In Part I of our series on Tesla, we discussed what historical data can tell us about the probability that class action suits, material weaknesses, or even restatements will occur when there is an alarming CFO change. In this post we will look at some historical data to provide context to the decision by four directors of Tesla to decline to stand for reelection.

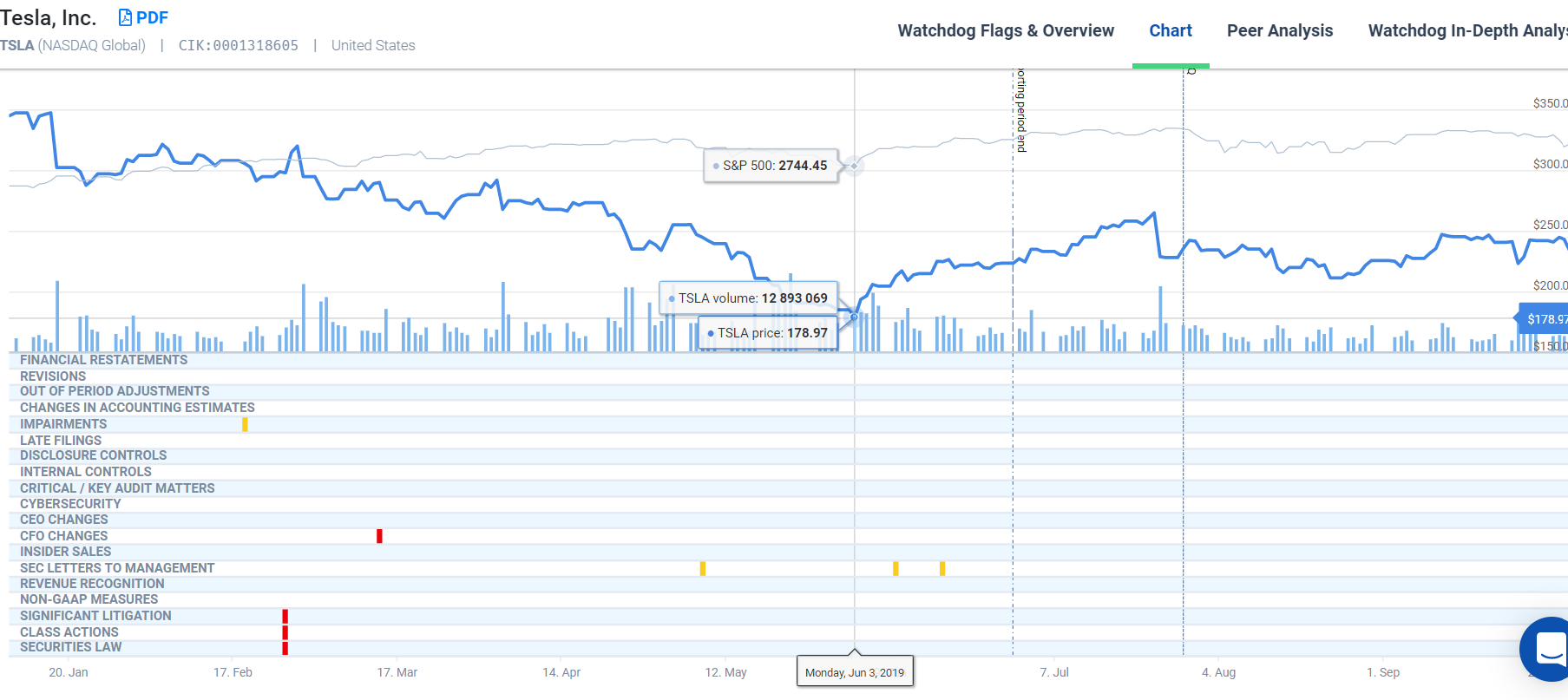

There have been other signs of trouble at Tesla in this past year: T. Rowe Price and FMR LLC, two of its biggest institutional investors, have dumped a great deal of stock after Tesla’s profitable third quarter in 2018, and have continued dumping this year. Operating losses have been over a billion dollars for the first two quarters, and the share price fell as low as $178.97 on June 3, from a high of $347 in early January.

The third quarter results for Tesla will be out in a few weeks, and investors want to know whether this is a company that will continue to trend downwards, or if it will rebound as they hope.

When four directors refuse to stand for reelection in the same year, common sense tells us that something bad is on the horizon. But how bad? And how unlikely is it that four directors would refuse to stand for reelection in the same year? Our analysts decided to look back ten years and find out.

Our analysts looked back and found that in the last ten years, for all the publicly traded companies on the Nasdaq and the NYSE, only 40 or so companies had four or more directors refuse to stand for reelection in the same year. We then narrowed our search to only large cap companies, and here were our results:

Our analysts used data from Audit Analytics to create this table.

In Bad Company

This is not a good list to be on. GE is essentially still in the process of being broken up. In 2012 Altaba was named Yahoo! and laid off 14 percent of its workforce while locked in a proxy battle with Google and Facebook over its board. Chipotle spent 2017 plagued by a disease outbreak and inadequate earnings. Wells Fargo had scandal after scandal after scandal after scandal, until the Fed refused to let them grow until they overhauled their board in 2018.

Here at Watchdog we are primarily concerned with transparency and providing context for investors. Directors on the board are intimately aware of the challenges the company faces. When four directors resign in the same year, it raises concerns that those directors have lost confidence in the company. This does not bode well for the third and fourth quarter results for this year.

Tesla has made a statement that having the board shrunk from 11 members to 7 will make the company nimbler. We hope so, because history tells us that Tesla will probably need to dodge as many problems as it can this year.

We aren’t done with Tesla yet, stay tuned…

Read the Report for Yourself

Get a free trial to our whole library of reports here.

What is Watchdog?

Watchdog Research, Inc. is an independent research provider that publishes Watchdog Reports. Our reports contain warning signs, red flags, material disclosures, and peer analysis for use in valuation, risk analysis, due diligence research, and idea generation. Watchdog Reports are designed to assist investment professionals fulfill their fiduciary obligations and to help investors, executives, board members, regulators and educators learn what they need to know about publicly traded companies. Watchdog Research, Inc. utilizes over 75 specialists and analysts to provide accurate and timely information to our readers.

The Watchdog Blog Team

Note: Our team is made up of current and former Big Four CPAs, Public Company CFOs, Litigation Specialists, Lawyers, Accounting Educators, Ethicists, Regulators, Entrepreneurs, and yes, even a few overly opinionated Harvard MBAs. Our mission is to write blogs that promote transparency in corporate disclosures.

Contact us:

If you want to subscribe to Watchdog Reports, call our subscription manager, at 813-670-2060.

If you have questions about this blog, call our content manager John Cheffers at 239-240-9284 or send an email to jcheffers@watchdogresearch.com.