Public companies disclose an enormous amount of information every year, but they don’t tell you what it means. Our Watchdog Reports summarize all the relevant corporate governance and financial reporting issues in a simple report that flags issues and provides peer-to-peer comparisons. Once you know what the information means, you can act with confidence.

One of the most important issues that we track is turnover in the C-suite. We track CEO and CFO changes for every public company and assign them a red, yellow, or green flag. If an investor should look to one person to best protect the investor’s interest it would be the CEO. If the CEO goes, investors should be very concerned and want to know a clear reason for the departure. In this post we will look specifically at CEO changes and show you the criteria for how we assign a red flag

The Reason Offered for a CEO Departure Can Raise a Red Flag

Companies must file a disclosure when they make a change at the CEO position, and they oftentimes offer some sort of reason for the departure. For example, we will assign a red flag if the CEO departs to “pursue other interests,” which is always suspicious considering how much CEOs get paid to be interested in working for their employers.

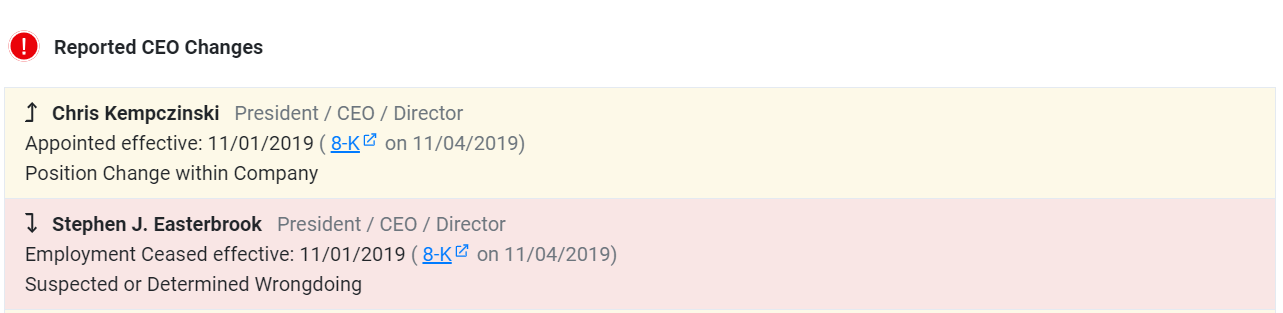

Our system also will assign a red flag to any CEO change due to a disagreement with management, a dismissal for cause, or if wrongdoing was suspected or determined.

For example, McDonald’s parted ways with ex-CEO Steve Easterbrook for violating company policy by engaging in an inappropriate relationship with an employee.

McDonald’s disclosure of wrongdoing was unusual. Our previous analysis of company disclosures concerning CEO departures from 2020 found that less than 4% of the departures were ascribed to misconduct. However, for almost 70% of CEO departures, the companies either gave no explanation, or an explanation so nondescript that it revealed nothing.

It is indisputable that companies replace CEOs for misconduct far more often than they disclose that they replace a CEO for misconduct. A PwC study suggested that nearly 40% of CEO departures in 2018 were due to an “ethical lapse.”

Since we cannot rely on the companies to tell us when a CEO departure should raise a red flag, we also look at the surrounding facts and circumstances.

A Brief Tenure Can Also Raise a Red Flag

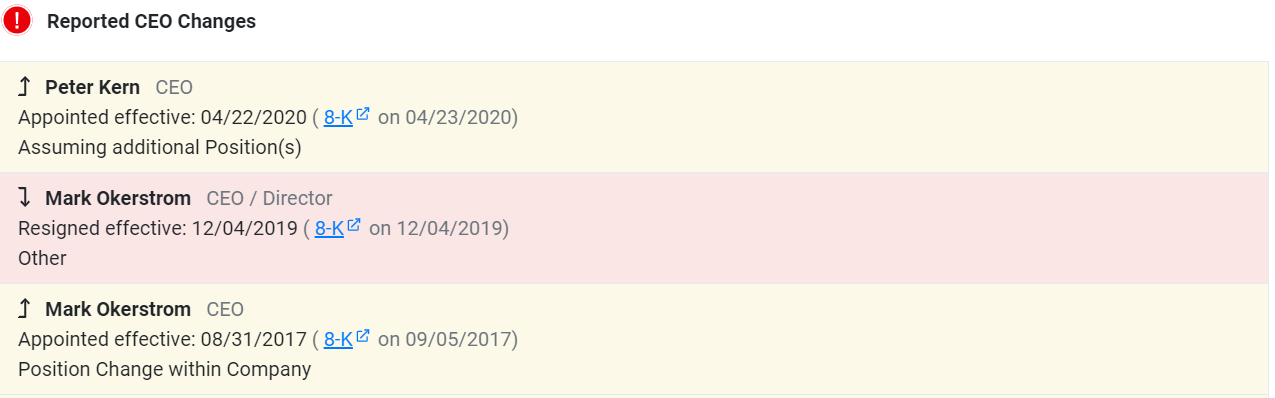

The most common reason we assign a CEO change a red flag is if the departing CEO leaves their position after a relatively brief period. For example, in 2019 we assigned a red flag to Mark Okerstrom’s departure from Expedia because he had only held the position for two years.

Expedia also replaced its CFO the same day as a part of a change in direction for the company. This decision appears to have been strategic and not related to any misconduct on the part of Expedia’s executives.

In retrospect our red flag for Lawrence Molloy’s departure from Under Armour was on point. Molloy resigned for “personal reasons” in January 2017. His departure appears to have sparked an investigation by the SEC of accounting practices from 2015-2016 that earned Under Armour a Wells notice this past July. Interestingly, Molloy’s abrupt departure as CEO appears to have been due to the ethical lapses of *other *executives at Under Armour, not him. But his departure should have raised a big red flag for investors.

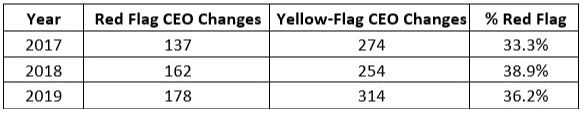

The PwC study that we referenced earlier claimed that 40% of CEO departures were due to ethical lapses in 2018, nearly 50% higher than in 2017.

Our own analysis shows that the number of CEO changes that we have assigned a red flag has steadily increased over the last three years.

These numbers give credence to the idea that a far greater portion of CEOs are departing under questionable circumstances than these corporations would like to admit.

Our System Filters Interim Changes

One last note on this topic of red flag CEO changes. As a part of the normal CEO turnover process, many companies will select an interim CEO while they search for someone to fill the position in the long-term. Our system does not assign red flags for these brief interim appointments because they are common practice.

Conclusion

The reason why we assign green, yellow, and red flags in our reports is because we want to make it easier to spot future gray swan events (public disclosures that often lead to a steep decline in a company’s stock price).

Changes at the CEO position are always important, but our system can help cut through the noise and draw attention to the CEO departures that are the most likely to have a significant effect on the company’s future.

Contact Us

D&O insurers spend a lot of time on new bid requests. Our clients use our Watchdog Reports to quickly discover which bids they should pursue. Click here to request a free demo. Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.