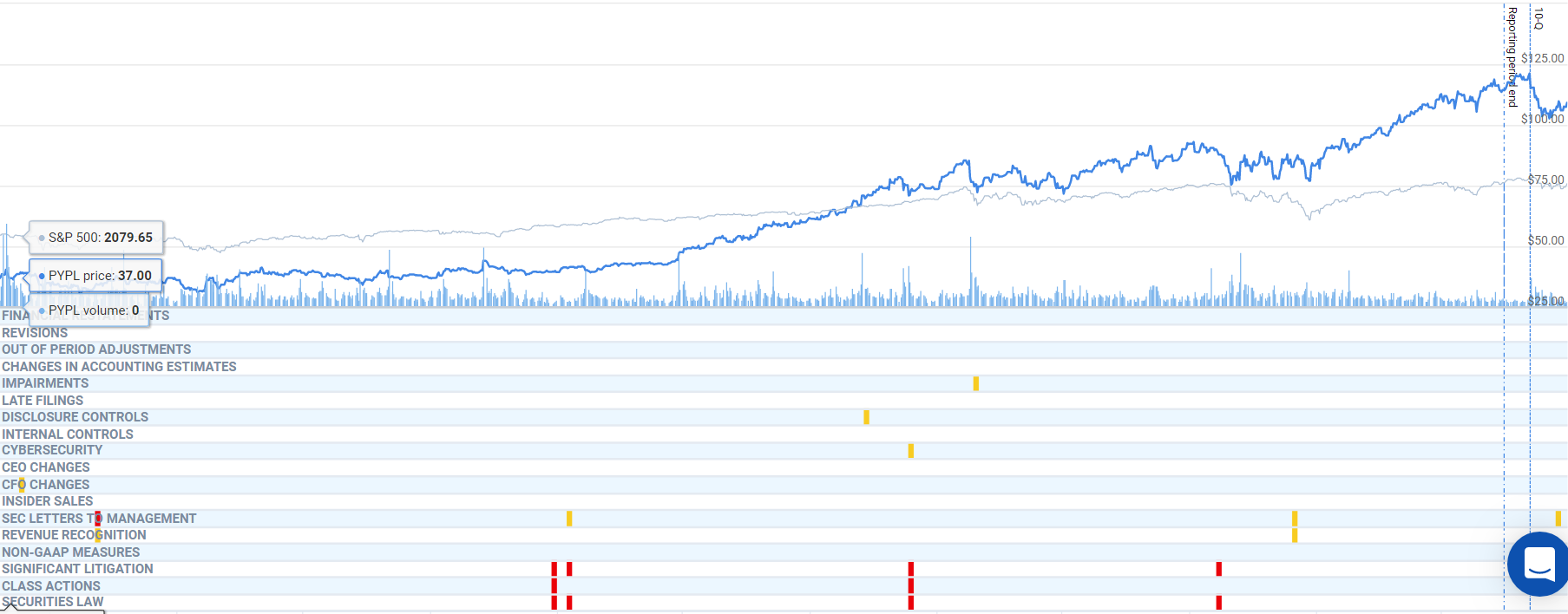

PayPal has experienced a great deal of success in the last three years since implementing a new acquisition strategy, with their share price increasing from $37 per share on August 30, 2016 all the way to $109.21 as of August 29, 2019. A quick look at the Watchdog Report shows an increase in share value which has outperformed the S&P 500 steadily since May 2017. Although their new strategy seems to be working, the Watchdog Report also contains indicators that have us concerned about PayPal’s commitment to transparency and what may lie around the corner for its investors.

PayPal’s Initial Acquisition Did Not Go According to Plan

PayPal began its acquisition strategy by acquiring Xoom, in July, 2015, and it hired Daniel H. Schulman as CEO and John Rainey as CFO to implement that strategy. It seems that PayPal may have overpaid for Xoom considering Xoom’s anemic growth and difficulty keeping up with its competitors in the cross border remittance market. PayPal shared some directors and core investors, so that may explain why PayPal paid a premium to acquire a company with lackluster performance.

