In Parts I and II we looked at Tesla’s latest CFO change and the decision by four of its Directors to not stand for reelection. Today we will look some indicators that measure the confidence that institutional investors have in Tesla, and how decreasing confidence by some institutional investors has made it safer, in some sense, to buy Tesla’s stock.

To understand this juxtaposition, you need to understand that having a high concentration of stock in the hands of only a few owners creates risk. If there are only a few major stockholders and one of them decides to get rid of their shares, it can create a panic that lowers the price of the stock and makes it very difficult to divest the shares at a reasonable value. If the ownership is spread more evenly amongst many investors, then it is less destabilizing when one of those institutional owners decides to dump the stock.

Since 2016 Tesla has had three major institutional backers, FMR LLC (Fidelity), Baillie Gifford, and T. Rowe. In their definitive proxy statement for 2018, Fidelity was the strongest backer with 10%, while Baillie Gifford had 7.6%, and T. Rowe Price held on to 6.4%. Tesla has never had a profitable year, but it surprised investors by posting a profit in the third and fourth quarters of 2018, generating a great deal of excitement about the future of the company.

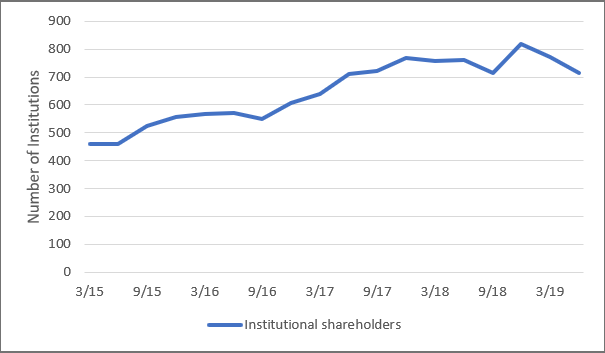

Institutional investors did not bask in the glow of all this good news, many institutional investors decided that this was the time to exit. Our analysts broke down the numbers for overall institutional investor ownership since 2015 and put them in a graph:

*Our team created this chart with data from Quandl

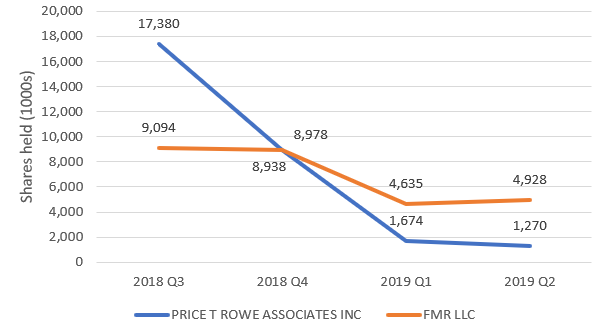

In the last two quarters, institutional ownership has declined by almost 10%, a sign of decreasing confidence. But the most dramatic change occurred at the top, with Fidelity and T. Rowe Price both dumping a lot of shares:

*Our team created this chart with data from Quandl

Looking at the broader context, the most likely explanation for this sell-off, especially for T. Rowe, is that they had lost confidence in Tesla before its profitable quarters last year and that nothing they saw changed their minds. It seems they had made up their minds to exit the company and saw Tesla’s good news as an opportunity to exit without creating a panic that would damage the price.

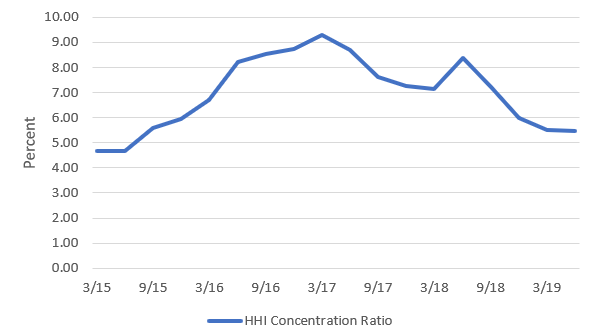

An interesting consequence of Fidelity and T. Rowe’s exit is that it dramatically reduced the concentration of ownership:

*Our team created this chart with data from Quandl

This decrease in the concentration of ownership in the hands of a few institutions increases the stability of Tesla’s stock. What this means is that the stock will hopefully reflect the company’s value and performance, instead of the trading practices of a handful of investors.

Tesla’s third quarter results have come out, and their results have been something of a mixed bag. They had already released their production and deliveries numbers for the third quarter, by which some analysts were disappointed, but it is still obtained a record number of deliveries.

If Tesla defied expectations again and delivered a profitable third quarter, although automotive revenues were down from the third quarter of 2018 by $750 million. There has been a great deal of excitement among some investors as the prices have shot up to over $300 a share. A wise investor should not be caught up in the excitement. Those big investors lost confidence in Tesla for a reason. At Watchdog, we look at a loss of investor confidence as a sign that they may think the company’s financial reporting is not reliable.

Investors should look a critical look at Tesla, now that the third quarter has been profitable, it may deliver the perfect opportunity to follow some of the smart money and get out.

Read the Report for Yourself

Get a free trial to our whole library of reports here.

What is Watchdog?

Watchdog Research, Inc. is an independent research provider that publishes Watchdog Reports. Our reports contain warning signs, red flags, material disclosures, and peer analysis for use in valuation, risk analysis, due diligence research, and idea generation. Watchdog Reports are designed to assist investment professionals fulfill their fiduciary obligations and to help investors, executives, board members, regulators and educators learn what they need to know about publicly traded companies. Watchdog Research, Inc. utilizes over 75 specialists and analysts to provide accurate and timely information to our readers.

The Watchdog Blog Team

Note: Our team is made up of current and former Big Four CPAs, Public Company CFOs, Litigation Specialists, Lawyers, Accounting Educators, Ethicists, Regulators, Entrepreneurs, and yes, even a few overly opinionated Harvard MBAs. Our mission is to write blogs that promote transparency in corporate disclosures.

Contact us:

If you want to subscribe to Watchdog Reports, call our subscription manager, at 813-670-2060.

If you have questions about this blog, call our content manager John Cheffers at 239-240-9284 or send an email to jcheffers@watchdogresearch.com.