Securities Class Action suits tend to have a negative effect on companies of all sizes. But Small and Mid cap companies tend to suffer more when named as a defendant.

In our last post we measured the impact of the Supreme Court’s decision in Cyan, Inc. v. Beaver County Employee Retirement Fund (Cyan). It increased the rates of Securities Class Action lawsuits for all companies but had a larger effect on litigation for Small and Mid cap companies than for Large companies.

This blog is derived from “Frequency and Impact of Securities Class Actions” a research report produced by Joseph Burke, PhD, and Joseph Yarborough, PhD, for Watchdog Research. If you are interested in accessing the entire report, email jcheffers@watchdogresearch.com.

Our team measures the impact of Securities Class Actions suits on public companies by looking at returns over the thirty-day period following a lawsuit and comparing those returns to the S&P 500 for the same period of time.

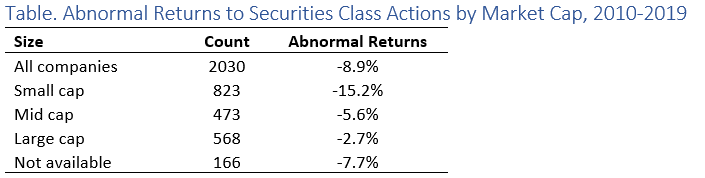

We looked at the abnormal returns of for every company following a Securities Class Action lawsuit for the past ten years and segmented the results by size.

Statistically, the negative impact of a Securities Class Action lawsuit was inversely proportional to a company’s size. The impact on Small cap companies was more than five times worse than the impact on Large cap companies.

These statistics bring the impact of Cyan into clearer focus. It appears that by opening state courts to Securities Class Action suits, the Supreme Court’s decision has created a significant burden on Small to Mid cap companies.

The Supreme Court’s decision has dramatically increased the rate of litigation for Small cap companies, a group which traditionally suffers the most when involved in this sort of litigation.

Conclusion

Small cap and Mid cap companies have limited resources, and this post-Cyan paradigm has put an unwelcome strain on these limited resources.

Even Small cap companies that have not been subject to Securities Class Action suits have suffered, as the D&O insurance market has hardened in response to these trends since getting named in a suit is not a matter of if, but when.

Higher insurance premiums are passed on to investors, employees, and customers, harming everyone. The question is, is the post-Cyan paradigm here to stay?

Contact Us:

If you have questions about this article, please contact the author, jcheffers@watchdogresearch.com. If you have questions about the company generally, or for press inquires, please contact our president Brian Lawe, blawe@watchdogresearch.com.