This year we have looked at the impact of several different types of events, like restatements, material weaknesses, and securities class actions on share values.

We measure the impact of these “gray swan” events by comparing the change in a company’s share price in the 30 days after the event with the contemporaneous change in the S&P 500. We do this analysis so that we can more accurately predict both the probability and the likely price decline of future gray swan events for over 4,800 public companies.

This blog is derived from the report “Frequency and Impact of CEO Changes” by Joseph Burke, PhD, and Joseph Yarborough, PhD. If you would like a copy of the report, please contact jcheffers@watchdogresearch.com.

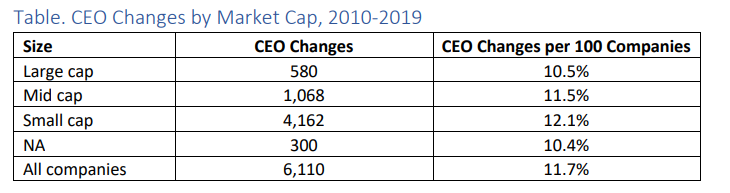

In this post we will take a brief look at CEO changes and impact they have had on share price. One interesting thing to note is that CEO changes appear to be distributed evenly among companies of all sizes. In the last ten years, bigger companies have only been slightly more likely to retain their CEOs for longer than smaller companies.

It is interesting because our examination of material weaknesses, restatements, and securities class action suits all uncovered vast disparities between companies based on market cap.

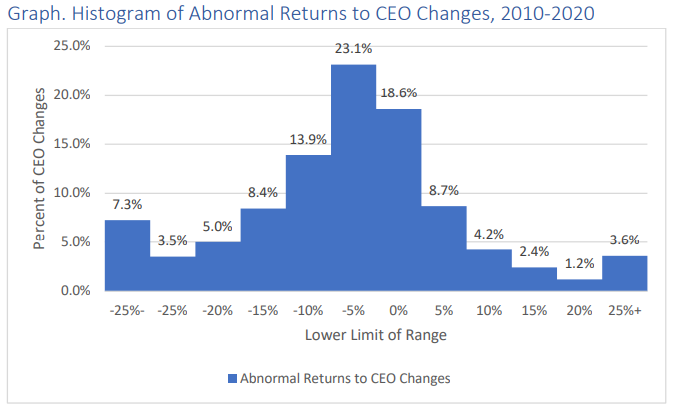

CEO changes tend to have a negative effect on the stock price, although the impact is not typically too substantial.

Here is a little more detail on the above graph. The average impact of a CEO change is -2.7% over the 30 days following the CEO departure. Although, 15.8% of the CEO changes resulted in losses of 20% or more during that window. In contrast, however, 40% of CEO changes do not result in negative returns.

The data indicates that a CEO change is not necessarily a significant event, but the challenges that come with turnover in management will tend to have slight negative effect on share value.

However, in about 15% of cases, the losses associated with the departure of a CEO will be significant. We suspect that in these cases the CEO’s departure is only a part of a “parade of horribles” that the company is experiencing.

Contact Us

D&O insurers spend a lot of time on new bid requests. Our clients use our Watchdog Reports to quickly discover which bids they should pursue. Click here to request a free demo. Special offers available.

If you have questions about this blog, email jcheffers@watchdogresearch.com. Or you can contact our President, Brian Lawe at blawe@watchdogresearch.com.