There is nothing worse as an investor than when a company experiences a gray swan event like a financial restatement. Investors are rarely prepared for the bad news and have difficulty placing it into context; it is no wonder that for many investors the initial reaction to a financial restatement is a panicked sell-off.

Information is the antidote to panic, so we have looked at the data for restatements and other gray swan events to arm investors with as much information as possible before something bad happens. We produce reports on certain kinds of events, like restatements, that take a survey of the field and measure their impact on share price. Investors can also look at our company specific reports and our Gray Swan Event Factor to get a more granular view.

In this post, we are analyzing the relative impact of restatements when segmenting the market by size. We have found that the impact of a restatement is proportional to the relative size of the company.

This blog touches on a few data points from an extensive report produced by two of our researchers, Joseph Burke, PhD, and Joseph Yarbrough, PhD. If you want access to the full report, email jcheffers@watchdogresearch.com.

The analysis for this report was primarily derived from the Audit Analytics restatement database.

For our research, we broke the market down into three segments, Large cap, Mid cap, and Small cap. In our analysis, Large companies have more $10 billion in market capitalization, Small cap firms have less than $2 billion, and Mid cap companies fall between them.

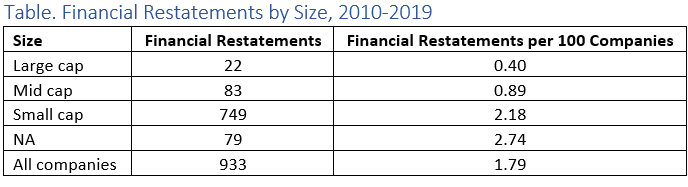

We looked at how many restatements occurred for each segment over the past ten years and calculated the likelihood of incurring a restatement for each segment:

This table shows the financial restatements by size from 2010-2019. One thing to note is just how exceptionally rare it is for a Large cap company to issue a restatement. A Mid cap company is more than twice as likely as Large cap company to issue a restatement. And Small cap companies are almost seven times more likely to issue a restatement than a Large cap company.

Size Proportional to Impact

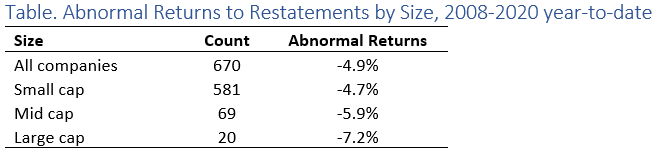

Our team also measured the impact of these restatements on share value. Our team calculated the impact by looking at how the stock performed in comparison with the S&P 500 over the next 30 days. Share price data was not available for every company which had a restatement, but we were able to get share prices for an adequately representative sample.

The result of our analysis shows that the impact of a restatement is proportional to the size of the company. Restatements have a large impact on big companies, but a smaller impact on smaller companies.

This table shows abnormal returns by size from 2008 to 2020 year-to-date. What explains this disparity? One factor may be the relative lack of attention and scrutiny on Small cap companies. Restatements for big companies are an unusual event, so when a Large cap company has one, the market experiences a strongly negative reaction to the news.

Additionally, Large cap companies are also far more likely to be subject to a securities class action suit after a restatement, which can amplify the negative cycle and downward pressure on share value.

Conclusion

According to our research, restatements have fallen steadily over the past decade. Restatements for Large cap companies are exceptionally rare, but when they do occur, they can be extremely harmful. But the same does not hold true for Mid cap and Small cap companies Our research indicates that the impact of a restatement is often proportional to the size of a company, so if a Small cap company issues a restatement, it may end up being small potatoes.

Contact Us:

If you have questions about this article, please contact the author, jcheffers@watchdogresearch.com. If you have questions about the company generally, or for press inquires, please contact our president Brian Lawe, blawe@watchdogresearch.com.