The Watchdog Report also indicates that PayPal has had issues with exercising the internal controls necessary to prevent transactions with terrorist countries. The SEC sent two separate letters asking about this issue in 2016, to which PayPal had denied any unlawful contacts with Sudan and Syria. The SEC followed up this year, however, after a story came out that the DOJ had subpoenaed PayPal concerning several issues with their overseas transactions. Again, PayPal initially stonewalled, saying that it had self-reported possible transactions to the Treasury Department’s Office of Foreign Assets Control (“OFAC”). This time the SEC was not satisfied, and asked PayPal directly which terrorist countries were involved in the transactions they had reported to OFAC. Finally, PayPal admitted to the contacts, and not with just Syria and Sudan:

In response to your comment and further to our discussions with the Staff, we respectfully advise the Staff that the self-reported transactions involved certain countries subject to U.S. economic sanctions at the time of the transactions, including North Korea, Iran, Sudan and Syria (the “Reported Countries”).

PayPal “Sold” Their Book of Business to Synchrony to Fuel Their Acquisition Strategy

In 2018 PayPal closed on a deal announced in 2017 whereby they offloaded their credit receivables to their partner, Synchrony Bank, in exchange for the $6.9 billion in cash necessary to fuel their relatively new acquisition strategy, in hopes of higher returns. This deal, however, is not as straightforward as it looks. The SEC sent PayPal this letter about it:

We note your disclosure that you accounted for the sale of your U.S. consumer credit receivables portfolio as a sale. You also disclose at the bottom of page 102 that you concluded your continuing involvement in the revenue share arrangement does not invalidate this determination. Please tell us in reasonable detail the specific nature of your continuing involvement in the transferred assets. Please also tell us how you concluded you met the conditions for sale accounting, and tell us the specific accounting literature you relied upon in reaching your conclusion.

PayPal and Synchrony have been partners since 2004, so it raised eyebrows at the SEC when PayPal “sold” a book of business to Synchrony but also retained an interest in the revenues. The SEC found the transaction confusing, and perhaps you should too.

PayPal replied to the SEC that because they no longer had legal control over the assets and because Synchrony could sell or pledge the assets, it was a real sale. At Watchdog we are not all that interested in the legal question of whether this was a sale. We are concerned with a pattern we are seeing at PayPal of using legal and accounting rules to disguise their transactions, rather than fully disclosing them.

A New Acquisition Creates A New Headache for PayPal

If the Xoom acquisition had not gone as planned, it did not alter PayPal’s strategy; PayPal purchased TIO Networks for $230 million in 2017. Unfortunately for PayPal, it also acquired TIO’s systemic cyber security issues. Only five months after closing the deal it announced that 1.6 million users had had their data compromised. According to PayPal’s latest quarterly report, it had to suspend TIO’s operation because of the data breach, and PayPal has been embroiled in litigation arising from the breach since the announcement.

A quick glance at the Watchdog Report seems that PayPal may have signaled that there was an issue with the cyber security over a month before making its announcement. In the October quarterly report it reported a disclosure control issue with this unintelligible statement:

During the third quarter of 2017, we completed the implementation of a customer and transaction sub-ledger within our enterprise resource planning system. As a result of this implementation, we have experienced certain changes to our processes and procedures which, in turn, resulted in changes to our internal control over financial reporting. Management will continue to evaluate and monitor our internal controls as processes and procedures in each of the affected areas evolve. For a discussion of risks related to the implementation of new systems, see Part II, Item 1A—Risk Factors—”Systems failures and resulting interruptions in the availability of our websites, applications, products or services could harm our business” in this Form 10-Q.

