In February 2018, we published a report calling out the management of Symantec for a perceived lack of candor in the way they handled a whistleblower report of accounting irregularities and a subsequent SEC investigation. In particular, we honed-in on Symantec’s failure to disclose any material weakness in their internal controls and their dubious claim that a $12 million adjustment in revenue in 2018 was immaterial.

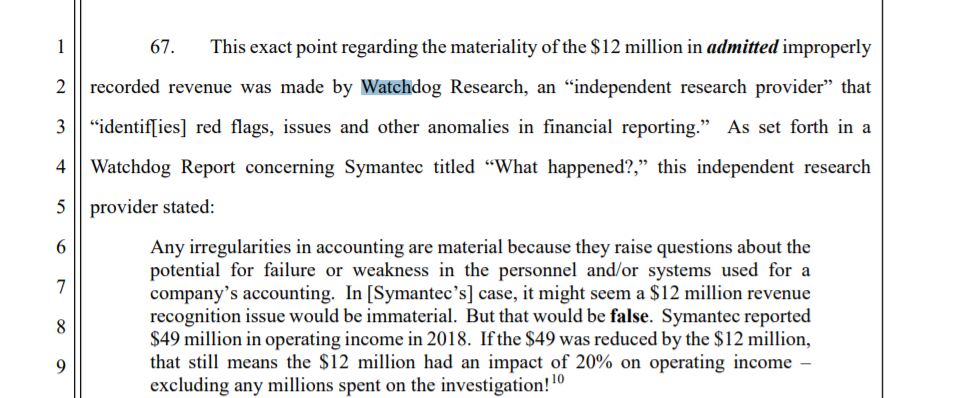

Our analysis was quoted in a securities lawsuit, Felix v. Symantec Corp. (N. D. Cal.) Here is the entire quote as it appears in the complaint.

Symantec’s Questionable Revenue Recognition Methods

MarketWatch’s Francine Mckenna, an independent reporter who now has her own website, The Dig, reported in November 2017 that Symantec was using non-GAAP methods to add back in deferred revenue after an acquisition. After that report, a whistle-blower came forward and accused Symantec of inappropriately adjusting revenue to boost executive compensation.

This non-GAAP accounting allegedly allowed Symantec’s management to pull out saved revenue and add it in when it suited their purposes. The plaintiff in this case accuses Symantec’s executives of deferring revenue when results were good and adding it back in when results were poor. This would potentially have allowed executives to hit certain compensation benchmarks and greatly increase how much money they were paid.

If these accusations are true, then this is a great example of how performance bonuses can create a conflict of interest for management. The same people responsible for accurately and truthfully reporting the financial condition of the company also stand to personally benefit the most from potential manipulation of the numbers.

Using deferred revenue is only one potential path that executives can take to manipulate results and enrich themselves. In another post we discussed how UA may have been manipulating revenue by “channel stuffing.” A recent study also indicated that some executives have been timing the release of bad news so that their company stock prices are artificially lowered when they receive their stock options.

Management’s conflict of interest reinforces the crucial role that independent board members play as watchdogs for the company. It is crucial that board members are truly independent from management, by both the letter and spirit of the law, so that they can deter and discover any manipulation in financial reporting.

On the Litigation

When we wrote our analysis of Symantec, we wanted to promote transparency and responsibility for investors, not to aide in litigation per se. But plaintiff’s attorneys can also serve as watchdogs to protect the interests of investors and we consider it a compliment that our reports and independent analysis are being cited in securities litigation.

Our Gray Swan Event Factor and Watchdog Reports are tools that allow investors to understand the inherent risks in their investments and potentially hold management accountable. It is our hope that if management is tempted to massage or manipulate the numbers for their own gain, that they will be deterred by potential scrutiny from independent board members, auditors, activist shareholders, regulators, plaintiff’s attorneys, and Watchdog Research. This accountability for management is crucial to protect the financial health of our companies and is in the best interests of all shareholders.

Contact us:

Retail Investors get free access to our Watchdog Reports. Institutional Investors and those interested in our Gray Swan Event Factor can subscribe, or call our subscription manager, at 239-240-9284.

If you have questions about this blog send John Cheffers, our Director of Research, an email at jcheffers@watchdogresearch.com. For press inquiries or general questions about Watchdog Research, Inc., please contact our President, Brian Lawe at blawe@watchdogresearch.com.