Foreign companies have played an increasingly relevant role on the NYSE and NASDAQ over the last decade and currently comprise over 20% of those exchanges. We recently completed a report on the particular risks by foreign listings entitled Foreign Restatements and Securities Class Actions.

This is a summary of our report on Foreign Restatements and Securities Class Actions authored by Joseph Burke and John Cheffers. If you would like access to the complete report at no cost, please email jcheffers@watchdogresearch.com.

Securities class action suits against Chinese companies rose significantly in 2020, despite an overall decline in securities class action suits. We have previously observed that nearly half of the suits filed against Chinese companies were the result of an activist short report.

We believe that the proliferation of these short reports and resulting securities class action suits is due to The Luckin Effect. In January 2020, Muddy Waters published an anonymous short report accusing the Luckin Coffee of fraud. Shortly afterwards, in April of 2020, Luckin admitted to an egregious fraud. Their stock lost over 90% of its value, most of it in a single day, with the result that the stock was later delisted and eventually declared bankruptcy.

Luckin Coffee was not Muddy Water’s first successful take down of a Chinese company, but the fraud revealed at Luckin was so brazen, and at such a large and well-known company, that it shook the confidence of the entire market. The Luckin Effect occurs when the problems at a single company reveal systemic problems that are so pervasive in a sector of the market that it undermines the entire sector. Our research into foreign restatements (included in this report) indicates that investors already had less confidence in U.S. listed foreign companies than in U.S. companies.

Such an enormous fraud seems only to have been possible with serious systemic weaknesses in audit quality, regulatory integrity, and corporate governance. The systemic vulnerability to fraud in China has become so glaring that Congress has seen fit to pass the “Holding Foreign Companies Accountable Act.” This law could result in the delisting of every Chinese company from U.S. exchanges if the PCAOB is not permitted to inspect Chinese audit firms.

The Luckin Effect has reduced investors’ confidence in the financial reporting of U.S. listed Chinese companies, making them a perfect target for activist short sellers. It is difficult to say just how long this effect will last.

Foreign Listings Have Increased to an All-Time High

Over the last ten years, the overall number of companies listed on U.S. Exchanges has held relatively steady, but the portion of foreign companies has increased significantly. In fact, foreign listings are at an all-time high. Foreign listings have increased rapidly, from 962 in 2017 to 1,064 in 2020.

This increase is primarily fueled by an increase in Chinese company listings. They account for 75% of new foreign listings between 2017 and 2020. The Chinese listings on U.S. exchanges increased from 181 in 2017 to 260 in 2020.

Increasing Litigation Risk for Foreign Listings

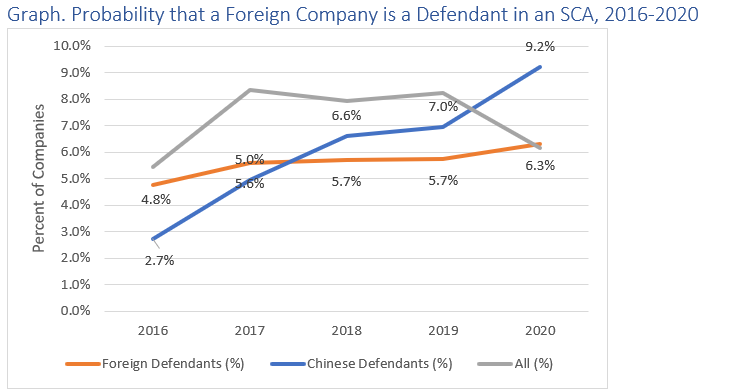

As foreign companies have listed in greater numbers, they have been named in an increasing number of securities class action suits. Foreign defendants in SCAs increased from a low of 29 in 2014 to a high of 67 in 2020. This holds true for Chinese companies as well; Chinese defendants in securities class actions increased from 5 in 2016 to 24 in 2020.

