To protect the elderly and immunocompromised, federal and state officials have locked down society to flatten the rate of infections. An unfortunate byproduct of these shut-downs has been the destruction of large swaths of the economy and skyrocketing unemployment. To relieve some of the financial pressure these lockdowns have put on businesses, federal and state officials have tried different measures intended to aid businesses. For its part, the SEC has permitted companies affected by the coronavirus to delay their annual and quarterly statements that would normally be due from March 31st-July 1st.

For some companies this may simply be a welcome respite during a difficult time, but we are concerned that some companies may use this as an opportunity to prevent investors from seeing just how badly things are going until it is too late. However, the SEC has also encouraged companies to reveal how the shutdowns are effecting them and to speculate about how they will bounce back from the disaster. The SEC has assured companies concerned about incurring liability for these speculative statements that they will not be “second guessed by the SEC.”

In effect the SEC has created two divergent paths for companies, some will file on time and may include extensive disclosures, but others may take the opportunity to delay reporting for as long as possible, perhaps in hope that by the time the 45 day period runs out, they will be able to report some good news (if they don’t declare bankruptcy first). We believe that the strongest indicator for which path companies will take is their financial health before the lockdowns. This would be consistent with findings from Audit Analytics that the companies who initially received going concern warnings from auditors, where the coronavirus was named as a substantial factor, had already received going concern warnings before the pandemic even started.

We have already expressed concern that some companies might use the coronavirus as a pretext to write off goodwill that was junk before the lockdowns, but we became concerned that some companies might abuse the delay allowance when we saw that Luckin Coffee was delaying its annual report due to the coronavirus. The disclosure did not even refer to the massive fraud it unveiled less than a month earlier, or the firing of its CEO that was announced a few days later.

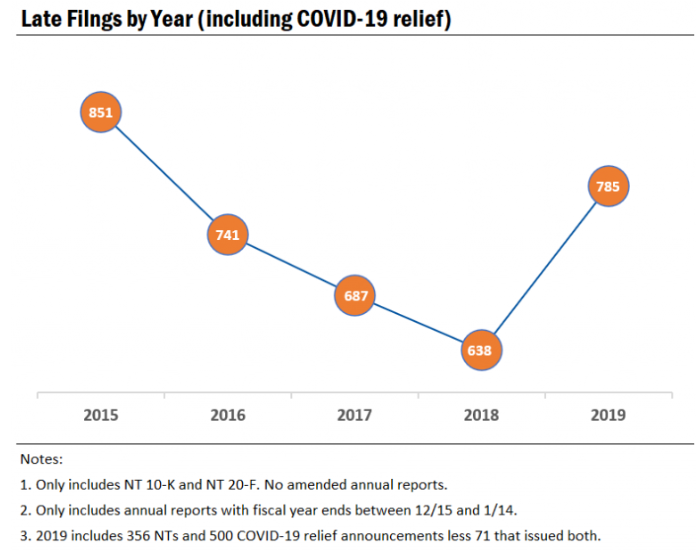

U.S. large accelerated filers, companies with a public float of over $700 million, were required to file their annual statements before March 1st, so they were unable to take advantage of the ability to file late. But smaller companies and foreign issuers with later deadlines were able to take advantage to file late if they wanted and many of them did:

Source: Audit Analytics

Source: Audit Analytics

Most large accelerated filers are due to file their quarterly statements this week, which is giving the markets their first real insight as to the effects of the coronavirus on the world’s biggest businesses. For example, the Kraft Heinz Company, (one of our favorite subjects) has benefited from the shutdowns with a boost in revenue, as we predicted. They also wrote off $226 million in goodwill, but that was apparently from consolidating their reporting into three segments instead of four and not from the coronavirus (how KHC’s figured that its new international segment is worth $226 million less than the sum of its component parts is anyone’s guess).

Likewise, Hertz filed its 10-Q in a timely fashion, but it did not have such good news to report. The rental car industry, which has high fixed costs and relies primarily on people traveling to earn revenue has been hit hard by the shutdowns. Hertz issued a going concern warning in its 10-Q that it cannot continue to make necessary payments without more revenue as it is burning through its cash. Currently, one of its biggest debts is in forbearance but that deal is set to end on May 22nd, and Hertz has been unable to offer any assurances that a deal will be struck. The debtors could potentially seize their collateral, including vehicles in Hertz’s fleet, hurting the company’s ability to recover when the lockdowns end. It is good that Hertz is sharing this crucial information for investors at such a critical time.

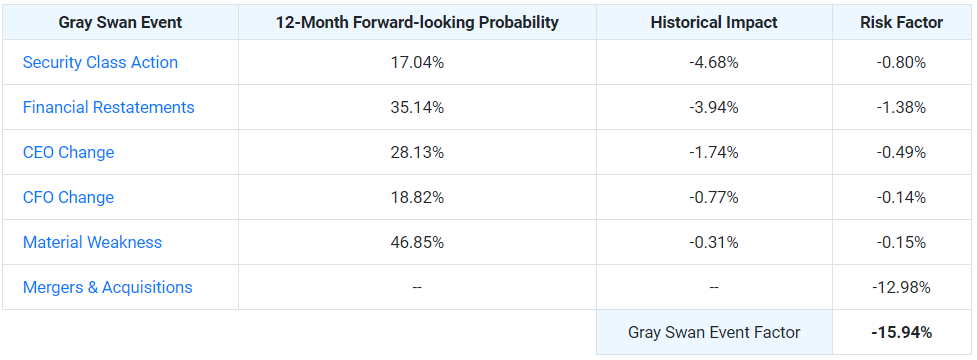

However, some companies have opted to delay their filings. One such company is HF Food Group (HFFG) which primarily serves Chinese takeout restaurants. Although not a large accelerated filer, this company had the dubious distinction of earning a higher Gray Swan Event Factor score than any other publicly traded company as of April 8th. Their high score was mostly attributable to two recent mergers, including one consummated in November 2019. The company also disclosed in its 10-K, filed on March 16th, 2020, that it identified a material weakness in its internal controls. HF was also been targeted by a short seller and had a securities lawsuit filed against it in March, and replaced its CFO on May 4th.

For those curious about our Grey Swan Event Factor analysis, here is the analysis for HFFG:

How is it that HFFG was able to put out a timely annual report but has needed to delay its quarterly report due to the coronavirus? Is it possible that this delay has more to do with material weaknesses in the internal controls and turmoil at the executive level, rather than the coronavirus? To its credit (and unlike Luckin Coffee), HFFG has released some information indicating that it has been suffering an adverse impact from the shutdowns, with net sales declining from $209 million to $175.8 million year over year. Still, investors will not really be able to assess the big picture until the quarterly results are published.

When this mess is over, the SEC ought to study the effect of its policy. Did the delayed filings really help companies who were suffering from the coronavirus? Or were they mostly used by companies who would have filed late anyways? And was any real benefit to companies worth the loss of crucial information for investors at such a critical time?