Tesla supporters have been reveling in the third quarter results that showed Tesla turning an operating profit for the first time this year. Tesla’s stocks have shot up dramatically based on the good news.

This wave of enthusiasm started when Tesla released their financial statements for the third quarter. Implicit in this enthusiasm is a trust in the integrity of the financial reporting, and a trust of the management team that has issued the report. But should investors place their trust in Tesla’s financial reporting?

Our previous posts on Tesla suggest that the answer is no. Specifically in Part IV we looked at the unreliability of Tesla’s statements concerning their acquisition of SolarCity, where management’s conflicts of interest seemed to supersede valid business interests. Parts I, II, and III looked at things that would provide an inference that insiders and institutional investors have lost confidence in the reliability of Tesla’s reporting. But we are going to go further, by looking at Tesla’s reliability light of the complexity of their accounting, their virtue signaling impairment, and their statements to the SEC.

Accounting Complexity Leaves Investors in the Dark

When looking at the reliability of the financial reporting of any company, it is always a good idea to look the Watchdog Report graph on accounting disclosure complexity. Tesla’s is particularly worrisome.

Let’s look behind the graph. The SEC has made a serious effort to make all company disclosures accessible to the public by requiring the use of standardized formats and standardized language. As part of this effort, the SEC also requires companies to submit these filings in an XBRL format, so it is simpler for software to provide meaningful analysis without too much manual work.

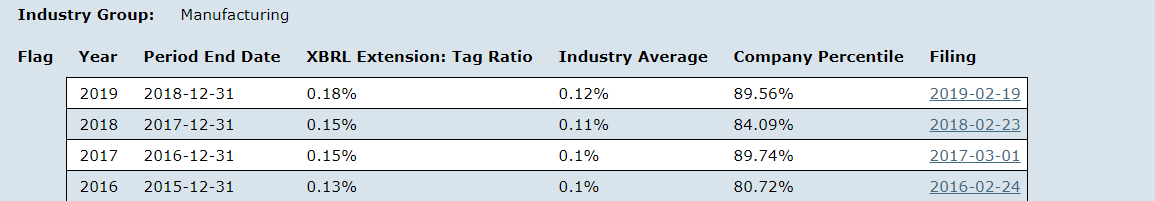

As a practical matter, when a company makes a filing, they mark it with a set of standardized XBRL tags. However, sometimes a company needs to use “custom” XBRL tags because their data does not fit into the standard language or format. Our graph represents how often a company introduces these “custom” tags in comparison with their industry peers. Here is a look at the specific numbers for Tesla:

When a company uses more custom language or formats than its peers, its disclosures are more complex, unusual, and hard to understand. When the financial statements are hard to understand, then you must pin your hopes on the honesty and competency of the management team making the disclosures. That is inherently risky, because management collects bigger checks when they report that all is well.

Our graph lets you know in seconds that Tesla’s reporting is difficult to understand because it has unusual terms or formats. So, if you are going to put money in something you don’t understand, then you need a lot of faith in the management team. Should you put your faith in Tesla’s management? We haven’t forgotten about Tesla’s revolving door at CFO, where the current occupant is only 34 years old and has never worked anywhere besides Tesla.

What Will Tesla’s Critical Audit Matters (CAMs) Tell Us About the Complexity at Tesla?

We will learn more when their auditors file their Critical Audit Matters (CAMs) at year-end, and we get a sense of what parts of the business pose difficulties for the auditors. With accounting complexity ranking this highly, we suspect that the CAM disclosure will name more issues that most of Tesla’s peers. It will also be interesting to see which parts of their business pose the most difficulty for auditors.

Tesla’s Virtue Signaling Impairment

We have noted this phenomenon before, at Kraft Heinz and PayPal. When a company issues an impairment on a loss that is immaterial, it concerns us because it is a sign that management wants to reassure investors that their internal controls and accounting methods are rigorous. Such reassurances tend to make our team wary.

In 2018, Tesla reported a $13.3 million impairment for a commercially infeasible product. Keep in mind that Tesla valued SolarCity at $2.6 billion dollars in value, but was winding down its operations within a year. Tesla unveiled the solar roof tile in 2016 and promised to start production in 2017, a promise that they did not keep, but a promise that they made yet again this quarter. And what about the $5.8 billion in solar systems that SolarCity had leased to customers that made up the bulk of their assets, what happened to those?