Interestingly, the litigation rate for Chinese companies has been increasing steadily since 2016. Here is a chart comparing the probability of being named in a securities class action suit for U.S. companies, foreign companies, and Chinese companies.

As discussed in the introduction, the divergence of the rates of litigation for China from the overall trends is partly due to a proliferation of short reports against Chinese companies. After Luckin Coffee’s fraud was revealed in April 2020, more of the investing public became aware of systemic weaknesses in Chinese corporate governance, accounting quality, and regulatory enforcement. These weaknesses make Chinese companies more appetizing targets for short sellers and resulting securities class action litigation.

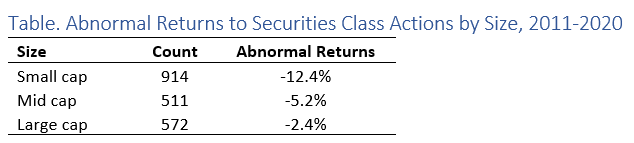

Securities Class Actions Have a Larger Impact on Smaller Companies

We measure the impact of securities class actions and foreign restatements by looking at abnormal returns. Abnormal returns are the average returns to the stock in the 60-day window around the event less average returns to the S&P 500 over the same period.

Average abnormal returns to securities class action are -7.6% across all companies. Securities class actions tend to have a larger impact on smaller companies and a smaller impact on larger companies. Average abnormal returns are -2.4% for large cap companies, -5.2% for mid cap companies, and -12.4% for large cap companies.

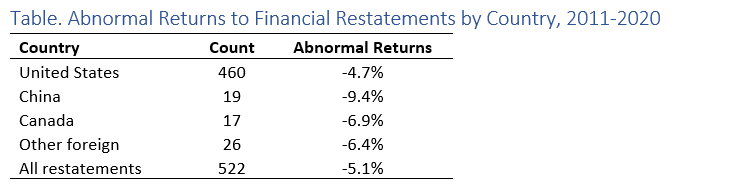

Financial Restatements Have the Largest Impact on Chinese and Foreign Listings

The impact of foreign financial restatements differs significantly those for U.S. companies. Average abnormal returns to financial restatements are -7.5% for foreign companies compared to -4.7% for U.S. companies.

The impact of restatements on Chinese companies is even more pronounced. Their average abnormal returns are -9.4%. This is due in no small part to Luckin Coffee, which had abnormal returns of -92% following their restatement.

The continuing disparity in abnormal returns between U.S. companies and foreign companies may indicate a confidence deficit. It appears that investor confidence is more easily shaken by a foreign restatement than by a domestic one. This seems to be particularly true of Chinese companies, a situation that has been greatly exasperated by The Luckin Effect. This confidence deficit help explain why foreign companies—especially Chinese companies—are more appetizing targets for short sellers.

We are not sure how long The Luckin Effect will last, but it seems possible that the mere passage of time will not restore confidence in Chinese companies. Confidence is more likely to be restored by some sort of event demonstrating that the systemic weaknesses revealed by the Luckin fraud are being seriously addressed.

Conclusion

Chinese companies make up nearly a quarter of all offshore U.S. listed companies and their probability for being named in a securities class action surpasses that any other country. In 2020, this increase appears to be largely due to The Luckin Effect.

Despite the fact that U.S. and foreign companies trade seamlessly on U.S. exchanges, the truth is that these two types of companies operate in very different legal and regulatory environments. The risks associated with Chinese companies in particular are substantially different from U.S. companies, and investors, lenders, insurers and other financial professionals are wise to consider these differences when evaluating them.

This summary is based on our Foreign Restatements and Securities Class Actions report authored by Joseph Burke and John Cheffers. The source material for our research primarily comes from Audit Analytics, with share price data coming from Shardar. If you would like access to the complete report at no cost, please email jcheffers@watchdogresearch.com. Watchdog Research generates independent research on overall trends, as well as company-specific reports. If you want to learn more about us, visit our website, or email our President Brian Lawe via blawe@watchdogreseach.com.