Our research indicates that large mergers are a strong leading indicator for Securities Class Actions.

In 2015, Warren Buffett’s Berkshire Hathaway and the Brazilian firm 3G Capital collaborated to facilitate a merger that formed Kraft Heinz (KHC). In 2019 Kraft Heinz issued one of the largest impairments in history, over $15 billion. This impairment seems to have been a direct consequence of corporate governance issues arising out of the merger. And it did not end there, Kraft Heinz impaired an additional $5 billion over the next two years and has been engaged in protracted legal battle.

Every merger presents a difficult challenge of reconciling two different systems (each company has its own corporate culture, governance philosophy, financial reporting methods, IT solutions, compensation practices, etc.). When this reconciliation process does not go well, it can create serious problems that can play out over a course of years. This has been the story for Kraft Heinz, but they are not alone.

Correlating Mergers and Securities Class Action (SCA) Lawsuits

Our research into mergers indicates that a company takes a big risk when it merges with another company that is relatively comparable in size. In contrast, a company takes significantly less risk if it gobbles up a relatively small operation. For example, PayPal wrote off almost all of the $230 million it spent acquiring TIO in 2017 without batting an eye.

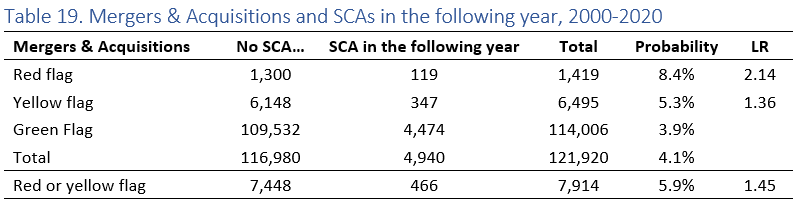

When cataloging these mergers for our research, relatively large mergers are assigned a red flag and relatively small mergers are assigned a yellow flag.

Our research indicates that over the last 20 years companies with a red-flag merger were 2.12 times as likely to be named in a SCA lawsuit in the same calendar year (potentially occurring before or after the merger). Companies with a yellow-flag merger were 1.38 times as likely to be subject to suit.

But this is not as dramatic as it sounds. It is likely that in many cases these lawsuits preceded the merger as merger-objection suits. Merger objection lawsuits typically lack substance and are often dealt with quickly. These ubiquitous lawsuits artificially inflate the number of lawsuits included in the calculation and diminish the importance of the relatively high correlation we found in the same calendar year.

However, we were surprised to see that when we looked at the correlation between red-flag mergers and SCA suits there was a slightly stronger signal in the following year.

Over the past 20 years, any company that had a merger was 1.45 times as likely to be subject to a SCA suit as a company that had not engaged in a merger.

But for companies that had red-flag mergers, they were 2.14 times as likely to be subject to a SCA the following year. Even without the inflationary effect of the merger objection suits, these red-flag mergers were a very strong leading indicator for SCA suits.

This research comes from “Securities Class Actions: Leading Indicators and Covariates” by Joseph Burke, PhD, and Joseph Yarborough, PhD. Available at $399 for an individual license and $699 for firm-wide license. Contact jcheffers@watchdogresearch.com to purchase. Free for subscribers.

Conclusion

Most actors in the market think on a quarterly basis, but insurance and investment professionals need to think in longer terms. Mergers are often forgotten by the markets almost as soon as they are consummated, but the problems that they create can linger for months, or even years.

We grade past risk factors and predict future risk impacts for over 4,500 publicly traded companies. Contact jcheffers@watchdogresearch.com to learn how we can help you.