Because of the closeness in time to the announcement of the cyber security breach, it is logical to assume that statement was meant to provide some warning of the cyber security issue, but this statement is so opaque it could refer to anything. At Watchdog we find this unintelligible disclosure statement far more concerning than a data security breach. Interested parties should take note if PayPal makes more unintelligible statements in the future.

Furthermore, PayPal has taken a 30 million dollar impairment on the intangible assets it acquired from TIO, that’s about half of the 66 million in intangible assets that PayPal believed it was gaining in the first place. When asked by the SEC about the impairment, PayPal explained that the intangible assets included $45 million for the service distribution channels and customer volume, both of which had been ruined by the data breach. In their estimation, the remaining value was about $15 million, hence the $30 million impairment.

That is not the end of the story, PayPal also had to suspend operations at TIO because of the security breach and decided to wind down operations in the first quarter of 2018. Considering that the $170 million dollars in goodwill gained from the acquisition of TIO was attributed to TIO’s workforce and synergies, it would seem that PayPal should have written off the entire $170 million as a loss.

But PayPal has not written off the $170 million, because of a new accounting standard released from the FASB board ASU 2017-04. The FASB has attempted to simplify the goodwill impairment process by only having a company write down the goodwill of a reporting segment if the carrying value (or book value) of the segment does not exceed the fair value. This new standard benefits companies with under-appreciated assets like PayPal, whose net assets are $16 billion when the market cap for PayPal is at $135 billion. PayPal put the goodwill from TIO in a reporting segment whose fair value is higher than its carrying value, so it has not had to write down the $170 million in goodwill, even though it is worthless.

So, PayPal has taken advantage of this new accounting rule to keep an extra $170 million dollars in assets on its books. At Watchdog, this is the sort of business practice that draws our attention; transparency is the fundamental principle that animates the accounting rules, which in turn give flesh and blood to the obligations that management owes to investors and the public. PayPal’s use of the new accounting rule to keep $170 million in worthless assets on the balance sheet is concerning. It raises questions about their commitment to transparency and makes us concerned that this $170 million is just the tip of the iceberg.

PayPal’s Virtue Signaling Impairment

This impairment raises another question. If PayPal can manipulate the accounting rules to keep from writing off the $170 in goodwill from the TIO acquisition, then why would it bother issuing such a small impairment? The $30 million loss is not material; it represents a mere 1.65% of PayPal’s net income. In fact, PayPal had made a $10 million downward adjustment for the goodwill that it gained in the Xoom acquisition without issuing an impairment.

PayPal seems to have filed the impairment to create the appearance that they are running a tight ship on their acquisitions, which would be a reassuring notion since PayPal has gone all in on acquisitions as a growth strategy. In 2018, PayPal paid $2.2 billion for iZettle and $400 million for Hyperwallet. And perhaps those acquisitions are going much better and next year PayPal can put all its troubles with Xoom and TIO Networks in the rearview mirror. But there are two more indicators on the Watchdog report that have us concerned; the unusual increase in audit fees and the insider sales from the CEO Schulman and CFO Rainey.

