Kraft Heinz (KHC) announced a massive $15.4 billion impairment in February, 2019 to its goodwill and intangible assets. This impairment was essentially an admission by management major components of the combined company were worth billions less than recorded on the balance sheet. It was also an admission that 3G Capital (3G) and Warren Buffett’s much touted merger of Kraft and Heinz was a failure. In the aftermath, Warren Buffett admitted that he had overpaid for his 27% of the combined company.

KHC’s impairment crushed share prices and has led to lawsuits, rapid executive bloodletting, an SEC investigation, and other deleterious events. We wrote about the KHC bus-crash last September and argued that KHC’s core problem was a loss of investor trust and a poor management ethos.

Now, a carefully researched complaint has brought new revelations that support our initial thesis. The Complaint is built on the public record, as well as information the plaintiffs have been able to request as shareholders (like board and committee minutes, and some other non-public financial information). Initially filed on March 25th, much of the complaint had been redacted because of KHC’s request for confidentiality. However, thanks to a challenge to the confidentiality filed by Francine Mckenna of The Dig, KHC has narrowed their scope of requested redactions considerably. The amended plaintiff’s derivative claim accusing 3G Capital of insider trading revolves around accusations of poor corporate governance and manipulation of accounting concerning goodwill testing and impairment for the benefit of 3G and its executives.

Background

KHC was formed in 2015 in a merger arranged by 3G and Warren Buffett’s Berkshire Hathaway. 3G is a Brazilian firm that became one of the largest and most successful private equity firms in the world after it used a series of acquisitions to create AB InBev.

Starting with the acquisition of Tim Horton’s in 2014, 3G has partnered with Warren Buffett’s Berkshire Hathaway on a number of acquisitions. In these joint ventures, Berkshire Hathaway has bankrolled much of the operation, while 3G has seized control and implemented its management philosophy of zero-based budgeting to cut costs and boost profit margins. This partnership was generally considered successful, reportedly making 3G Warren Buffett’s partner of choice.

Corporate Governance Disaster

Mutual Pledges of Loyalty

When a company has serious accounting-related problems, usually it also has serious problems in its corporate governance structure. After the merger that created Kraft Heinz, the company had 11 board members, 5 were appointed by the former board of Kraft, and the other six were evenly divided between representatives of 3G and Berkshire Hathaway. This gave 3G and Berkshire Hathaway a controlling interest in Kraft Heinz.

The Complaint draws attention to a 13G disclosure made by 3G Capital and Berkshire Hathaway where they acknowledged a shareholder agreement to support each other’s nominees to the board and not take any actions to remove the other’s board members. This effectively created a mutual pledge of loyalty between 3G Capital and Berkshire Hathaway as shareholders. Even though this agreement does not violate the law, it created a conflict of interest that deprived the board of effective independent members and compromised the loyalty of these directors to the company.

Agreements between shareholders are common, and the law permits them because shareholders do not (usually) owe any duty to each other, or the company, or the board. However, in this case, the main shareholders (3G and Berkshire Hathaway) were entities whose partners also comprised more than half of the board of directors. Additionally, and this is key, 3G’s partners were in control of the operations of the company.

Let’s go over the basics of corporate governance. Every corporation has a board of directors that oversees the management of the company. Each member of the board owes the corporate entity a fiduciary duty to the corporate entity to make decisions for the benefit of the shareholders, not for the benefit of management. A fiduciary duty is a legal term of art defined as an affirmative duty to act on behalf of a person or corporation in good faith, with reasonable care and undivided loyalty. The duty of loyalty requires board members put the interests of the corporation before all other interests.

The mutual pledge of loyalty by Berkshire Hathaway and 3G undermines the loyalty that the partners are supposed to have toward KHC. It is hard to believe the partners at 3G and Berkshire Hathaway would effectively pledge mutual loyalty to each other as shareholders of KHC in one room, and then walk into another room and act as independent watchdogs monitoring 3G’s management of KHC.

The Complaint also highlights issues with board independence and asserts that seven of the members had disabling connections to 3G Capital. The Nasdaq stock exchange requires that the majority of directors on the board be independent so that it is not beholden to management and can act as effective watchdog. Even if all these directors technically qualified as independent, their connections to 3G, which was in control of management, violated the spirit of Nasdaq rules concerning independence.

Core Accusation of Manipulation and Insider Trading in the Complaint

At its core this case is about whether 3G Capital and its partners manipulated the accounting related to the company’s goodwill in a way that delayed disclosing bad news, and used that delay to sell their holdings at a price they knew was overvalued. This case revolves around the interpretation of ASC 350, an accounting rule that tells companies when and how to test their intangible assets like goodwill for impairment. The FASB issued ASU 2017-04 simplifying the test for goodwill impairment and allowed companies to adopt it early. KHC adopted the revised rule on April 1, 2018, so we will focus on the new test for impairment, not the previous version.

We have criticized this rule before. Whenever companies have a merger or acquisition, the tangible and intangible assets are accounted for, and where the market price of the company exceeds the book value of the company’s assets the excess is recorded as “goodwill” on the balance sheet. To ensure that the amount recorded as goodwill really represents something substantive and defensible, companies are required to test their goodwill value every year as well on the occurrence of a triggering event.

