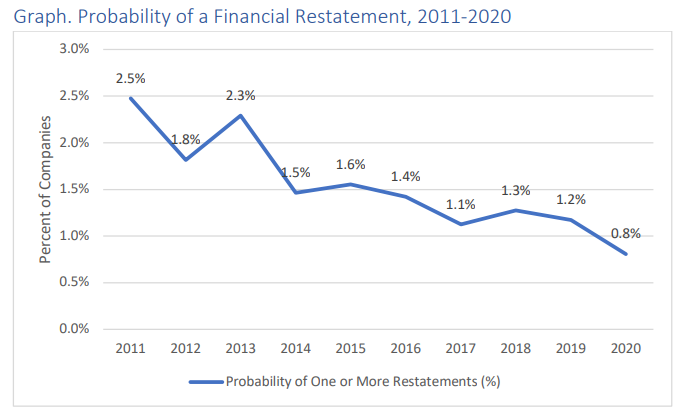

U.S. companies filed 42 restatements in 2020, the fewest ever.

2020 was a difficult year for most companies. The coronavirus pandemic has ravaged industries and impacted how nearly every company does its business. One bright spot for U.S. public companies was that their probability of filing a restatement fell to an all-time low.

It is important to note that these numbers do not include restatements from foreign companies, nor do they include “revisions” that are disclosed outside of the annual or quarterly filings. We are going to address those topics in a later report.

This blog is derived from “2020: Frequency and Impact of Restatements” a research report produced by Joseph Burke, PhD, and Joseph Yarborough, PhD, for Watchdog Research. If you are interested in accessing the entire report, email jcheffers@watchdogresearch.com.

Restatements and Securities Class Action Suits

Restatements are often followed by a securities class action suit. The reason is simple enough. A company usually files a restatement to correct mistakes that they made due to an internal control problem. This correction results in a loss of confidence and a drop in the share price.

Plaintiff’s attorneys then file a lawsuit claiming that the management of the company intentionally made misrepresentations in the past (which have now been corrected in the restatement). The drop in share price helps establish damages.

Not every restatement will result in a lawsuit for a variety of reasons, but there is a well-established pattern.

This year restatements and securities class action lawsuits both declined. Securities lawsuits do not always follow the restatement trend considering that restatements have trended down over the past decade while securities class action lawsuits hit historic highs over the last three years. But the number of restatements remains a significant contributing factor to the overall number of securities class action lawsuits.

Conclusion

Restatements were down significantly for U.S. companies in 2020, reaching a new low. It is not clear if this decline has something to do with the coronavirus, or if it is simply the continuation of a long-term trend.

The decline in restatements has likely contributed to the decline in securities class action suits that also occurred in 2020, although restatements traditionally have minor impact on the overall securities class action trends.

Contact Us

We provide independent research on public companies, ETFs, and portfolios. Our clients include D&O insurers, buy-side analysts, and consultants. Click here to request a free demo. Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.