Concerning Indicators for 2020

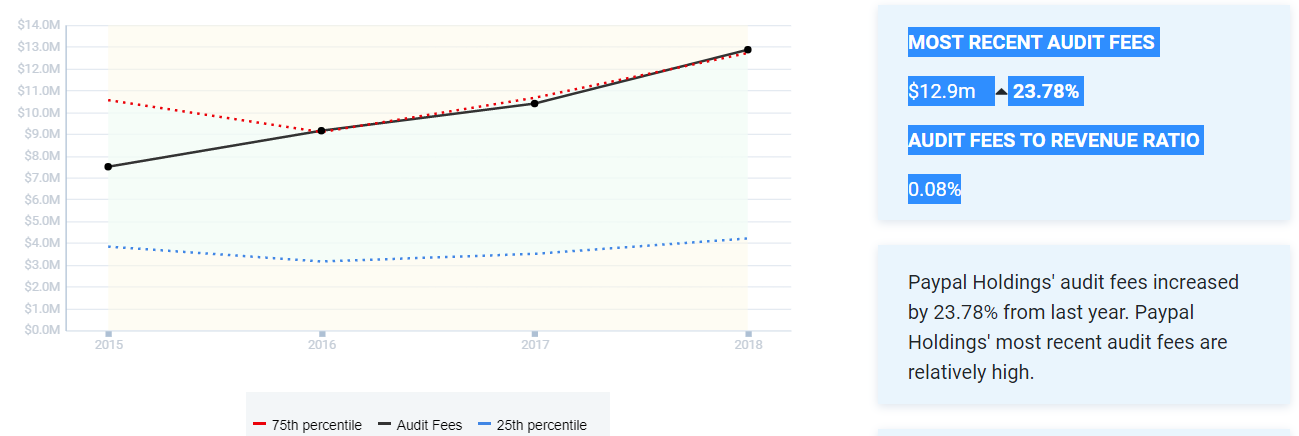

Over the last three years audit fees have risen substantially, over 23% in the last year.

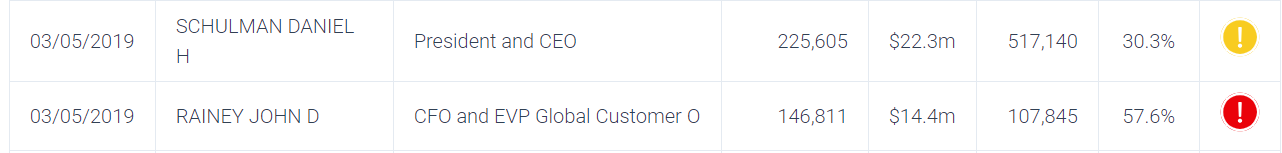

These increases in fees could indicate that PayPal is experiencing some accounting issues from its recent acquisition spree, and it is certainly possible that they could increase significantly again next year. But the most troubling indicator raised on the Watchdog Report is that the CEO Schulman and the CFO Rainey both engaged in significant insider sales on March 05, 2019. CEO Schulman divested himself of 30.3% of his holdings for $22.3 million dollars in cash. CFO Rainey divested himself of 57.6% of his shares for $14.4 million dollars in cash.

PayPal seems to have changed its growth strategy over the last few years to focus on acquisitions that will grow the company and its share price at a faster rate. The share price is up but here at Watchdog we are concerned. The early acquisitions have brought a slew of problematic accounting issues, and that is reflected in the steadily increasing Audit Fees.

At Watchdog we are more concerned by the consistent lack of forthrightness; their disclosures are hard to understand, and they use technical accounting rules and legal definitions to obscure potential problems from their shareholders and regulators. The market has confidence in PayPal, but when unknown liabilities are lurking on the balance sheet and the executives are divesting their shares, it is hard to share in the enthusiasm.

Read the Report for Yourself

Get a free trial to our whole library of reports here.

What is Watchdog?

Watchdog Research, Inc. is an independent research provider that publishes Watchdog Reports. Our reports contain warning signs, red flags, material disclosures, and peer analysis for use in valuation, risk analysis, due diligence research, and idea generation. Watchdog Reports are designed to assist investment professionals fulfill their fiduciary obligations and to help investors, executives, board members, regulators and educators learn what they need to know about publicly traded companies. Watchdog Research, Inc. utilizes over 75 specialists and analysts to provide accurate and timely information to our readers.

The Watchdog Blog Team

Note: Our team is made up of current and former Big Four CPAs, Public Company CFOs, Litigation Specialists, Lawyers, Accounting Educators, Ethicists, Regulators, Entrepreneurs, and yes, even a few overly opinionated Harvard MBAs. Our mission is to write blogs that promote transparency in corporate disclosures.

Contact us:

If you want to subscribe to Watchdog Reports, call our subscription manager, at 813-670-2060.

If you have questions about this blog, call our content manager John Cheffers at 239-240-9284.