SOX 404(b) auditor attestation requirement. We discussed this problem when looking at Luckin’s fraud. And again, when the SEC further scaled back the number of companies required to comply with SOX 404(b).

If the auditor is not testing the internal controls of a company throughout the year, there is very little incentive for management to develop proper internal controls over financial reporting. This creates the perfect environment for the manipulation of financial results.

If investors want to protect themselves from potential machinations by management, they should demand that their companies get an auditor to attest to the internal controls, even when they are exempt from SOX 404(b).

Contact us:

Retail Investors get free access to our Watchdog Reports. Institutional Investors and those interested in our Gray Swan Event Factor can subscribe, or call our subscription manager, at 239-240-9284.

If you have questions about this blog send John Cheffers, our Director of Research, an email at jcheffers@watchdogresearch.com. For press inquiries or general questions about Watchdog Research, Inc., please contact our President, Brian Lawe at blawe@watchdogresearch.com.