There are more publicly traded companies from China on U.S. exchanges than from any other foreign country, including Canada. We have already covered how Chinese companies get delisted at higher rates than companies from other countries. Here we will look at the dramatic increase in securities class action lawsuits filed against Chinese companies over the past five years.

This blog is partially derived from “2020: Frequency and Impact of Securities Class Actions” a research report produced by Joseph Burke, PhD, and Joseph Yarborough, PhD, for Watchdog Research. If you are interested in accessing the entire report, email jcheffers@watchdogresearch.com.

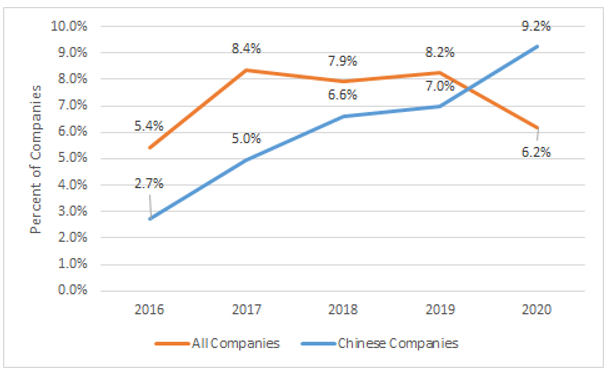

After Cyan, there was a sharp increase in the number of securities lawsuits filed across the board, but that increase was not evenly distributed. In 2016, Chinese companies only had a 2.7% probability of being named as a defendant in a securities class action suit. From 2016-2019 that probability increased every year, but it remained less than the average probability for all companies, until 2020.

In 2020, the overall probability that a company would be named in a securities class action suit fell below its historical high rates from 2017-2019. But the rates for Chinese companies moved in the opposite direction, shooting upwards to 9.2%.

Short Reports Are Driving Litigation Against Chinese Issuers

Almost everyone is familiar with the fall of Luckin Coffee, a Chinese unicorn purported to be the “Chinese Starbucks.” On January 31st, 2020, Muddy Waters announced it was short Luckin Coffee based on an anonymous 89-page short report. In April, Luckin Coffee announced that up to a third of its revenues and a substantial portion of its expenses from 2019 were fabrications. Luckin was delisted shortly after these revelations.

In February, after Muddy Waters’ short report but before Luckin’s admission of fraud, the law firm Pomerantz LLP filed suit in the Southern District of New York against Luckin. Once Luckin disclosed the extensive fraud, another lawsuit was filed and eventually consolidated into the original suit.

This case is both emblematic and an exception to the symbiotic relationship that appears to have developed between short sellers and plaintiff’s attorneys. Short sellers will typically publish reports alleging fraud at a company, resulting in a panicked sell-off. Afterwards, a plaintiff’s firm will file a lawsuit against the company, using the facts alleged in the short report to assert some sort of misrepresentation and use the loss in share value from the sell-off to prove damages.

The case of Luckin was an exception because the short report was rapidly followed up by an admission of fraud and complete collapse, ultimately resulting in Luckin’s delisting. Generally, short reports do not result in the delisting of the targeted company. The impact of Muddy Waters’ success has already had tremendous implications in 2020 and will continue to echo in 2021.

Imitation as Flattery

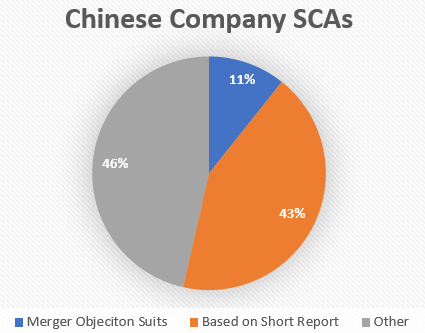

This exceptional result for Muddy Waters seems to have encouraged other short sellers to target Chinese listed companies. By the end of 2020, 12 of the 28 securities class action suits filed against Chinese companies were based on short reports.

Muddy Waters followed up its own success with a short report for GSX. Wolfpack Research filed four separate reports on four different Chinese issuers. Hindenburg Research, fresh off its victory over Nikola Motors, issued a report on the Chinese company Kandi Technology. All these reports (as well as several others filed by Grizzly Research and Marcus Aurelius Value) resulted in lawsuits against the companies targeted.

It is possible that the courts will attempt to sever the seemingly inseparable duo of short sellers and plaintiff’s firms, but such a dramatic change is unlikely if even possible.

Conclusion

We have previously discussed many of the systemic problems in China: the lax foreign reporting requirements, the corporate governance flaws, and the lack of meaningful oversight for their auditors.

These problems make it plausible that China has a serious and systemic fraud problem. To help factor in this risk for our clients, we penalize every Chinese company by automatically boosting their gray swan event risk factor.

While more investors are becoming skeptical of Chinese companies, Western capital continues to flow into China. This abundance of fear and greed creates an ideal environment for short sellers. We suspect that short sellers will continue to target Chinese companies at elevated levels in 2021 and that securities class actions will follow closely behind.

Contact Us

D&O insurers spend a lot of time on new bid requests. Our clients use our Watchdog Reports to quickly discover which bids they should pursue. Click here to request a free demo. Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.