Audit fees are usually “sticky,” so you should notice when they jump.

By law, every public company must hire an independent auditor to review their financial statements and offer an opinion. Although the public is privy to an auditor’s final opinion, almost all the auditor’s work is shrouded in mystery. However, every company must disclose how much money it spends on audit related services (audit fees).

Companies negotiate with their auditors every year over price, so year-over-year and peer-to-peer comparisons of fees can potentially reveal interesting insights about what is going on behind the scenes at a company. For this reason, there have been a number of academic papers on audit fees and their potential implications.

Over time evidence has emerged that audit fees are “sticky” and do not adjust rapidly to changing conditions at a company. This makes sense considering the multifaceted relationship that develops between an auditor and management. Yes, auditors are independent, but they want to serve their clients and maintain a strong relationship.

But sometimes an auditor’s fee will buck this trend and jump…

This phenomenon was the subject of a 2016 academic paper titled “Abnormal Audit Fees and Accounting Quality.” The authors found evidence that companies whose audit fees jumped up out of their normal range had indicators of lower accounting quality (e.g., a greater risk for restatements, material weaknesses, and fraud). The authors hypothesized that sharp increases in fees were due to efforts by auditors to fix problems, indicating the existence of problems in financial statements.

An unexplained jump in audit fees is certainly a red flag (we have also discussed that same point with respect to non-audit fees). But insurance and investment professionals should be cautious even when a ready explanation for the increase in fees is at hand.

A Complicated Real-World Example

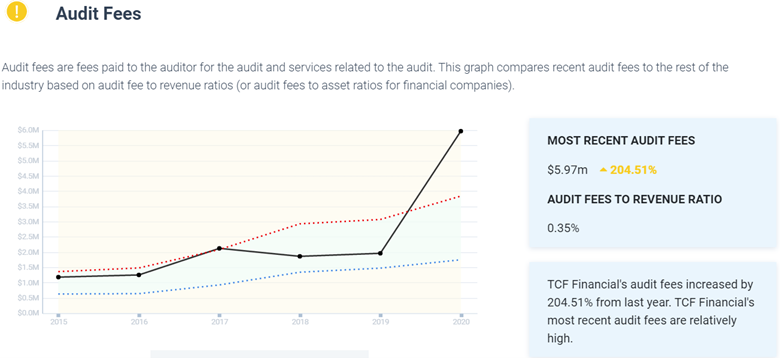

In 2020, TCF Financial Corporation’s annual report disclosed a sharp jump in their audit fees. This increase coincided with a reverse merger with Chemical Bank that was consummated in 2019, but the increase in audit fees may also have represented remediation efforts by the auditor.

Another possible signal of trouble came from the non-audit fees, which also reported a spike in 2020.

In September 2020, Probes Reporter confirmed that TCF Financial was subject to an undisclosed investigation by the SEC.

In October 2020, Craig Dahl left abruptly as CEO after serving in the position of the joint company after a little over a year (he had been tenured at TCF for 21 years and had served as their CEO prior to the merger).

A company spokesperson took issue with an earlier version of this story where we characterized Mr. Dahl’s departure as a removal.

It is not clear why he was departed from his position early, but his resignation was effective the day after the announcement. For some context, the TCF’s CFO’s resignation also became effective in October, but his departure was announced in December 2019.

The company also agreed to pay the former CEO a significant lump sum, over $11 million, and $1.5 million a month for 18 months.

Now it is possible that TCF’s sharp increases in audit fees and non-audit fees had nothing to do with the SEC investigation, or whatever lead to the abrupt departure of the CEO, but the academic literature indicates that jumps in audit fees are a sign of trouble in the financial statements and should not be ignored.

Conclusion

Academic research of audit fees indicates that they are “sticky,” so sharp increases can be considered an abnormal event. Insurance and investment professionals should do their best to carefully discern when these abnormal increases are a sign of potential trouble.

Every Watchdog Report provides a year-to-year and peer-to-peer comparison for audit fees, non audit fees, and many other potential risk factors. These reports are available for over 4,500 publicly traded companies. If you want one of our team members to give you a tour, email jcheffers@watchdogresearch.com.

A company spokesperson for TCF Financial said that they would get back to us concerning further comments regarding an earlier version of this piece. We will append any comments they make to this article.