When assessing a company, it is always a good idea to see if there has been any unusual turnover in the C-suite.

Turmoil in the C-suite often trickles down to other aspects of a company and is often associated with other problems. New CEOs can clash with existing management, and often there is a rocky transition as new systems are imposed on a company. Sometimes a new CEO will uncover problems successfully hidden by the previous CEO.

Additionally, some of our previous research showed that companies with a red flag CEO change were more than twice as likely to be named in a Securities Class Action suit in that same year as companies without one.

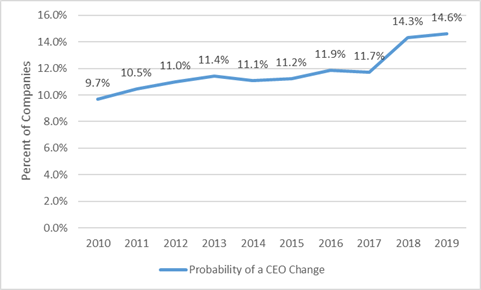

Interestingly the rate of CEO departures had remained steady for most of the last decade, at least until 2018.

This chart depicts the CEO turnover for publicly traded companies on the Nasdaq and NYSE for the past decade.

Our analysis for the year-to-date in 2020 shows that the rate for CEO departures so far this year is 13.5%. This number will tick up as more CEOs depart in December. We won’t know the final results for about another month, but it is clear that 2020 has continued in the same vein as 2018 and 2019.

Why is this happening?

It is difficult to establish exactly what is driving this trend, but we can point to two interesting pieces of research.

The first comes from PwC, who found that 39% of CEO departures in 2018 were due to “ethical lapses.” This was up 50% from 2017. This number itself is something of a mystery. It would be tempting to ascribe this increase to the #metoo movement that lead to so many accusations of sexual harassment in 2017-2018, but that explanation does not explain why the turnover would remain high the following years.

We also don’t know how PwC determined that a CEO departure was due to an “ethical lapse.” We looked at the company disclosures concerning the departures most of them don’t give any real information. For the year-to-date in 2020, 38.5% of the explanations were opaque. And another 30.3% actually said nothing at all. Only 2.9% of the company disclosures stated that there was misconduct on the CEO’s part. Since companies are so tight lipped, PwC must be looking at some other sources of information to support their conclusions.

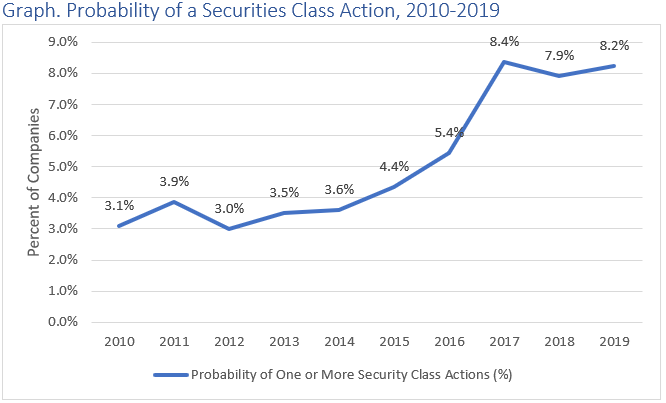

The second piece of research is ours and it relates to the increase of litigation after the Supreme Court’s decision in Cyan, Inc. v. Beaver County Employees’ Retirement Fund. Cyan helped dramatically increase the rates at which companies were sued in Securities Class Action suits.

This graph shows the likelihood for any company on the Nasdaq or NYSE to be named in a Securities Class Action suit in the last decade. The graph shows that litigation increased dramatically in 2017 and has remained at an elevated level ever since.

It is not clear if litigation is causing CEO turnover or if CEO turnover is causing litigation, but the phenomena are related. Litigation can put a strain on a company’s resources and put a spotlight on the decisions or conduct of the CEO, causing them to depart prematurely. A sudden CEO departure can also trigger a lawsuit.

Conclusion

Taken together, the sustained increases in litigation and CEO departures point to a widespread increase in volatility in public companies. It’s not clear if this volatility is occurring for legal or cultural reasons.

The volatility could be due to decisions from the Supreme Court and the outgoing Trump Administration, or it could be due to the emergence of new cultural values in boardrooms.

The overall increase in volatility could also just be a part of a generational shift as baby boomers exit the stage.

Is this new volatility a blip, or a paradigm shift? Only time will tell.

Contact Us

Public companies publish so much information that it is easy to miss critically important information. Our Watchdog Reports allow our clients to quickly assess any public company. If you never want to get caught flatfooted, then request a demo . Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.