At Watchdog Research we evaluate a company’s past to get an idea of its future. As part of our research, we assign every company a Gray Swan Event Factor. We have developed a statistical model that looks at the size, industry, and historical flags for each company to evaluate the probability that a company will suffer a Gray Swan Event, and the likely impact of such an event on its stock price. These calculations are rolled into our Gray Swan Event Factor.

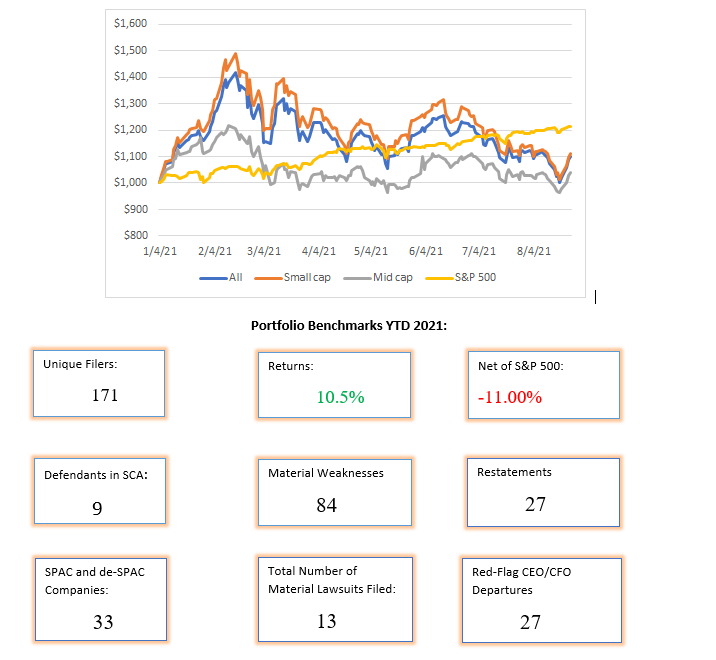

We grouped together all the companies with the highest Gray Swan Event Factors and put them into a mock portfolio. Here is the performance of our mock Gray Swan Portfolio benchmarked to the S&P 500.

Portfolio Disclaimer and Details

Disclaimer

The risk of a Gray Swan Event is only one factor to consider when investing. Some companies in this portfolio have had fantastic returns; other low-risk companies have had disastrous returns. Our model can help evaluate risk, but you as an investor must make your own informed decisions. This mock portfolio should not be considered investing advice, it is designed to foster discussion concerning a topic that we believe is underappreciated, accounting-related risks for publicly traded companies.

Portfolio Details

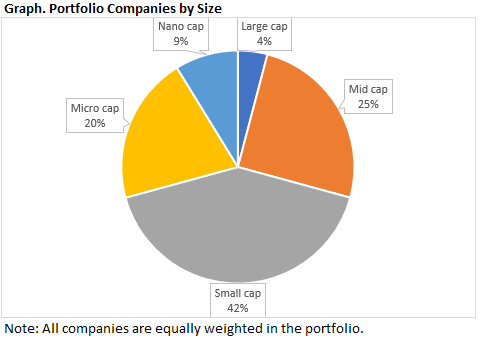

Our Gray Swan Portfolio is made of 171 companies of all sizes, including micro and nano cap companies. The majority of companies in the portfolio are small cap companies; the next largest group is mid cap. Large cap companies are the smallest group.

Special Considerations for 2021

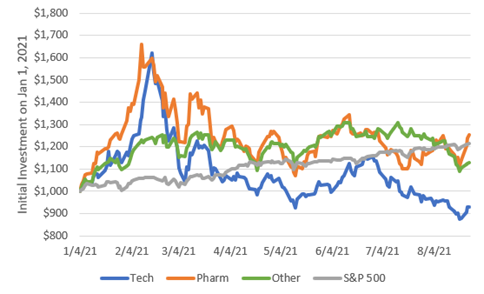

There are two separate new phenomenon which were not anticipated by our statistical models which have affected our expectations for this portfolio. The first is the Covid-19 pandemic, which has benefited many pharmaceutical companies. As you can see in this chart, if you separate out Pharmaceuticals with high Gray Swan Event Factors, their performance so far this year has generally outperformed the S&P 500.

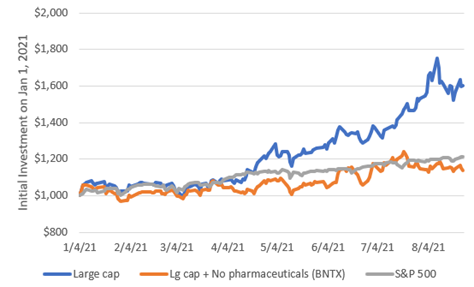

To hammer home the point, here is a look at the comparative performance of the Large Cap segment of the Gray Swan Portfolio with and without BioNTech (BNTX) a co-manufacturer of the Covid-19 vaccine with Pfizer.

The other novel issue is the emergence of SPACs and the recent guidance by the SEC that forced many SPACs to restate their financials, dramatically increasing the number of restatements filed this year. Of the 27 restatements filed by companies in this portfolio, 21 were filed by former SPACs.

Gray Swan Portfolio September Spotlight

BioNTech SE (BNTX)

Market Cap: $90.3 Billion

GSEF on 1/1/2021: 6.1%

Current GSEF: 3.46%

Returns YTD: 338.6%

Notable Flags from 2020:

BioNTech is a foreign company listed on the Nasdaq in the Pharmaceutical industry. In 2020 they disclosed a material weakness in their internal controls for insufficient management review of their control procedures. Additionally, a suit was filed against them in connection with their merger with Neon Therapeutics (settled a month later). Both flags increased BNTX’s risk for a Securities Class Action suit in 2021, an event that could have damaged their performance.

Notable Events from 2021:

Despite a cybersecurity breach of Covid-19 vaccine information stolen from a government agency, 2021 has brought BioNTech unprecedented success for the company. They successfully partnered with Pfizer to create a Covid-19 vaccine that has been approved by the FDA, the only vaccine to get full regulatory approval so far this year. Additionally, to provide the vaccine at no cost to their citizens, many governments have purchased large quantities of the vaccine, driving sales.

Analysis:

Investing in a relatively small pharmaceutical company is always a risky proposition, but BNTX is a great example of why some investors think it is worth the risk. Even investing in companies with promising technology to combat Covid-19 has been risky, as the SEC has brought enforcement actions against some companies for making false and misleading claims. BNTX’s ability to manufacture a commercially successful vaccine has clearly outweighed any negative impact that their internal control issues might have generated.

Final Note

We are highlighting BNTX this month to make a few points about our statistical risk analysis. The fact that a company has a high accounting/governance/legal risk profile does not mean that the company is necessarily a bad investment. Investors need to make a multi-factored analysis when deciding where to put their money.

Additionally, our statistical analysis looks at the past performance of similar companies to estimate what will happen to a particular company in the future. However, past performance is not necessarily indicative of future performance, especially in individual cases.

Finally, despite enormous gains from BNTX and the relative success of firms in the pharmaceutical industry, the Gray Swan Portfolio has underperformed the S&P 500 up to this point. This indicates that accounting, legal, and governance issues captured by our Gray Swan Event Factor are not properly accounted for by the market.

Contact Us

If you would like to learn more about our research, you can start a conversation by reaching out to us at jcheffers@watchdogresearch.com.