Our research indicates that only 3.3% of all companies are incorporated in the Cayman Islands, and that includes some companies that are actually located there. In contrast, 28% of all SPACs are incorporated in the Cayman Islands, despite the fact that 88% of them are located in the United States.

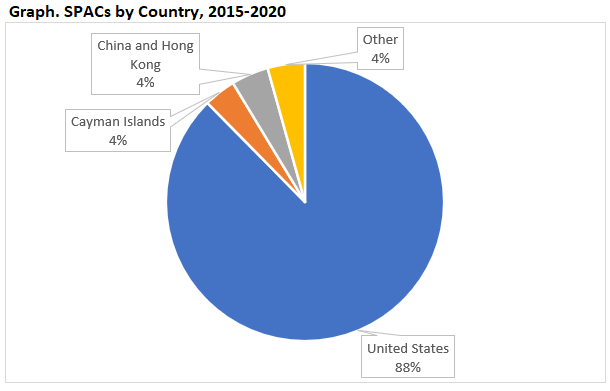

2020 has been called the year of the SPAC, as the number of SPAC IPOs eclipsed the number of traditional IPOs for the first time ever. The dramatic rise of SPACs has raised a lot of questions. In this post we will compare the differences in where SPACs are located with where they are incorporated.

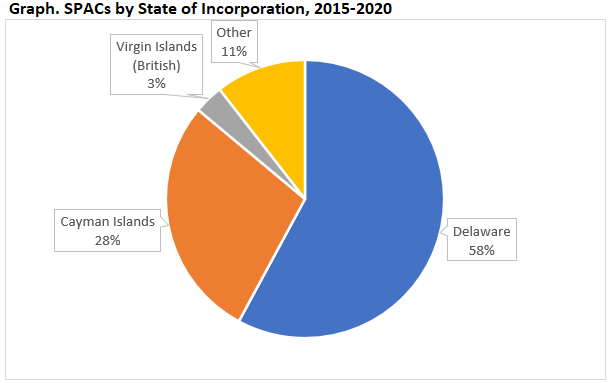

It is typical for companies to incorporate in Delaware or Nevada, even when they are located another state. However, it is not typical for companies to incorporate in a foreign jurisdiction.

In contrast, even though SPACs are overwhelmingly located in the United States, many of them are incorporated in the Cayman Islands. Compare this graph of SPACs by their location.

With this graph of SPACs by their state of incorporation.

Our research indicates that only 3.3% of all companies are incorporated in the Cayman Islands, and that includes some companies that are actually located there. In contrast, 28% of all SPACs are incorporated in the Cayman Islands, despite the fact that 88% of them are located in the United States.

It is likely that SPACs are incorporated in the Cayman Islands because they are a tax shelter with lax disclosure requirements. The Cayman Islands do not have any reporting requirements to speak of, so a company incorporated there can do the bare minimum necessary to stay on the exchanges. This has given companies incorporated in the Cayman Islands a dubious reputation.

Interestingly enough, the Cayman Islands are also heavily used by Chinese companies for their state of incorporation. This similar use of the Cayman Islands as a place of incorporation by SPACs and Chinese companies invites an unflattering comparison for SPACs.

Conclusion

The growth of SPACs has been spectacular in the last year. That kind of growth can be extremely attractive and create its own sort of momentum. However, it is not yet clear that SPACs are a good alternative to traditional IPOs for investors. Their tendency to incorporate in the Cayman Islands is concerning, especially since incorporating in the Cayman Islands is a common tactic for Chinese companies.