Accounting related problems at a company generally don’t get much press … until they do. A total accounting failure can result in an SEC investigation, restatements, lawsuits, and a catastrophic and long-lasting decline in stock price. In the last few years, we have seen GE, Kraft Heinz, and Under Armour all suffer severe and lasting consequences for accounting related issues.

These were not black swan events, each of them was presaged by warning flags that should have warned investors of what lay ahead. Unfortunately, few people had the time to notice these flags, or had the expertise to factor in the risk.

Maybe you correctly foresaw these gray swan events, but the odds are that you were in the majority of people who missed them and lost money. Our Gray Swan Event Factor can help you stay ahead of the curve and anticipate accounting risks more easily. Request a free demo today.

Material Weaknesses on the Rise

When we calculate our Gray Swan Event Factor, we look at a lot of different variables. One variable is whether a company disclosed a material weakness. A company will disclose a material weakness when one or more of their internal controls (procedures and safeguards against financial reporting irregularities) is ineffective.

Every year we create a report on the frequency and impact of material weaknesses. This article touches on a few key points, but if you would like to see the full report, email us and we will send it to you.

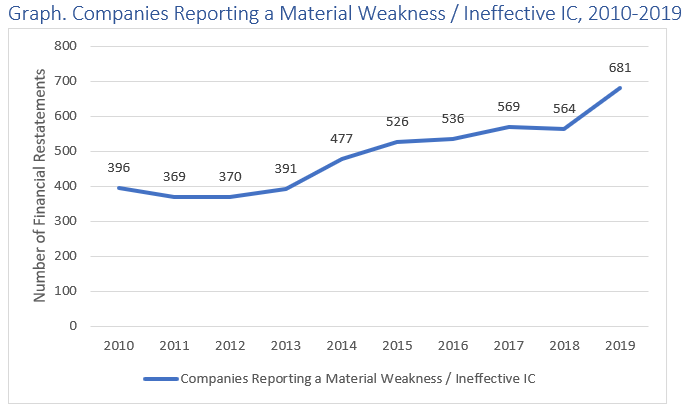

The number of companies that reported a material weakness increased sharply in 2019.

This increase in the overall number of material weaknesses reported continues an upward trend that has been consistent over the past decade.

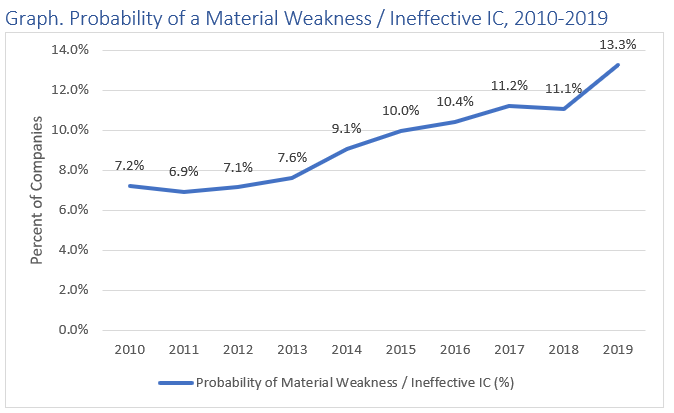

To get a sense of the likelihood that any given company will disclose a material weakness, we took the same information and expressed it in percentages. In 2019, 13.3% of companies disclosed a material weakness.

This increase in material weaknesses should raise concerns amongst investors. When a company has a material weakness it means that there could be undetected problems with their financial reporting. Those undetected problems could be grievous accounting errors requiring a restatement, or worse, fraud.

It is interesting that the number of disclosed material weaknesses are on the rise, despite the fact that the SEC continues to loosen standards concerning the auditor attestation requirement under Sox 404(b).

Company Size Predictive of Frequency and Impact

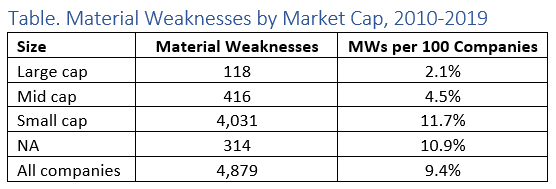

Not all companies are equally likely to experience a material weakness. In fact, our research indicates that a small company is far more likely to have a material weakness than a large company.

One reason for this disparity is that the auditors of large companies must test their internal controls, this creates a strong incentive to expend the resources necessary to create effective internal controls.

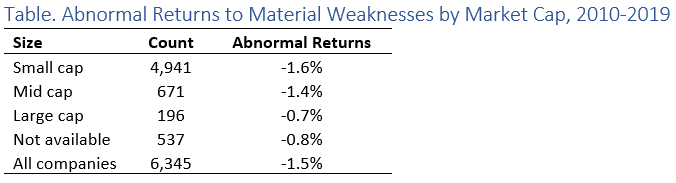

Finally, the disclosure of a material weakness does not tend to have a large impact on the value of a company’s stock price, particularly for larger companies.

A company that has material weaknesses in their financial reporting is more likely to experience other events that have a much greater impact on stock price, like restatements, or securities class action suits.

Conclusion

Material weaknesses have increased steadily over the past decade from 7.2% in 2010 to 13.3% in 2019. Smaller companies that have fewer regulatory requirements and fewer resources were far more likely to disclose a material weakness than larger companies.

These material weaknesses do not have much of an immediate impact on stock price, but they do increase the risk of problems with the financial reporting. Problems with the financial reporting can lead to restatements, lawsuits, investigations, and a host of other problems that can result in catastrophic losses.

Contact Us

A gray swan event can lead to catastrophic losses unless you are one of the few people who see it coming. Our Gray Swan Reports can help you navigate an uncertain future. Sign up for a free demo today and learn how our information can keep you ahead of the curve.

If you would to have our blog sent directly to your inbox, sign up here.

You can email jcheffers@watchdogresearch.com about this article. For press inquires, contact our President, blawe@watchdogresearch.com.