Did Tesla incur any losses associated with the acquisition of SolarCity that would require a write off? With their complex accounting, including many unconventional lease agreements and tax credits, it’s impossible to tell. In the third quarter, approximately $50 million of Tesla’s profit was due to a change in its provision for warranty, a one-off adjustment. Will there be more major one-off adjustments, either up or down, for the final quarter this year? Who knows?

Tesla Denies a Loss of Almost a Billion Dollars in Tax Benefits is Material

The IRS allows purchasers of electronic vehicles to apply a $7,500 credit to their taxes, this provides the manufacturer a benefit of effectively reducing the price of their vehicle by $7,500. However, once a manufacture sells 200,000 vehicles, the credit phases out over the next year. Tesla hit the 200,000 mark in 2018, and on January 1st, 2019, the phaseout began. The credit was cut to $3,750 for the first six months, and then went down to $1,875 and will be completely phased out at the end of the year.

The SEC sent Tesla a letter asking to estimate any material effect this phase-out will have on sales. Tesla’s response:

We respectfully advise the Staff that we have not expected, and currently do not expect, any impact of the scheduled phase-out of the federal tax credit over the course of 2019 on our vehicle demand or sales to be material

Was this gusto, or obfuscation? In 2018, Tesla sold approximately 182,400 vehicles in the U.S. in 2018, meaning it benefited from $1,368,000,000 billion in government tax credits. In the first six months of 2019, when the credit was still $3,750 credit, Tesla sold approximately 83, 875 vehicles in the U.S., benefiting from approximately $314,000,000 million in tax credits. Now that the credit has dropped to $1,875, the amount of government benefits they will receive will be even smaller. Keep in mind that other manufacturers can still receive the benefit of the credit, making other all electric alternatives to Tesla more attractive.

So, in 2018 Tesla told the SEC it did not expect the loss of the credit to have a material impact on sales, but after losing a billion dollars in the first half of 2019, Musk said that the step down in the credit was complicating growth in the U.S. The third quarter results show that Tesla had $2 billion less in third quarter sales in the U.S. than it did in the third quarter of 2018. This is partly due to a reduction Tesla has made in the prices of its cars, to offset the phasing out of the tax credit. Tesla has joined with other manufacturers to lobby for an extension of the tax credit, but the current administration seems hostile to the idea.

Clearly, the loss of the tax credit has really hurt Tesla’s domestic sales this year. Not only have they lost the benefit of the credit, but that same benefit now is giving Tesla’s competitors an advantage in selling their vehicles. Tesla knew this would have a material effect. This is same company that professes to have such rigorous controls and accounting procedures that they reported a $13.3 million impairment. Yet they did not inform their shareholders of the expected loss of sales, and then doubled down by making a statement to the SEC that turned out to be demonstrably false.

Conclusion

Tesla has some of the most complex accounting disclosures in the manufacturing sector, and that leaves investors in the hands of management. But has management proven that it is committed to transparency? If you look at their statements to the SEC and their acquisition of SolarCity, it seems the answer is no.

Read the Report for Yourself

Get a free trial to our whole library of reports here.

What is Watchdog?

Watchdog Research, Inc. is an independent research provider that publishes Watchdog Reports. Our reports contain warning signs, red flags, material disclosures, and peer analysis for use in valuation, risk analysis, due diligence research, and idea generation. Watchdog Reports are designed to assist investment professionals fulfill their fiduciary obligations and to help investors, executives, board members, regulators and educators learn what they need to know about publicly traded companies. Watchdog Research, Inc. utilizes over 75 specialists and analysts to provide accurate and timely information to our readers.

The Watchdog Blog Team

Note: Our team is made up of current and former Big Four CPAs, Public Company CFOs, Litigation Specialists, Lawyers, Accounting Educators, Ethicists, Regulators, Entrepreneurs, and yes, even a few overly opinionated Harvard MBAs. Our mission is to write blogs that promote transparency in corporate disclosures.

Contact us:

If you want to subscribe to Watchdog Reports, call our subscription manager, at 813-670-2060.

If you have questions about this blog, call our content manager John Cheffers at 239-240-9284 or send an email to jcheffers@watchdogresearch.com.