In March 2018, the Supreme Court handed down a unanimous decision in Cyan Inc. v. Beaver County Employees Retirement Fund (“Cyan”). This decision allowed plaintiffs to bring cases in some state courts which previously had only been triable in federal court. Cyan made it easier for plaintiffs to bring cases, and the predicable result has been an increase in cases.

This blog is derived from “Frequency and Impact of Securities Class Actions” a research report produced by Joseph Burke, PhD, and Joseph Yarborough, PhD, for Watchdog Research. If you are interested in accessing the entire report, email jcheffers@watchdogresearch.com.

Cyan was a boon for plaintiff’s attorneys and for the defense attorneys called up to answer these claims, but it has been a real disaster for everyone else. D&O Insurance premiums have risen dramatically and created a hard market for policies. The increase in the cost of doing business has certainly been felt elsewhere too as costs get passed through to investors, employees, and customers.

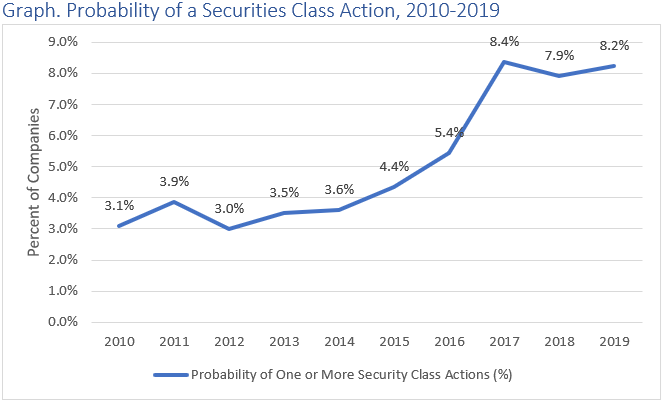

But just how much of an impact has Cyan had? Our team has published a report that can help quantify its impact. One way to measure the impact of Cyan is to see the dramatic increase in the likelihood that any given company will be named in a Securities Class Action suit.

In 2017, as Cyan was working its way toward the Supreme Court, cases shot up dramatically. The number of Securities Class Action suits has remained at an elevated level ever since.

This graph actually understates the increase in litigation post-Cyan because many companies have more than one suit filed against them in a given year. So, we also measured the rate of Securities Class Actions over the past ten years to better capture the frequency with which these suits are filed.

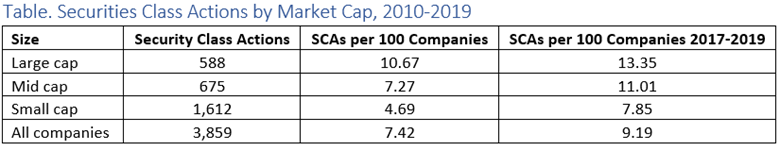

This table reveals a few interesting things about how Cyan has changed Securities Class Action litigation. The first thing to note is that the litigation rates have gone up for companies of every size. (Large cap companies have a market capitalization of $10+ billion, Mid cap companies have $1-10 billion, and Small cap companies is everything under $1 billion.

Another interesting thing to note is that the increase in the rate of litigation has been relatively higher for Small and Mid cap companies than for Large cap companies. This indicates that Cyan has made it easier and more cost effective to bring cases against smaller companies.

This result was predictable, since the state courts have fewer procedural safeguards, making it easier and less expensive to bring a case. Small defendants with fewer resources and a smaller potential payout appear to have become more appealing targets for litigation. Additionally, fewer procedural safeguards make it easier to justify bringing a weaker case.

Our research corresponds with academic research and commentary indicating that suits in state courts are settled at significantly higher rates because it is much easier for plaintiffs to survive a motion to dismiss.

Conclusion

Securities Class Action litigation hit record levels in 2017, and thanks to Cyan, litigation has remained at an elevated level. In this new paradigm, companies of all sizes are at far more risk of being named in one or more suits than in years past.

Our research indicates that the size of a company is one of the most important factors determining the impact of litigation, but we will take a closer look at that data in our next post.

Contact Us:

If you have questions about this article, please contact the author, jcheffers@watchdogresearch.com. If you have questions about the company generally, or for press inquires, please contact our president Brian Lawe, blawe@watchdogresearch.com.