First, they evaluate the fair market value of their companies (often granularly reporting unit by reporting if there is more than one), and secondly, they compare this to the book value. If the book value exceeds the fair value, then the company writes down, or impairs, the goodwill. If there is not that much “cushion” between the fair value and the carrying value and the goodwill is at substantial risk for an impairment, then the company is required to disclose that risk to investors. There is no bright line for the amount of “cushion” but in 2018 KHC used 10% as its threshold. This threshold was not unusual at the time, as some of KHC’s peers, such as Mondelez used the same standard.

The ASC 350 testing for an impairment to goodwill and other intangible assets is at the center of this case. The question is when should it have occurred, and what should the results have been? When KHC disclosed the massive impairment they made a case that the impairment was properly recorded in the 4th Quarter, since that is when it claims the circumstances arose.

For the fourth quarter of 2018, in connection with the preparation of our year-end financial statements, we assessed the changes in circumstances that occurred during the quarter to determine if it was more likely than not that the fair values of any reporting units or indefinite-lived intangible assets were below their carrying amounts.

While there was no single determinative event, the consideration in totality of several factors that developed during the fourth quarter of 2018 led us to conclude that it was more likely than not that the fair values of certain reporting units and indefinite-lived intangible assets were below their carrying amounts.

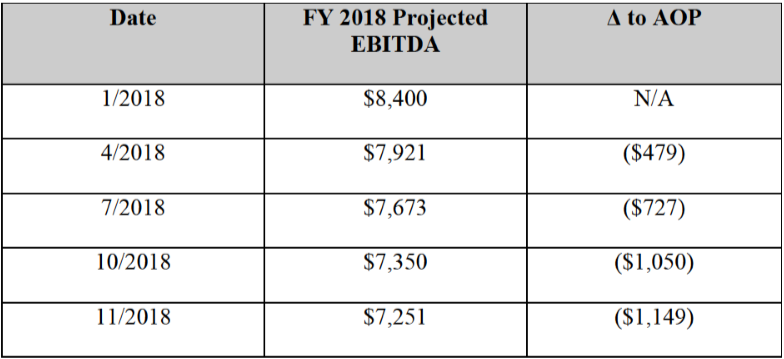

The Complaint argues that the 3G Capital partners managing KHC knew that the company was in trouble well before the 4th quarter. We made this point ourselves in our original post, although we pointed to sales that were virtually flat in 2017 and 2018, (2017’s poor results were obscured by a $7 billion benefit from the Tax Cuts and Jobs Act signed by Trump). The Complaint looks at KHC’s repeated downward adjustments to EBITDA projections to argue that KHC was aware of serious problems by the end of the second quarter. EBITDA is a financial metric that measures earnings before taxes, interest expense, depreciation, or amortization costs are realized. The Plaintiff put together a table of KHC’s revisions to EBITDA in 2018:

Source: City of Hollywood v. Kraft Heinz, Motion for Confidential Treatment, Exhibit A (18)

Particular attention is also given to the Audit Committee and Board meetings at the end of the second quarter. In those meetings management revised EBITDA projections down by $248 million from earlier revisions for a total decline from the beginning of the year of $727 million. They also disclosed that the SEC made a request that KHC not destroy accounting-related documents due to a pending investigation. The management at KHC also told the Audit Committee that it had tested some of its international segments, and that two of them required an impairment because their book value exceeded the carrying value by $265 million.

However, KHC’s management’s valuations of the U.S. reporting units (the same ones subject to a $15.4 billion impairment six months later) did not indicate that those units either required an impairment or that they were at significant risk of an impairment.

The Complaint alleges that KHC manipulated the valuations of these segments by using outdated and rosy estimates of future earnings, as well as discount rates on future cash flows that were not high enough. The Complaint also states that KPMG, which assisted in the required annual testing of goodwill, was also using stale projections from earlier in the year.

The plaintiff asserts that an increase in the discount rates by a mere .5% would have resulted in KHC being required to issue a warning to investors that certain segments were at risk for impairment. As they stood, these segments were measured at just over the threshold for 10% that would have required a warning. This accusation of manipulation lies at the heart of their case, and if it were to go to trial both sides would provide experts to argue the reasonableness of their position.

Valuations Often Speculative and Subjective

We do not have access to the underlying financial information that went into this valuation so we cannot make any determination if the allegations of manipulation in the Complaint are true. But it is worth noting that these valuations are often subjective, unreliable, and easily manipulated. In their 2018 2nd quarterly report KHC discussed how these valuations were subject to lots of estimates and guesses:

Some of the more significant assumptions inherent in estimating the fair values include the estimated future annual net cash flows for each reporting unit (including net sales, cost of products sold, SG&A, working capital, and capital expenditures), income tax rates, and a discount rate that appropriately reflects the risk inherent in each future cash flow stream … Estimating the fair value of individual reporting units requires us to make assumptions and estimates regarding our future plans, as well as industry and economic conditions.

