Xi Jinping’s rebuke of Jack Ma has laid bare a critical problem in Chinese corporate governance. Chinese companies are required to put loyalty to the CCP and Xi Jinping before all other loyalties. Any perceived lack of loyalty to Xi Jinping is punished.

The ANT Group was supposed to IPO on November 5th, it was going to raise $34.4 billion, the biggest capital raising of all time. In a remarkable turn of events reported by the Wall Street Journal, Xi Jinping, China’s dictator, scuttled the IPO after getting incensed at some comments made by ANT Group’s Chairman Jack Ma.

The Wall Street Journal quoted a senior Chinese official, who stated “Xi doesn’t care about if you made any of those rich lists or not … What he cares about is what you do after you get rich, and whether you’re aligning your interests with the state’s interests.”

The Wall Street Journal’s reporting makes it clear that the sole purpose for scuttling ANT Group’s IPO was to punish a lack of loyalty.

Even though investors are aware that Xi Jinping is an authoritarian dictator and that his whim is law, it still came as a shock to see his power exercised in this way. Alibaba, which shares ownership of ANT Group with Jack Ma, lost a significant amount of value after ANT Group’s IPO was scrapped.

It was unsettling to see the raw power and influence of Xi Jinping and his associates on display in this case. But there are broader implications for China and the U.S. that should really be giving investors pause.

Concerning the broader implications of the ANT Group story, Kevin Lacroix, author of blog The D&O Diary, wrote:

The one thing this sequence of events does show is that there is a substantial component of political risk involved in doing business in, and investing in companies that do business in, China. The fact that political officials and financial regulators might intervene in markets out of anger against company executives or out of a desire to cut company officials down to size underscores the fact that the political dimension of China’s economy can never be disregarded. These events put a huge asterisk beside the market capitalization and business prospects of any company doing business in China.

Every Chinese Company Has a Serious Flaw in its Corporate Governance

For Chinese executives, loyalty to Xi Jinping supersedes all others and leaves shareholders holding the bag.

At Watchdog, we produce reports for every public company traded on U.S. exchanges. Each one of these reports contains a section on corporate governance issues because understanding what is going on in the C-suite is critical for understanding what is going on at a company.

The pith of the problem in Chinese corporate governance is that executives have obligations to both the state and investors, and those loyalties are in conflict. But to understand that conflict over loyalty and why it is such a significant problem, we need to take a few steps back.

Corporations exist to facilitate the flow of capital from people outside the corporation (investors) to the people inside the corporation (the directors and officers). Investors put their capital at risk to generate productivity, growth, and wealth, and they reap some share of the profits as a reward.

The directors and officers at the company are in a position of trust, and corporate governance rules are designed to ensure that they do not abuse this trust. Courts and legislators have taken steps to protect this trust because it is essential to the efficient flow of capital, indeed to capitalism itself.

To protect investors, the legislators and courts in this country have found that directors and officers owe a fiduciary duty to the investors and the corporate entity. In his 1928 opinion in Meinhard v. Salmon, Judge Cardozo articulated the essence of this legal duty as a “duty of the finest loyalty… Not honesty alone, but the punctilio of an honor the most sensitive, is then the standard of behavior.” (emphasis added) This duty has real teeth, since when a director or officer violates their fiduciary duty, shareholders can seek redress in court.

Courts have found that this duty of loyalty requires that the director or officer put the interests of the company and the shareholders before other interests. Directors and officers must act within the confines of the law, but they violate their duty of loyalty if they advance their own interests, or the interests of any other entity, including the State or the broader community, over the interests of the shareholders (*507).

The core corporate governance problem for Chinese companies is that they are required to put loyalty to the CCP and Xi Jinping before all other loyalties. Any perceived lack of loyalty to Xi Jinping is punished.

This practice reflects the Constitution of the People’s Republic of China, which states in Article 1, “The People’s Republic of China is a socialist state under the people’s democratic dictatorship …. Disruption of the socialist system by any organization or individual is prohibited.”

In addition, shareholders of Chinese companies have no recourse if the directors engage in self-dealing.

Problems in corporate governance often lead to problems in financial reporting because proper corporate governance is a key safeguard against fraud and abuse. Our research has shown that Chinese companies delist from U.S. exchanges at a higher rate than any other country, and that almost 60% of those delistings were credibly associated with fraud.

The Conflict in Loyalty is Not Just a Corporate Governance Issue

Xi Jinping’s demand for absolute loyalty also warps the roles of lawyers and accountants.

This conflict over loyalty is not limited to a tiff between China’s dictator and its wealthiest business owner. This problem touches many different aspects in international business in China.

For example, in a post cautioning business owners from relying on Chinese lawyers, the China Law Blog raises the possibility that “ working against your interest … might be your lawyer’s patriotic duty in China.” Since Chinese lawyers take a loyalty oath to the CCP, so “it is simply unrealistic to expect there will be any meaningful pushback against government pressure.”

Pressure has been brought to bear in the accounting profession as well. We have written several stories about how the CCP refuses to allow auditors to share their work papers with the PCAOB, at least most of the time.

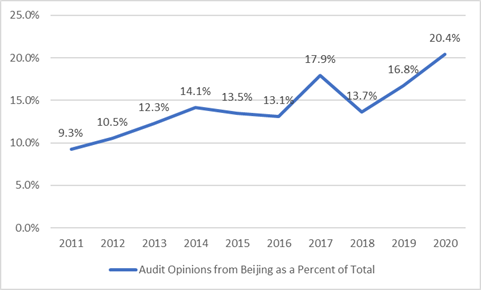

The CCP requires Chinese nationals to run the Chinese Big 4 affiliates. This suggests that the CCP is exercising influence on the accounting profession, and we were not surprised to see an increasing share of audit opinions issued out of Beijing as power has concentrated there under Xi Jinping.

Conclusion

ANT Group’s failure to launch is a canary in the coalmine. It is not the first warning that investors received concerning the dangers of investing in China, but it has struck close to home. Jack Ma’s former company, Alibaba, is the biggest recipient of western investment dollars, and is currently capitalized at $750 billion. The share price of Alibaba dropped significantly after ANT Group’s failure to launch; it will recover, even though Xi Jinping has demonstrated that he could seize Alibaba on a whim.

This episode also reveals a fundamental problem effecting every Chinese company. The communist ideology that animates the CCP undermines the fundamental relationships in a corporation. An executive’s primary loyalty is supposed to lie with the shareholders, because the executive has been entrusted with the shareholder’s money.

But in China, loyalty to the CCP and Xi Jinping supersedes all other loyalties.

The communist ideology undermines the fundamental trust in relationships that make capital flow efficiently. Indeed, it undermines capitalism itself. This realization is no surprise to those who are familiar with communism’s history, or the writings of Marx, but it seems to have escaped those holding the levers of power in government and Wall Street.

Contact Us:

If you have questions about this article, please contact the author, jcheffers@watchdogresearch.com. If you have questions about the company generally, or for press inquires, please contact our president Brian Lawe, blawe@watchdogresearch.com.