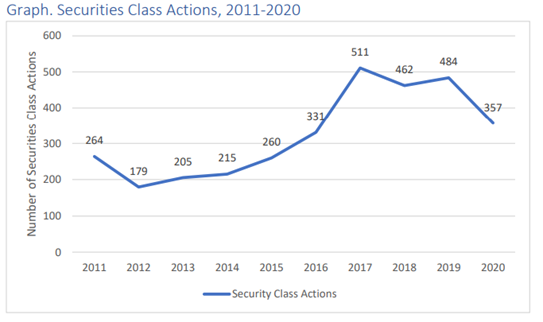

Companies sustained record-setting levels of securities class action suits in 2017, 2018, and 2019 after the Supreme Court’s decision in Cyan threw open the doors of the state courts to traditionally federal securities litigation. In 2020, the number of securities class action suits filed receded from these all-time highs, but it is unclear whether the reduction is a temporary departure from a new paradigm, or the beginning a of a return to the mean.

This blog is partially derived from “2020: Frequency and Impact of Securities Class Actions” a research report produced by Joseph Burke, PhD, and Joseph Yarborough, PhD, for Watchdog Research. If you are interested in accessing the entire report, email jcheffers@watchdogresearch.com.

This trend of overall decline in 2020 does not apply to all types of cases. In a previous piece we looked at how cases against Chinese companies in 2020 bucked this trend and increased sharply.

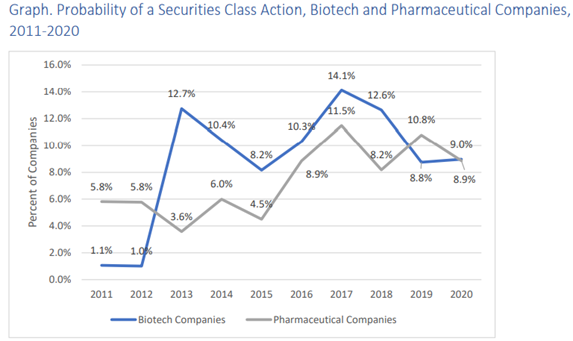

Here we will look at two industries, biotech, and pharmaceuticals. (Our classification system may vary slightly from others you are familiar with because we classify companies by NAICS codes.)

As we can see from the graph, suits against pharmaceuticals in 2020 declined, but remained in line with the average number of suits from 2016-2019. Suits against biotech companies remained almost identical to 2019, but the last two years are a significant downward departure from 2013-2019.

It is hard to draw too many conclusions from this data because the sample size is relatively small and subject to volatility. However, it is interesting that both industries were immune to whatever caused securities class actions suits to decline overall in 2020.

By our count, there were only 25 coronavirus related class action securities lawsuits in 2020. (There are some disagreements as to what should be considered a “coronavirus related” suit, which is why the count of “coronavirus cases” varies. We are shamelessly copying the count provided by Kevin Lacroix, whose blog the D&O Diary is a must read.)

As you might expect, several companies in the biotech and pharmaceutical industries were subject to coronavirus-related lawsuits. Our total was 8, accounting for a significant portion of the cases brought against pharmaceutical and biotech companies. If not for the coronavirus, these industries would have probably seen significant declines in litigation, paralleling the overall downward trend.

Conclusion

This pattern may repeat again in 2021 as two of the three coronavirus-related lawsuits filed as of February 15th were against companies in the biotech and pharmaceutical industries. It appears that even if securities class actions continue to decline towards the long-term mean, there is a good chance that coronavirus-related lawsuits will keep biotech and pharmaceuticals at an elevated risk for litigation.

Contact Us

We provide independent research on public companies, ETFs, and portfolios. Our clients include D&O insurers, buy-side analysts, and consultants. Click here to request a free demo. Special offers available.

If you have questions about this blog, contact John Cheffers at jcheffers@watchdogresearch.com. For general or press inquires, contact our President Brian Lawe at blawe@watchdogresearch.com.