In this post we look at the large accelerated filers who have not filed their 10-Qs yet due to the coronavirus. These companies are outliers, with only 27 active filers delaying quarterly reports out of a population of nearly 600. We have already expressed concerns about the SEC allowing companies to be less transparent during such a critical time, and these concerns were not allayed by our research for this post. We will look at some broader trends and highlight a few egregious examples.

In response to the coronavirus, the SEC has allowed public companies to delay releasing their annual or quarterly reports by up to 45 days. This order initially went into effect on March 4th, after large accelerated filers (companies with more than 700 million in public float) had already submitted their annual reports. However, large accelerated filers were due to report their first quarter results on May 11th, giving these big companies a choice.

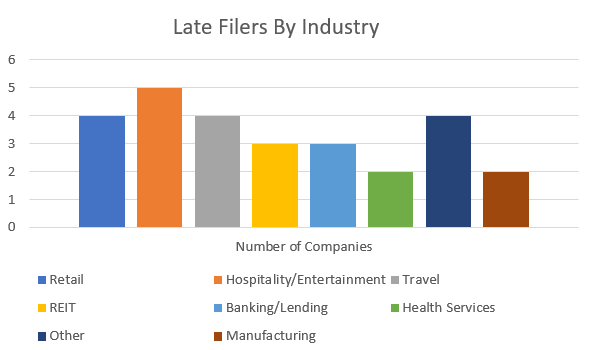

We wanted to see how many large accelerated filers were choosing to file their 10-Qs late. Our analysis showed that as of May 19th, only 27 U.S. based companies had failed to file their 10-Qs due to disruptions from the coronavirus. We arrived at this number by eliminating foreign filers (who have different reporting obligations and dates) and by eliminating companies that failed to file because they were acquired or stated their failure to file was due to internal control problems.

It is significant that so few companies decided to file late. We decided to look deeper to see what made these companies the exceptions. We were not surprised to see Party City (PRTY) on this list. In addition to having its stores closed, long term social distancing practices could destroy their prospects for recovery; its stock has taken such a beating that it was delisted. But for other companies it is less clear why they were unable to file. For example, Entercom Communications (ETM), which owns radio stations and other digital content, has only reported a 4% loss in net revenue for its first quarter, hardly cataclysmic.

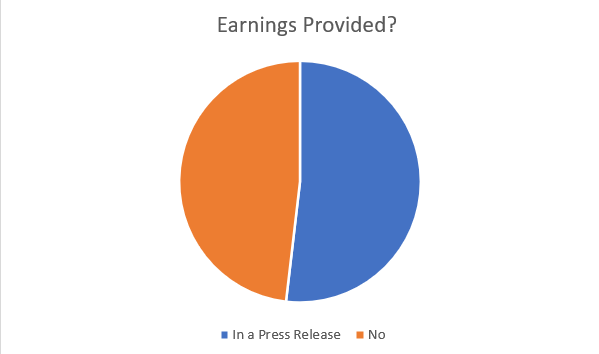

We also found that about 14 of these companies had offered their first quarter results to their investors in an earnings call and concurrent press release. We are not quite sure what to make of this. On one hand, it seems commendable that they are keeping investors appraised of what is going on, but if they can pull together an accurate earnings call, then why can’t they file their 10-Qs on time?

Interesting Specific Examples

Circor International (CIR). This industrial valve manufacturer failed to timely file their 10-k this year because of internal control issues and a cybersecurity breach. Now they are claiming that the coronavirus is the reason for their late 10-Q. They also filed two of their quarterly reports late in 2019. This company sells manufactures valves and other products for the industrial, aerospace and defense, and energy sectors. This is probably the clearest cut case of a company making a dubious assertion that its filing delay is due to the coronavirus as opposed to preexisting internal issues.

MFA Financial (MFA). This Real Estate Investment Trust (REIT) provided an interesting reason why they could not timely file their quarterly report, “Company’s management has had to devote significant time and attention to address [the impact of coronavirus], which have diverted management resources from completing tasks necessary to file the Company’s Quarterly Report….” The other two REITs who failed to file in a timely manner cited the need for accounting staff to work at home as a reason for the delay. In contrast, it appears MFA’s management simply did not make time to file their 10-Q because the SEC has allowed them to put it on the backburner.

Credit Acceptance Corp (CACC). MFA was not the only company to say its management was too busy to file a 10-Q. CACC had a near identical disclosure, claiming management was just too busy assessing the potential impact of the coronavirus. For context, CACC specializes in offering subprime loans on vehicles, which some people find unsavory. Even though almost every other company is trying to increase and preserve liquidity to survive the shutdowns, CACC is in the process of repurchasing up to 3 million shares, reducing their cash position. We also can’t help but point out the irony of CACC filing their 10-Q late on the flimsiest of excuses while also issuing this statement on their website “…Credit Acceptance is unable to support payment deferrals, and your payments will continue to be due on your scheduled monthly due date….” Considering the current predicament of many of the low-income recipients of these predatory loans, we don’t know how CACC shareholders can sleep at night.

Every investor wants to know if management is reliable and is dedicated to transparency. When management is opaque, it makes an investment far riskier. The best way to assess the trustworthiness of a management team is to see what kind of choices they make. The coronavirus has presented management teams with lots of choices, and we should watch them carefully as they make their decisions.

Contact us:

Our Watchdog Reports are Free for Retail Investors, if you are a professional investor you can sign up or call our subscription manager about a group rate, at 239-240-9284.

If you have questions about this blog, send our content manager John Cheffers an email at jcheffers@watchdogresearch.com.