Public companies are required to keep investors and the public well informed concerning their financial condition. People rely on this information and expect it to be accurate. Accordingly, a company must file a restatement if it determines that its previous financial disclosures were inaccurate, and that people should not rely on them.

This blog touches on a few data points from an extensive report produced by two of our researchers, Joseph Burke, PhD, and Joseph Yarbrough, PhD. If you want access to the full report, email jcheffers@watchdogresearch.com.

The analysis for this report was primarily derived from the Audit Analytics restatement database.

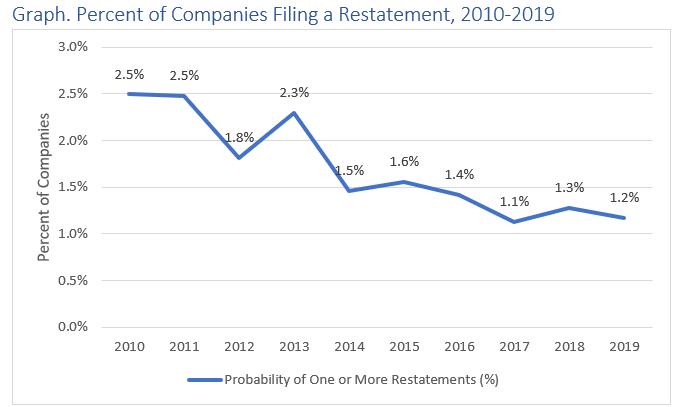

One thing to note is that restatements have declined significantly over the past ten years, although the rate of decline has slowed significantly.

This graph shows the annual share of companies filing one or more financial restatements from 2010 to 2019.

This decline should bring a great deal of comfort to many companies since restatements are one of the most harmful gray swan events that we track. Restatements are often the opening salvo in a torrent of bad press. A restatement often occurs because of a substantial material weakness in the internal controls and often can precipitate turnover in the management team, particularly at the CFO position. Additionally, restatements often trigger class action securities lawsuits.

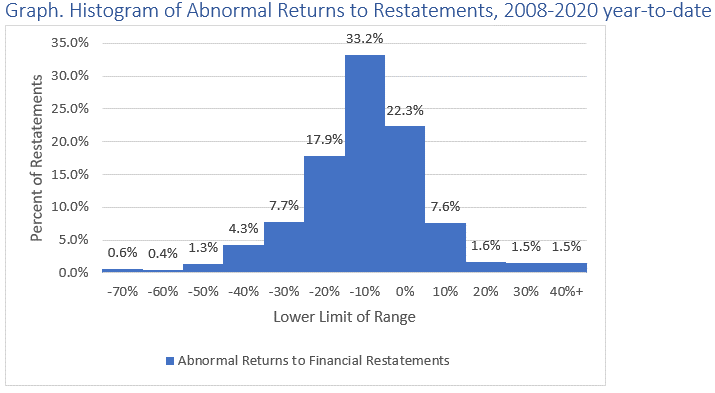

Our analysis compared the returns over the thirty days following a restatement to the returns from the S&P 500 over the same timeframe. The data shows that the typical reaction of the market to a restatement is negative (approximately 2/3 of restatements resulted in negative returns). The most common result is negative returns from zero to 10%, but a significant portion (approximately 15%) had a negative return of 20% or more.

This graph groups companies by how their share prices performed in comparison with the S&P 500 in the 30 days after a restatement was reported.

Our analysis indicates that for many companies, issuing a restatement is a trying—but manageable—event. However, in a significant minority of cases, the losses can be catastrophic.

Some Notable Cases from 2019

Even though the percentage of companies impacted by a restatement in 2019 was relatively low, some of the restatements that did occur had a near record-breaking impact.

Pareteum Corp (TEUM) had a restatement in October, 2019, and lost 69.6% of its value over the next 30 days ($119 in market cap). TEUM’s decline in value (as a percentage of its pre-restatement value) over the thirty days following its restatement was more than any other company in the last ten years. TEUM was delisted in October 2020.

Kraft Heinz (KHC) had a restatement in February 2019 that erased $12.7 billion in market cap after its restatement on February 9th, 2019. This loss in vale was the second largest in the last ten years. If you want to know more, you can read some of our analysis on KHC here, and here, and here.

Baxter International Inc (BAX) had a restatement in October 2019 that erased $4.39 billion in market cap over the next thirty days. Even though BAX lost significantly less money than KHC, it was still the third largest loss of value in the last ten years.

Conclusion

Restatements today are far less common than they were a decade ago, although the rate of decline has slowed in recent years. Our research also shows that 2/3 of restatements have a negative impact on share price. Although the response to a restatement is generally negative, people may be surprised by the fact that 1/3 of restatements had no negative impact on the share price after 30 days.

Even though restatements are not as common as they used to be, a restatement can still be a catastrophic gray swan event, as is evident from the negative impact that they had on TEUM, KHC, and BAX in 2019.

These restatement numbers are just one facet of our Gray Swan Event Factor. With our GSEF we calculate the risk of gray swan events for over 4,500 publicly traded companies. If you would like a demo, email our President Brian Lawe via blawe@watchdogresearch.com.