In our research on securities class action lawsuits, we measure the impact of lawsuits by looking at abnormal returns over the 30-day period following a securities lawsuit. We calculate the abnormal returns by comparing how the company performed to how the S&P 500 performed on average over the same 30-day period.

For example, if the S&P 500 rose 10% in the 30-days following a lawsuit against company X, and the company X’s stock remained at the same price during that period, then we calculate an abnormal return of -10% for company X.

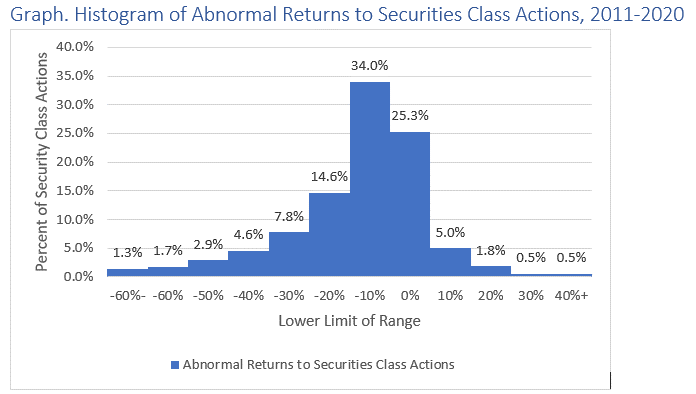

Here is a histogram for all the abnormal returns for all securities class actions from 2011-2020.

There are a few things to note about this chart. Firstly, about one third of the time the company’s share value increases after a securities lawsuit is filed. Most people would consider getting named as a defendant in a lawsuit as bad news, so the most likely explanation for the modest increase we see in a about a third of cases comes from positive developments that cancel out the bad news.

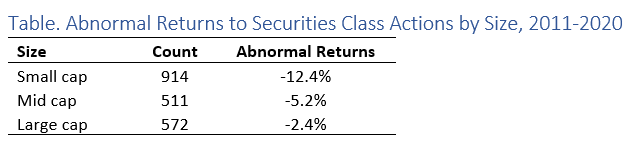

Secondly, about a third of the time the lawsuit coincides with a relatively modest underperformance by the company, with abnormal returns of zero to -10%. This is partially due to the fact that the impact of securities class actions on large companies tends to be significantly less than their impact on small companies:

Large cap companies have access to more resources that can help them mitigate the impact of a securities class action suit. Large companies can afford a PR firm and can take steps to change the media narrative. Additionally, investors may think that the lawsuit is immaterial if the company is large and wealthy enough.

The final thing to note about the table is that it is skewed to the left. About a third of the time the company named as a defendant will have abnormal returns that are worse than -10%. In comparison, fewer than one-tenth of companies had positive returns that were better than 10%.

The data indicates that securities lawsuits pose a significant risk of intense losses for any given company.

We specialize in researching accounting, legal, and regulatory issues that affect public companies. We produce reports on general trends, and granular reports on over 4,500 companies. If you want to learn more about what we do, email jcheffers@watchdogresearch.com to start a conversation.