Investor Confidence in Foreign Companies is More Easily Shaken

Our regular readers are aware that we regularly put out reports on the impact that restatements, securities litigation, and material weaknesses have on public companies. Currently we are working on a report that will meld some of this analysis with a special focus on foreign companies.

For our report, and this article, a foreign company is defined as a company that is incorporated outside the United States, but publicly traded the Nasdaq or NYSE. These companies have different filing requirements than publicly traded companies incorporated in the United States. They use different forms and are exempt from certain disclosure requirements (e.g. insiders only report on ownership and trading activity once a year).

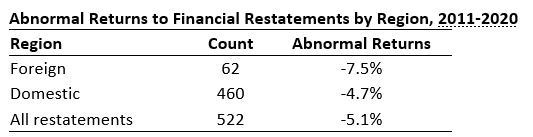

Over the past ten years restatements have had a far greater negative impact on foreign companies than on U.S. companies.

A Question of Confidence

Share prices reflect the confidence of investors and the market. When a company issues a restatement, that can undermine the confidence of investors and result in a decline in stock price.

Our research shows that the reaction to a restatement by a foreign company is more severe than the reaction to a restatement by a domestic company. This leads us to believe that the confidence of investors in foreign companies is more easily shaken than for domestic companies.

To put it another way, investors are not as confident in the stability of foreign companies as they are in of U.S. companies.

Implications

One implication is that foreign companies are a much more appetizing target for activist short sellers. Our research indicates that investors lose confidence in foreign companies more easily, so a damaging short report is more likely to generate strong returns for the short seller.

Another implication is that foreign companies who file restatements are an easier target for plaintiff’s firms, which can use the price swings following an event like a restatement to establish damages.

Contact Us

We provide independent research on public companies, ETFs, and portfolios. Our clients include D&O insurers, buy-side analysts, and consultants. Click here to request a free demo. Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.