In the minutes of the Audit Committee Meeting on July 31st, 2018, Kraft Heinz auditor PwC (which had audited both Kraft and Heinz before the merger) warned that management had made some “close call judgements” about the valuations of certain reporting units. Those warnings appear to be consistent with the PwC’s Critical Audit Matters (CAMs) disclosures made this year. Auditors are required to disclose any portion of management’s financial reporting that the auditors found particularly challenging, subjective, or complex, and therefore potentially less reliable, as CAMs. PwC highlighted KHC’s goodwill and intangible asset impairment testing as CAMs for FY 2019.

Of all the potential valuations KHC could have selected given the “play in the numbers,” it is clear that KHC selected a valuation that allowed them to avoid making an impairment or even warning of a substantial risk of one occurring. There is no bright-line rule for telling investors when there is a substantial risk of impairment, but KHC changed its threshold after it recorded the massive impairment. Prior to it, it would disclose only if the “cushion” was below 10%, but afterwards they doubled the “cushion” to 20%.

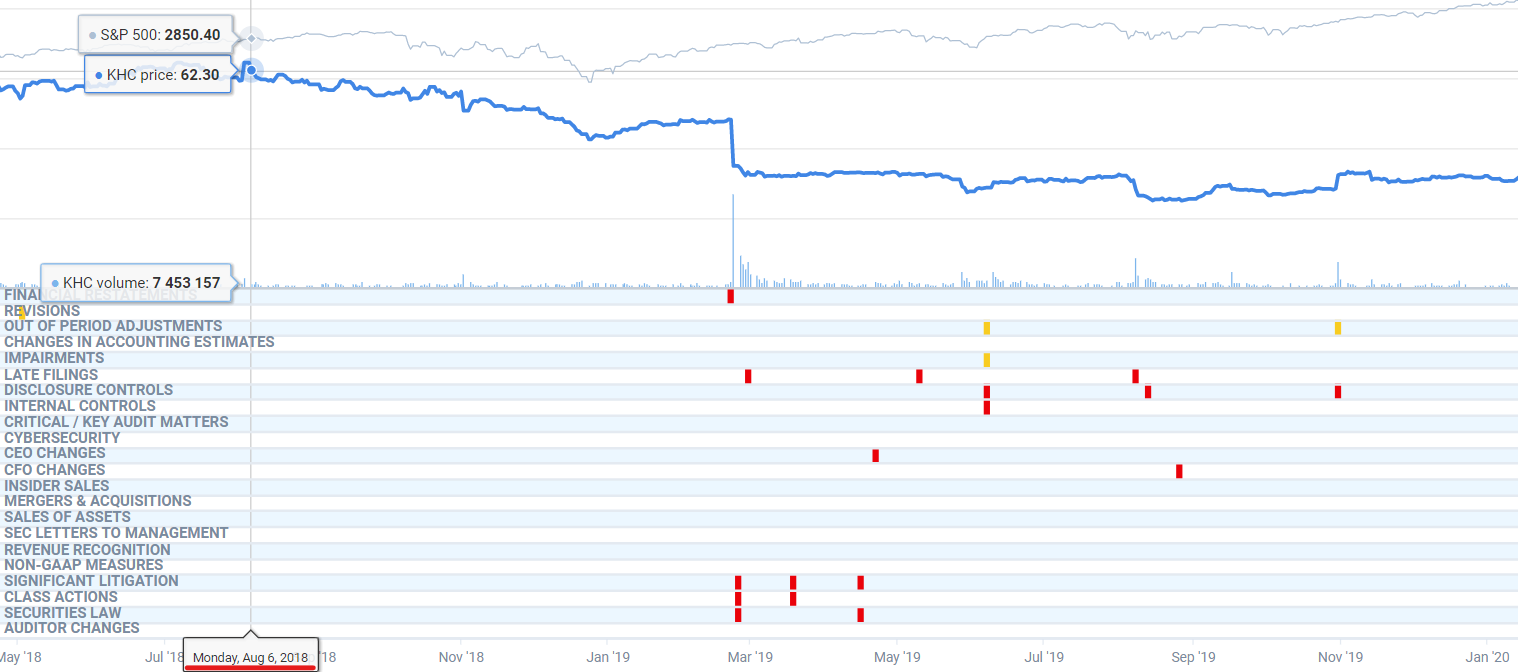

3G Capital Trims Stake in KHC Before Second Quarter Results Released

The board met on August 2nd. The CEO, Hees, shared with the board the poor results up to that point, and lowered projections for the end of the year. Just four days later, on August 6th, 3G trimmed its holdings from 29% to 22% of KHC’s ownership, selling $1.2 billion worth of stock. Selling at $59.80 a share, 3G netted at least $653 million more than they would have if they sold after the impairment was announced in February 2019.

3G’s sale was suspicious under the best of circumstances. The firm had orchestrated the merger creating KHC, it was in control of the operations of KHC, and it had three members sitting on the board (plus four other board members with substantial connections). If 3G smelled something rotten in KHC, then something must have been rotten. Was this decision to sell based on insider information, or was it done properly based on the information disclosed in the 10-Q on August 3rd?